- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Annual Travel Insurance in 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you’re a frequent traveler, annual travel insurance may be something you’ve been considering. Unlike single-trip insurance, annual travel insurance plans can cover you for an entire year, no matter how often you’re on the road.

Let’s look at the best yearly travel insurance companies, why we choose them and the coverage you can expect.

Factors we considered when picking travel insurance companies

We used the following criteria when choosing which companies we thought were best:

Cost . Annual plans can be expensive — depending on the type of coverage you choose — so we wanted ensure that they stayed affordable.

Types of coverage . Travel insurance for annual travelers can be limited in its coverage. We picked the ones with the broadest range of coverage for possible travel disruptions.

Coverage amounts . Annual trip insurance isn’t worth much if your limits are too low. Instead, we wanted plans with reasonable coverage amounts.

Customizability . If your travels take you to different places, you’ll want the ability to customize your plan. The best annual travel insurance plans can provide this.

» Learn more: What does travel insurance cover?

An overview of the best annual travel insurance

We gathered quotes from various travel insurance companies to determine the best annual travel insurance policies. In these examples, we used a year-long trip by a 22-year-old from Alabama. We indicated the main countries of travel as France and Malaysia, and when asked, put the total trip costs at $6,000.

The average cost for an annual travel insurance plan came out to $220. The plans ranged from $138-$386.

Let’s take a closer look at our top recommendations for annual travel insurance.

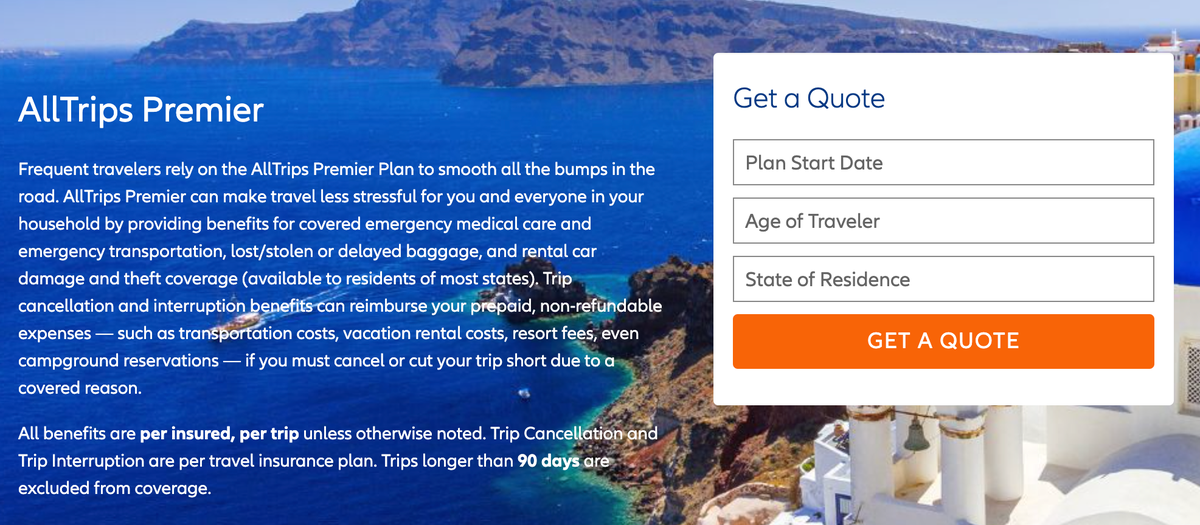

1. Allianz Travel

What makes Allianz travel insurance great:

Lower than average cost.

Provides health care and travel insurance benefits.

Includes rental car insurance up to $45,000.

Here’s a snippet from our Allianz Travel insurance review :

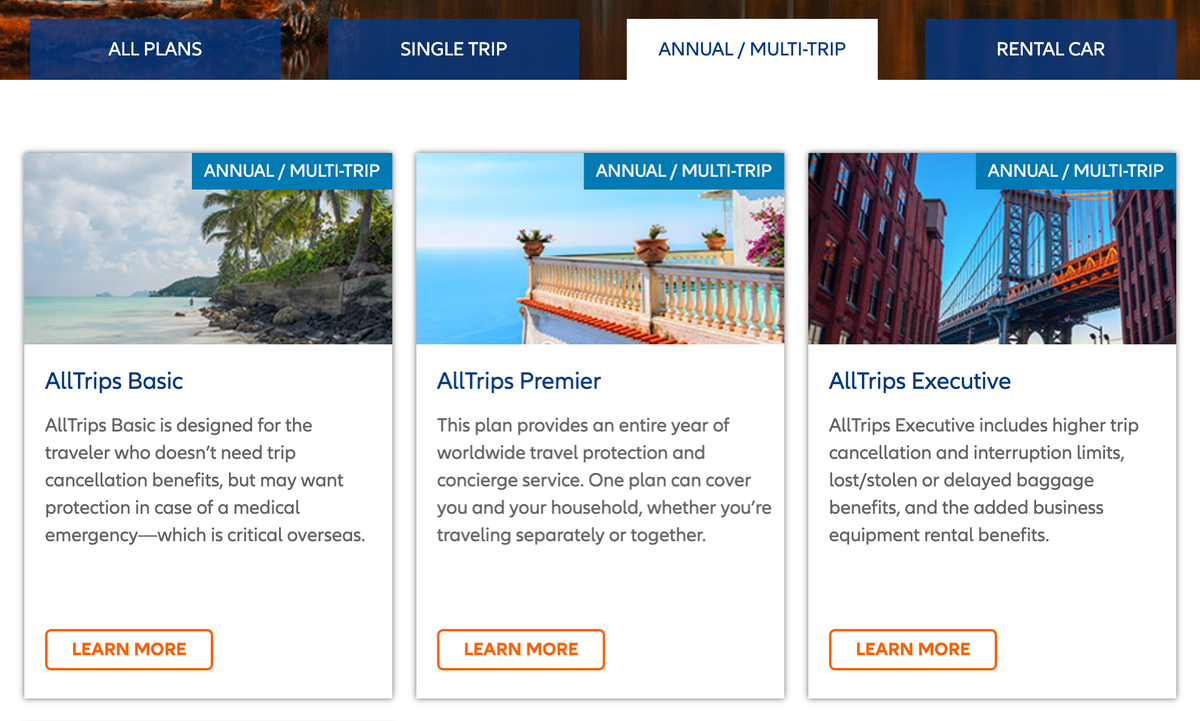

“AllTrips Basic (annual plan) is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.”

2. Seven Corners

What makes Seven Corners great:

Offers up to $20,000 for acute coverage of pre-existing conditions.

Includes up to $1 million for emergency medical evacuation.

Optional add-on for adventure sport activities.

$0 deductible available.

Here’s a snippet from our Seven Corners review :

“Seven Corners offers one annual policy called Travel Medical Annual Multi-Trip. The policy can be customized depending on how long you plan to be away from home for any one trip. You can travel as much as you like during the 364 days, so long as any one trip doesn’t exceed the option selected — 30, 45 or 60 days.”

What makes IMG great:

Good customizability with medical evacuations and sports coverage.

Low $250 deductible.

Includes coverage for semi-private hospital rooms.

Here’s a snippet from our IMG review:

“Some policies provide emergency medical evacuation coverage, while others skip this benefit entirely. This benefit may be more important to you if you travel to a remote location or engage in physical activity such as trekking.

More comprehensive plans may include other benefits such as assistance with acquiring a new passport, reimbursing reward mile redeposit fees or coverage for pre-existing conditions. If these are something you’re interested in, be sure to check that your policy includes these options.”

4. Trawick International

What makes Trawick International great:

100% coverage for trip cancellation and trip interruption.

Emergency medical evacuation included.

Trip delay reimbursement coverage.

Here’s a snippet from our Trawick International review :

“Trawick International is a comprehensive travel insurance provider that offers trip delay and cancellation insurance, baggage delay coverage, medical coverage and medical evacuation, rental car damage protection, and even COVID-19 coverage among its various policies.

Trawick covers trips for worldwide destinations, including for foreign nationals coming to the U.S.”

What does travel insurance cover?

You’ll find a wide variety of coverage types offered by travel insurance policies. This is true whether you're purchasing a single-trip or annual travel insurance plan. Here are some common types you can expect to find:

Accidental death insurance .

Baggage delay and lost luggage insurance .

Cancel for Any Reason insurance .

Emergency evacuation insurance .

Medical insurance .

Rental car insurance .

Trip cancellation insurance .

Trip interruption insurance .

How to choose the best annual travel insurance policy

While we’ve highlighted some of the best annual travel insurance companies, the truth is that the best plan for you isn’t going to be the best plan for someone else. If you’re interested in buying annual travel insurance, you’ll want to collect a variety of quotes to see which policy best fits your needs.

This may mean opting for a plan that covers pre-existing conditions or one that specifically includes high-risk activities. Or, if you’re in a country where health care is notoriously expensive, you may want to choose a policy with higher maximums.

Many credit cards come with complimentary travel insurance .

Whatever the case, do your research first and review all the plan details before making your purchase.

» Learn more: How to find the best travel insurance

If you want to buy annual travel insurance

Annual travel insurance can be a great option if you’re often out of town. With such a wide range of policies available, selecting a plan that fits your needs is easy. We’ve done some of the work for you by choosing the best annual travel insurance companies, all of which made the top of the list for their cost, customizability, types of coverage and plan maximums.

Like any travel insurance policy, the cost of your plan is going to vary. Factors that may affect the cost of your annual travel insurance include your age, where you’re going, how long you’ll be traveling, your policy maximums and whether preexisting conditions are included.

Although not all travel insurance providers offer annual travel insurance, many of them do. We’ve gathered together the five best, including Allianz Travel, World Nomads, Seven Corners, IMG and Trawick International.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- United States

- United Kingdom

1Cover Travel Insurance

Our verdict: unlimited cover for both overseas medical expenses and trip cancellation are a big plus but you'll want to check the fine print if you're after covid-19 cover..

In this guide

Summary of 1Cover's Comprehensive policy

How does 1cover travel insurance cover covid-19, what policies does 1cover offer, here's a breakdown of 1cover travel insurance features, standard features, optional add-on, how to make a 1cover travel insurance claim, here's the bottom line about 1cover travel insurance, frequently asked questions, compare your travel insurance quotes.

Destinations

- 1Cover Travel Insurance offers unlimited cover for both trip cancellation and overseas medical expenses - The ultimate peace of mind when planning a holiday

- Enjoy up to $5,000,000 personal liability cover when you choose 1Cover Travel Insurance. Many other providers cover much less than this.

- This provider's COVID-19 cover doesn't extend to cancellation costs. If you get sick before or during your trip, you'll need to rely on your travel provider for any refunds.

Compare other options

Table updated November 2022

1Cover offers some cover for pandemic-related expenses but not everything you might need. All its policies cover overseas medical claims related to COVID-19 if you test positive and require emergency medical treatment. This includes:

- Overseas hospital medical treatment

- Ambulance transportation

- Repatriation back to Australia

Where 1Cover falls short is with its cancellation cover. If you catch COVID-19 before you depart for your holiday or during your trip and need to cancel, you're out of luck here. This includes additional costs such as PCR tests or quarantine costs.

If you think you'll need more than overseas medical cover for COVID-19, we've compared all the providers that offer cover for pandemic-related expenses .

1Cover has seven different plans available to fi th the needs of a wide variety of travellers. Comprehensive, Essentials, Medical Only, Domestic and Already Overseas cover single trips while International Frequent Traveller and Domestic Frequent Traveller are annual policies that can cover multiple trips over the year.

Comprehensive

Medical Only

Already Overseas

Frequent Traveller (International or Domestic)

This insurance is underwritten by certain underwriters at Lloyd's. It comes with a cooling-off period and choice of standard excess .

The cooling-off period is 14 days and allows you to cancel your policy for a full refund provided you haven't started travelling or made a claim. All policies have a standard $200 excess which will be an out-of-pocket expense if you need to make a claim for an insured event . This excess can be reduced to $100 by paying extra on your policy.

These are some of the features that 1Cover will cover if something goes amiss on your trip. Some of these benefits are only available for certain levels of cover (e.g. the Comprehensive policy vs Essentials).

- Additional accommodation and travel expenses

- Cancellation fees and lost deposits

- Domestic pets and services

- Hospital cash allowance

- Loss of income

- Luggage and personal effects

- Overseas emergency medical assistance

- Permanent disability

- Rental vehicle insurance excess

- Resumption of journey

1Cover offers three different add-on packs to give your travel insurance policy more flexibility. Not all plans are eligible to add on these packs.

- Cruise pack. Get cover for your trip on the high seas. This pack includes cruise-specific cover for things like missed port connections and cancelled prepaid shore excursions.

- High value items. If you're travelling with expensive gear that costs above 1Cover's limits, you have the option to take out extra cover in case your item is lost, stolen or damaged.

- Rental vehicle insurance excess. If your policy includes rental car excess cover, you can increase the cover amount for a bit more money.

- Winter pack. A must if your trip involves things like skiing or snowboarding . Get cover for unexpected accidents on the slopes and if you need emergency evacuation. This is only available for those 64 years and under.

1Cover Travel Insurance has some general exclusions listed in its Product Disclosure Statement (PDS) that you should be clear on. These include claims arising from:

- Motorcycle or scooter accidents where the driver doesn't hold a valid motorcycle license

- Any act of war, rebellion, revolution, insurrection or taking of power by the military

- Travel to or remaining in a country with a warning risk rating of 'Do Not Travel'

- Mandatory quarantine, lockdown, curfew, or isolation orders

- Pregnancy after the 24th week or any previously identified complications unless approved by 1Cover

- Travel booked or undertaken against the advice of a medical adviser

- Elective surgery or treatment

- A pre-existing medical condition not approved by 1Cover

- You being under the influence of any intoxicating liquor or drugs except those prescribed by a medical adviser

- Quad biking, mountaineering or rock climbing using ropes or climbing equipment

- Suicide or attempted suicide, physical, mental or emotional exhaustion

- Hiking or trekking within an altitude limit above 3500 metres (including Everest base camp )

Make sure you review 1Cover's PDS for a detailed breakdown of general exclusions .

You can submit your claim by downloading a claim form online and posting it to PO Box 6798, Baulkham Hills, NSW 2153.

Alternatively, you can submit a claim online by following these steps:

- Head to https://www.1cover.com.au/online-claim-form/

- Enter your policy number, email and date of birth to log in

- Complete your claim details by answering all sections

- Upload any documents to support your claim

- Submit, and you should hear back within 10 business days

With over 1.5 million customers, 1Cover is among the most well-known insurers in Australia. Some of the standouts of 1Cover travel insurance include emergency assistance anywhere in the world, free cover for the kids, no age limits and cover for certain pre-existing medical conditions.

Where 1Cover might be lacking for you can be found in the fine print. While COVID-19 overseas medical expenses are covered, cancellation costs are not. This might be sufficient if your travel arrangements are flexible and can be refunded but for some, that risk might be too great to take on. Senior travellers should also be wary. If you're aged 80 years or older, a $3,000 excess applies for any claims associated with an injury, illness or medical condition.

If you're not quite sure about 1Cover, you can compare other travel insurance companies here .

How does 1Cover handle pre-existing conditions?

Like most insurers, you will usually need to disclose any pre-existing conditions when you apply for cover. However, 1Cover has 35 pre-existing conditions which they automatically cover. Under certain conditions, this can include diabetes , epilepsy, pernicious anaemia and asthma. Be sure to read their product disclosure statement before deciding whether or not you need to disclose information for pre-existing medical conditions.

Do 1Cover policies cover cruises?

A cruise pack add-on is available when you buy any 1Cover travel insurance plan, except Essentials and Medical Only plans. When you purchase cruise cover as an add on, you'll get cover for services like:

- Cabin confinement

- Prepaid shore excursions cancellation

- Missed cruise departure

- Missed port cover

- Formal attire cover

- Formal attire delay allowance

Can I get travel insurance immediately?

Yes, 1Cover lets you get a quote and apply for insurance all online. This means you can be covered straight away for any upcoming travel plans.

If you are already overseas , 1Cover can also provide you with travel insurance but coverage doesn't start until 72 hours from the start date on your Certificate of Insurance.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Cristal Dyer

Cristal Dyer is a travel writer at Finder. She has been writing about travel for over five years and has visited over 40 countries around the world. Cristal currently travels full-time, writing about her favourite cities and food finds, and she is always on the lookout for amazing flight deals to share.

More guides on Finder

Everything we know about the Tasmea Limited IPO, plus information on how to buy in.

Cash usage continues to decline, but what happens next?

SPONSORED: Not sure if your current business account is right for your needs? Use our checklist to find out.

These General Terms and Conditions ("General Terms") apply to the game of chance identified as the "Competition" in the schedule of particulars for the Competition that explicitly references the General Terms ("Competition Schedule").

Our experts compared 24 policies, 160+ features and got over 140 quotes to help you find the best pet insurance products of 2024.

Get points from Virgin while you binge on your favourite shows.

SPONSORED: Using a loan matchmaking service can be a great way to get a personal loan that suits your needs – and a better deal on it too!

Finder acknowledges that today ASIC has filed an appeal with the Full Federal Court in relation to proceedings against Finder Wallet regarding its Finder Earn product.

Save $1,800 by switching to a more affordable health fund.

Abuse and violence towards retail workers and service staff has reached disturbing new levels, according to new research by Finder.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

22 Responses

We are booked on a cruise around Australia in October for one month and looking for travel insurance that covers all our needs and Covid.

Please visit our guide to COVID travel insurance . You’ll be able to compare a range of insurance providers that include COVID-19 medical expenses.

Make sure to read the PDS of each provider before signing up with the one that meets your needs.

Regards, James

What are the dollar limits on luggage lost by airlines?

Thanks for getting in touch! International cover for luggage and personal effects is $5,000 at the time of writing, with a $100 excess. However, this is for multi trip insurance only.

As it says on ther website, “when we receive a personal belongings claim, you have to provide proof of ownership for the lost or stolen items. We realise that policy holders cannot always provide receipts for each and every item, but you’ll still have to provide evidence of ownership. We can accept photographic evidence, warranty cards, manuals, receipts, bank or credit card statements as proof of ownership.”

Hope this was helpful. Don’t hesitate to message us back if you have more questions.

Best, Nikki

I am going to England/Europe in April. I am just enquiring who is the underwriter for 1Cover

Hi Christine,

Thank you for reaching out to finder.

This insurance is underwritten by certain underwriters at Lloyd’s. Hope this helps!

Cheers, Reggie

I would like a quote for travel insurance for my son. He is 23yrs old, Australian departing Japan on November 6, arriving in the USA on the same day. Not sure of when he will be returning home but presume it will be at least 6 months. He will be skiing while in the USA. Is this something you can help me with?

Hello Kristie,

Thank you for your comment.

We apologize for not being able to answer this comment before your son left for the USA. Anyway, as for the quote for the travel insurance, since your son is already overseas, he could have gotten a quote directly from 1Cover Already Overseas Travel Insurance by clicking the Get Quote button.

As for the other options of getting travel insurance back home, he may check our list of overseas travel insurance . It has the list of the insurers (2 insurers) that your son may take and get a quote directly while overseas. Also, kindly read the tips on how to go about getting insurance while overseas for your son.

Please make sure to read the eligibility criteria, features, and details of the policy, as well as the relevant Product Disclosure Statement PDS/T&C’s of the policy before making a decision and consider whether the product is right for you. If necessary, speak to the insurance brand to verify any details.

Should you wish to have real-time answers to your questions, try our chatbox on the lower right corner of our page.

Regards, Jhezelyn

Cruise from Australia visiting Singapore Thailand Vietnam Cambodia Malaysia . Dates 1st — 27rh Nov 2019. 1 person age: 76.

Thanks for leaving a question on Finder.

If you a looking for travel insurance for a cruise you will need cruise cover. You can compare cruise policies using our comparison table. Just press the “Get quote” button to request free quotations.

When deciding on which policy you’ll want to consider a policy that covers any pre-existing medical conditions that you have. Once you find a policy that you prefer, you can go through to the provider’s page and get in touch with them in regards to any pre-existing medical conditions that you have. Some benefits you may look for include:

- Unlimited medical benefits

- Cancellation cover that covers the cost of your trip

- An excess that you are okay with paying e.g. you may have to pay an excess of $100 when you claim

Please send me a message if you need anything else. :)

Cheers, Joel

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

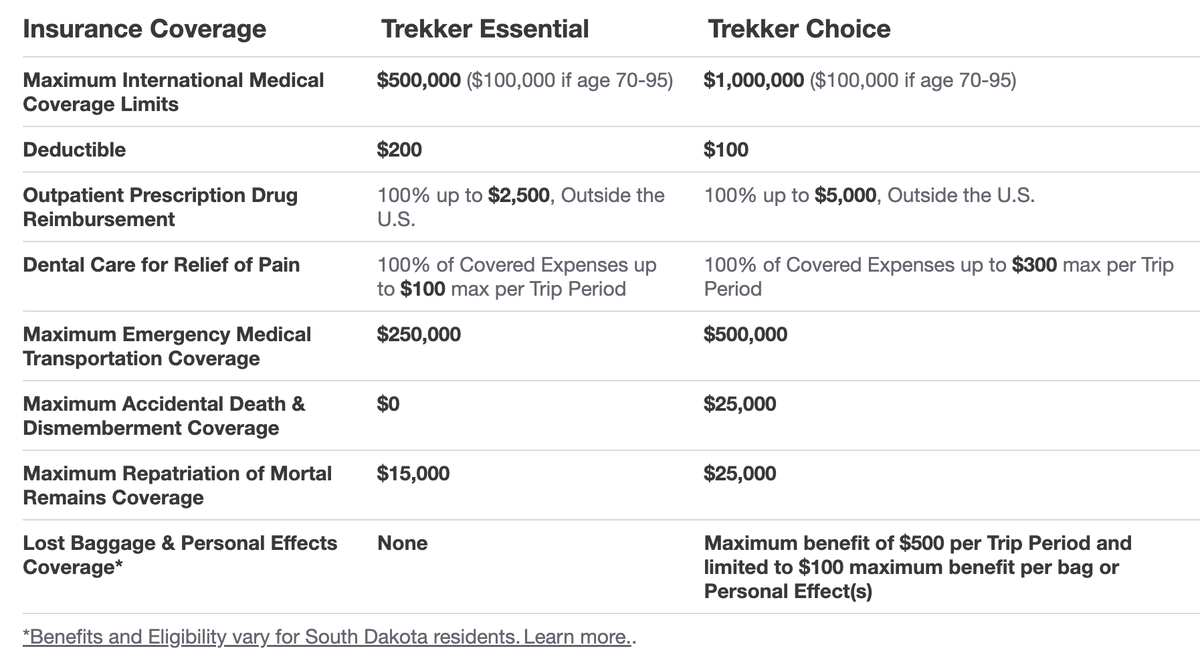

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

For the Frequent Traveler: The 11 Best Annual Travel Insurance Policies

Content Contributor

65 Published Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

83 Published Articles 472 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

32 Published Articles 3109 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

GeoBlue Trekker Choice

Geoblue trekker essential, trawick international safe travels annual basic, trawick international safe travels annual deluxe, allianz travel alltrips basic plan, allianz travel alltrips prime plan, allianz travel alltrips executive plan, allianz travel alltrips premier plan, aig travel guard annual travel insurance plan, usi affinity voyager annual travel insurance, seven corners travel medical annual multi-trip, a plan that didn’t make our list, how annual travel insurance works, when to buy an annual travel insurance policy, what annual travel insurance policies do and don’t cover, understanding trip length rules, is annual travel insurance worth it, how much do annual travel insurance policies cost, does credit card travel insurance apply annually, choosing an annual travel insurance policy, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you take multiple trips every year, insuring each one can be a hassle. There are forms to fill out, comparison shopping over and over again, and then remembering the policy documents for each specific trip. And then there’s the risk you might forget to take out travel insurance for one of your trips.

Plus, those costs add up. There must be a better way.

Enter annual travel insurance. Also known as multi-trip travel insurance, taking out an annual policy covers you for a whole year of travel. Not only is it simpler, it may be cheaper than taking out multiple single-trip policies. But is it right for you?

Annual travel insurance policies aren’t exactly the same as the trip insurance you’d buy for a weeklong holiday with your family. Here are the best annual travel insurance policies, what they do and don’t cover, and how to decide whether taking out a yearly policy might be right for you.

The 11 Best Annual Travel Insurance Policies

GeoBlue offers 2 Trekker plans for annual coverage, which are unique in several ways. These plans cover preexisting conditions, COVID-19, and all travel outside the U.S.

However, they don’t cover any trips inside the U.S. or provide any coverage for canceled, delayed, or interrupted trips. Instead, these are travel medical insurance plans . With the GeoBlue Trekker Choice plan , you’ll get higher maximum payouts in all categories and pay a lower deductible ($100). However, note that this is still secondary coverage .

You’ll get unlimited access to telemedicine and coverage for trips up to 70 days in length . Additionally, coverage is available up to age 95, which isn’t offered on most other policies.

The GeoBlue Trekker Essential plan offers the same pros and cons as the Choice plan. The main differences are the lower maximum payout values and the higher deductible ($200 instead of $100). You also won’t get the Choice plan’s lost baggage and personal effects coverage, which can provide up to $500 per trip. Again, this secondary medical insurance policy is only valid on trips outside the U.S.

Trawick International offers 2 annual plans, and the Safe Travels Annual Basic plan is more economical. You’ll have coverage for everything you expect in a trip insurance policy , such as 100% coverage for trip cancellation or interruption (up to a $2,500 annual maximum) and coverage for delays, lost luggage, delayed luggage, and even medical expenses. To make up for the lower cost of the plan, coverage limits are lower than what you’ll find elsewhere . However, if you want peace of mind while traveling, you can get it for a year and cover trips up to 30 days in length.

While Trawick International’s Safe Travels Annual Deluxe plan offers higher maximum coverage limits than the Basic plan, its maximum payouts for medical and evacuation benefits are lower than what you’ll find with competitors . Where this plan shines is in the coverage for change fees, lost deposits on tours, and coverage for lost items if an airline misplaces your luggage.

You’ll be covered for up to $300 per trip for prepaid excursions, up to 100% of your trip cost (with an annual maximum of $5,000) for trip cancellations or interruptions, and up to $150 per item and $750 per trip for personal effects. After signing up for a plan, you’ll also get a 10-day free look period.

If you want an annual plan with a low price tag , this could be what you’re looking for. The Allianz Travel AllTrips Basic plan covers you for unlimited trips up to 45 days each over the course of a year. Coverage includes emergency medical, emergency medical evacuation, baggage loss and delays, travel delays, rental car theft and damage, and travel accident coverage.

However, there’s a fair list of exclusions from this plan . That includes trip cancellation, trip interruption, missed connections, and change fees. As the name implies, you’ll get basic coverage at a basic price.

The Allianz Travel AllTrips Prime option covers 365 days of trips, though the maximum trip length is just 45 days. While you’ll get coverage for all the standard travel insurance benefits, including trip cancellation, trip interruption, emergency medical, delays, and baggage mishaps, there are limits you should know about with this plan.

The travel accident coverage, which applies to death or the loss of a limb, maxes out at $25,000 per trip, baggage delay maxes out at $200, and baggage loss or damage maxes out at $1,000. The maximum coverage for emergency medical is $20,000, and costs can exceed that quickly in a true emergency.

However, this is a decent option if you want a fair amount of coverage across numerous categories without a high price tag.

For those worried about expensive business equipment or losing points and miles, this plan has you covered. On top of higher maximum payouts in categories such as trip cancellation, emergency medical transportation, or travel delays, you’ll also get rental car damage and theft coverage, change fee coverage, and reimbursement for renting business equipment if yours is lost, stolen, damaged, or delayed during a trip.

Moreover, you can be reimbursed up to $500 to cover fees for reinstating your points and miles if a covered trip is canceled or interrupted. The Allianz Travel AllTrips Executive plan also provides coverage for preexisting medical conditions if you meet certain criteria and buy at least 14 days before the first trip.

Allianz also has a customizable AllTrips Premier plan , allowing you to choose between several payout tiers for trip cancellation and interruption. You’ll pay more when choosing higher maximums, but this allows you to choose exactly what you want in coverage and not pay for more than you need. Another positive is coverage for preexisting medical conditions if you meet certain criteria and buy your policy at least 14 days before your first trip.

You’ll also get rental car damage and theft coverage , $500,000 of emergency medical transportation coverage, $50,000 of emergency medical, and coverage for travel delay expenses after a delay of 6 hours or more. The baggage delay coverage is up to $2,000, but it requires a delay of 12 or more hours. The maximum trip length allowed is 90 days.

The AIG Travel Guard Annual Travel Insurance plan isn’t available to Washington state residents. Still, it provides coverage for trip interruption, trip delay, lost baggage, delayed baggage, and missed connections, as well as both medical and security evacuation, accidental death and dismemberment, and travel medical expenses. However, the coverage limit for dental is just $500, and the maximum coverage for travel medical expenses is just $50,000. Those are lower limits than other plans. Additionally, trip cancellation isn’t included.

However, Travel Guard has some strengths. Trip delay coverage applies for up to 10 days and requires a delay of just 5 hours, and the missed connection benefit applies after just 3 hours. You get a “free look” period of up to 15 days to cancel for a refund, so long as you haven’t started your trip or filed a claim. Maximum coverage for any particular trip is 90 days.

USI Affinity’s Voyager plan has a Silver and Gold option , and pricing is easy to determine from the chart. Simply find your age bracket and the associated cost. The key differences between the plans are in the higher maximum payouts for nearly every coverage type with the Gold plan, other than emergency dental and accidental death and dismemberment. However, the Gold plan also includes coverage types the Silver plan doesn’t: political and natural disaster evacuation, airline ticket change fees, and trip interruption. However, trip cancellation isn’t included with either plan .

The maximum trip length is 90 days, and coverage for Silver and Gold plans lasts for 364 days. An unlimited number of international and domestic trips are covered, and you’re covered for trips as little as 100 miles from home. That’s a lower requirement than most other plans (which tend to require 150 miles).

This plan is ideal for those who don’t live in the U.S., as other plans on this list are only available to U.S. residents and citizens. While the plan technically lasts for 364 days, Seven Corners’ Travel Medical Annual Multi-Trip plan is customizable. It lets you choose a maximum trip length of 30, 45, or 60 days and include or exclude coverage for the U.S. Note U.S. citizens and residents cannot add coverage for inside the U.S.

Seven Corners also provides coverage for travelers aged 14 to 75 years, though maximum payouts decrease in some categories for those aged 65 and older. If you receive medical care in the U.S., Seven Corners will pay 90% of the first $5,000 of covered expenses and 100% of the cost afterward. You’re covered 100% outside the U.S. Note that coverage doesn’t apply to your home country (which includes the U.S. if you’re a citizen, even if you live in another country) and isn’t available in Antarctica, Cuba, Iran, Israel, North Korea, Russia, Syria, or Ukraine.

We considered another plan. Here’s why this annual travel insurance policy didn’t make our “best of” list.

IMG Patriot Multi-Trip International : For trips inside the U.S., you may be on the hook for 20% of your medical expenses if you visit a provider outside IMG’s PPO network. Additionally, the maximum trip length is 30 days, and coverage limits are quite low in multiple categories. These include $50,000 for emergency medical evacuation and $10,000 for political evacuation, a maximum of $50 per item and $250 overall for lost luggage, a $100 maximum for dental treatment, and $25,000 for accidental death and dismemberment 24/7 coverage.

Annual travel policy plans vary considerably. Most provide secondary medical insurance, so you may need to submit to your other coverage (home healthcare plan, credit card insurance provider, etc.) first and then submit to your travel insurance provider for any remaining expenses or deductibles. If you won’t have other coverage, you may want to look for a plan that provides primary health coverage instead. Also, understand that most plans provide reimbursement, so you would pay out of pocket for overseas hospital visits and then submit to your insurance provider for reimbursement after the fact.

What Is Annual Travel Insurance?

Annual travel insurance covers you for many trips over the course of a year (or sometimes 364 days). Rather than needing to buy a travel insurance policy for each trip separately — which can add up — you can buy a single policy that covers all your trips for the next year. It’s important to understand the terms of these policies, though. Some may require buying coverage in advance, such as 14 days before your first trip, while that requirement normally doesn’t exist on single-trip travel insurance.

It’s also important to note which types of trips and destinations are covered by your policy — and which aren’t. Look for how far from home you must travel to be covered and whether domestic trips are included. Moreover, consider what benefits you’re looking for. These can vary from medical-only to all the bells and whistles, such as baggage delay and medical evacuation. Once you know the type of coverage you want, you can find a policy or policies that align with your needs, helping you narrow down your options to conduct a more effective comparison.

Annual travel insurance works as an umbrella policy, covering all your trips during the policy period. You don’t need to inform the policy provider about each trip’s start and stop dates or destinations. You simply buy a policy, and then you’re protected for every trip that meets the conditions while your policy is in effect. Some regions may be excluded from coverage, and you may be subject to a maximum trip length.

Trip length is an important element to pay attention to. Annual travel insurance doesn’t cover you for a year-long trip. It covers you for a year for many small trips within that time, typically up to 30 or 45 days per trip. If you’re looking for a plan to cover you during a year-long trip to another country, you should look for specialized plans for study abroad, mission work, or other situations that apply to you. Traveling full-time? You may need a policy geared toward digital nomads and backpackers.

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and determine that the cost of insuring each alone would be higher than that of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want.

Considering that single-trip plans can sometimes be found for $10, yet an annual trip is likely to cost $150 or more per adult, you’d need 15 trips to justify the annual policy. However, that’s not really an apples-to-apples comparison, as a $10 basic travel insurance policy won’t provide as much coverage as you’re likely to find on even the most basic of annual policies.

It’s also not just about the number of trips you take but the types of trips, the complexity of the trips, and money at risk in nonrefundable costs. The more of these you foresee in your next year of travels, the more likely an annual plan would be good for you.

We already highlighted that annual policies don’t cover traveling nonstop for a year due to their restrictions on the maximum trip length. Annual travel insurance policies also restrict how far you must travel for coverage to kick in. Driving to the next town over may be a trip in your kids’ eyes, but it’s probably not far enough for your travel insurance to kick in.

While coverage varies by policy, you’ll typically have coverage for sickness, accidental death and dismemberment, lost or delayed luggage, trip cancellation, and possibly injuries during skiing or snowboarding. However, it’s important to read the terms of each policy because coverage maximums and inclusions vary widely. Some policies only provide medical coverage, while others offer robust coverage across the board.

Each policy specifies a maximum trip length. How trips longer than that are treated can vary. Most policies won’t cover any expenses related to a trip longer than the maximum trip length. Suppose you take a trip of 41 days on a policy with a maximum of 40 days. In that case, claims for delayed luggage or medical expenses may be rejected when the claim evaluator asks for your trip confirmation details.

However, GeoBlue covers the first 70 days of any particular trip. If something goes wrong during that time, you’re covered. You’re on your own for anything that happens on days 71 or beyond. Still, you’re covered on those first 70 days, despite taking a longer trip.

If you foresee long trips in the future, make sure you understand these rules.

For some travelers, yes, annual travel insurance is worth it. For others, it’s not.

Annual travel insurance is worth it when it costs less than what you’d pay to insure each trip individually. It’s also worth it if you think you might forget to purchase some of those individual policies throughout the year and would prefer to be done with them for another 365 days.

However, annual travel insurance isn’t worth it if you only take a few trips a year, they’re mostly domestic, and you don’t have major nonrefundable expenses. If you’re traveling within the U.S. with your standard health insurance policy in effect and you have credit cards that provide trip insurance for delays or cancellations, that coverage may be sufficient.

Costs will vary by your home state, age, and number of people included in the policy. Here are the “starting at” costs for our best annual travel insurance policies, sorted from lowest to highest:

Yes and no. Using a credit card to pay for your trip can provide some built-in protections. However, you should be mindful of annual maximums on any policy. You may run into limitations such as a maximum of 2 claims per 12-month period or similar exclusions. If you take many trips, that could be an issue.

To better understand what is and isn’t covered, check out our complete guide to credit card insurance .

To choose the right policy, look beyond the cost alone. Rather than immediately choosing the cheapest policy, find the policy or policies that provide the coverage types you want with payout maximums that cover your travel plans for the next year — both confirmed bookings and likely plans.

Consider your coverage needs. Will you be carrying expensive items such as scuba equipment for a trip to the Galapagos or top-notch camera lenses for a bird-watching tour in Papua New Guinea? How many extreme sports will you participate in?

Conversely, how many “never heard of this airline before” flights will you take to get off the beaten path? These are flights where you may be worried about cancelations that lead to extra costs or a misplaced suitcase.

Consider the types of trips you’ll take and the up-front money at risk if something goes wrong or you get delayed, then look at which plans align with your travels. From there, choose the best plan that aligns best with your needs, which may or may not be the cheapest one.

As an annual travel policy holder myself, I promise you that having the right plan is important when you wind up in a remote hospital in Tanzania with malaria.

Annual travel insurance isn’t right for everyone. However, it makes sense for those who travel often and could save money by taking out a single policy instead of many separate policies. It also makes sense if you’d prefer to avoid filling out paperwork numerous times throughout the year for each trip.

Annual travel insurance policies aren’t great for those who tend to travel closer to home, don’t have major nonrefundable travel expenses, or need to customize coverage for each trip because their travels tend to vary. For example, you might need different coverage for a backcountry ski trip with friends versus a 2-hour drive with your family.

Look at what annual policies do and don’t cover and see if these align with your travel goals and needs. Then, consider the prices for the plans that align well with your situation. After taking an informed look, you should have a good idea of whether an annual policy is right for your situation.

Frequently Asked Questions

Is yearly travel insurance worth it.

For some, yes. For others, no. Annual travel insurance is worth it when the cost is less than what you’d pay to insure each trip separately or you would prefer to just sign up once then be done for a year. However, annual travel insurance isn’t worth it if you only take a few, mostly domestic, trips a year where your healthcare coverage works, and you don’t have major nonrefundable expenses.

How much does annual trip insurance cost?

Costs vary greatly depending on the type of coverage you want. Annual travel insurance plan costs range from $140 to $500 for a single person. If you take a lot of trips, the cost can be worth it over the course of a year, but each person’s situation is different.

When should I take out annual travel insurance?

You should buy your annual travel insurance policy as soon as you know you’ll have multiple trips in the next year and that the cost of insuring each alone would be higher than the cost of a single multi-trip plan. What’s the break-even point on that cost? It depends on the coverage you want. Look at the different types of coverage and your expected costs for insuring each trip separately, then see if it makes sense for you.

Does annual travel insurance automatically renew?

It varies by policy provider, but some companies have an auto-renew feature to ensure you don’t have gaps in coverage.

Was this page helpful?

About Ryan Smith

Ryan completed his goal of visiting every country in the world in December of 2023 and now plans to let his wife choose their destinations. Over the years, he’s written about award travel for publications including AwardWallet, The Points Guy, USA Today Blueprint, CNBC Select, Tripadvisor, and Forbes Advisor.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

All you need to know about annual travel insurance policies

As demand for travel soars and everything from weather to staffing issues leads to higher prices and cancellations, it's more important than ever to protect your trip arrangements with travel insurance .

However, it's not always easy figuring out which type of plan to pick. There are standard policies that cover general delays, interruptions and cancellations; "cancel for any reason" plans that account for personal whims in addition to unforeseen circumstances; and lesser-known annual options.

In this article, I'll go over what you need to know about the third type: annual travel insurance coverage.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What is annual travel insurance?

Annual travel insurance plans (also known as multi-trip plans) last for one year and generally cover all trips taken within that period until either the policy expires or the maximum payout amounts are reached. The policy usually kicks in for trips that take you more than a certain distance from home.

For example, my Allianz AllTrips Prime annual plan remains in effect for one year following the purchase date of my policy. I'm covered on all trips during which I'm at least 100 miles from my residence.

This differs from standard travel insurance, which is purchased on a per-trip basis and covers only one specifically insured journey per policy. Standard policies begin when travel for the insured trip begins and end when the insured trip ends, rather than covering multiple travel experiences within a specific period of time.

What does annual travel insurance cover?

Coverage depends on the plan you purchase. There are usually several tiers from which to choose, with the lowest offering the least coverage and the highest offering the most.

Using my policy as an example, I'm covered for up to $3,000 per year in trip interruption expenses, including hotel room coverage at $250 per night, which I used when I was recently isolated for 10 days after testing positive for COVID-19.

My policy also offers a $3,000 annual trip cancellation benefit, $20,000 in emergency medical coverage, $100,000 in emergency transportation (including medevac services), $45,000 in rental car theft and damage protection, $25,000 in travel accident coverage and $1,000 for essentials in the event of baggage loss or damage, along with a handful of other small benefits.

Note that many annual policies do not include things like "cancel for any reason" coverage or trip interruption benefits. If those items are important to you, check with your provider before making a purchase.

How much is an annual travel insurance policy?

Sure, an annual travel insurance policy may sound great, but how much does one cost? I was surprised to find that insuring your trips for a whole year with an annual policy is often not much more expensive than insuring one or two trips individually, depending on the options you select.

A decent annual travel insurance plan will likely set you back a couple hundred dollars. The more coverage you add, the more expensive the plan will become. The cost also changes depending on variables like your age and where you live.

The best thing to do is contact your preferred provider for a quote or check out an aggregator like InsureMyTrip to compare premiums.

Which companies offer annual travel insurance plans?

The Points Guy recommends the following travel insurance providers , all of which sell annual or semi-annual policies:

- Allianz Travel Insurance .

- Seven Corners .

- Travel Guard .

- World Nomads .

When should I purchase annual travel insurance?

There are several reasons why annual travel insurance might be better for you than separate policies for individual trips. If you travel a lot — more than two or three times annually — it could be more cost-effective than purchasing separate policies for each journey.

For me, it makes sense because I travel for a living, often taking a dozen or more trips each year. Also, much of my travel is comped, which makes insurance more difficult to acquire. (If I haven't paid for a cruise, flight or hotel, I can't attach a dollar amount to it and, therefore, often can't insure it. I also wouldn't be able to provide purchase receipts in the event something went wrong and had to file a claim.)

Other factors to consider include your health, how adventurous your travels might be, whether you have coverage as a credit card perk and how much your travel arrangements cost versus how much coverage you can get with an annual plan versus individual policies.

Another consideration right now is COVID-19. For me, the annual plan made sense because most of Allianz's individual plans don't cover issues linked to COVID-19. However, the annual coverage I purchased does.

Other things to know about annual travel insurance policies

Here are a few additional tidbits I learned after filing a trip interruption claim under my annual travel insurance policy. Keep them in mind when deciding if an annual policy is right for you.

- Before committing to the purchase of any travel insurance plan, make sure to inquire about specific components that are important to you. For me, those were COVID-19 coverage, trip interruption benefits and medevac coverage.

- Know that your coverage does not reset each time you travel when you opt for an annual policy. So, if you have a trip that goes awry, you file a claim and you max out the benefit allowed by your plan, you won't have that benefit available to you for the remainder of your policy year.

- Depending on your policy, you might have to return home between travel sessions in order for each trip to be covered. Taking several back-to-back trips could prevent them from qualifying for coverage under your annual insurance plan, so be sure to read the fine print, and plan accordingly.

- If you purchase annual or multi-trip travel insurance, keep your policy card and provider phone number with the other important documents you bring when you travel so they're easily accessible in a pinch.

- If you find yourself in a covered situation for which you'd like to seek reimbursement, keep all receipts and take photos that will help to support your claims when they're submitted.

- Don't assume all your expenses will be reimbursed, even if you think they'll be covered. It doesn't hurt to try, but in my case, my Allianz plan only partially covered the hotel expenses I submitted.

- All Inclusive Single

- Frequent Traveller

- Emergency Medical

- Annual BorderHop

- Visitors To Canada

- Included Extras

- Cruise Insurance

- What Is Travel Insurance?

- What Is Covered?

- Cover Summary

- Policy Documents (PDS)

- Make A Claim

- Emergency Contacts

- Medical Assistance

- Travel Warnings

- Travel Insurance Tips

- Government Advice

- USA Survival Guide

- Mexico Survival Guide

- UK Survival Guide

- Snowbirds Guide

- The Secret Traveller

- Dominican Republic

- Travel Insurance Compare

- Credit Card Travel Insurance

- Medical Travel Insurance

- Cancellation Insurance

- Cheap Travel Insurance

- Travel Health Guide

- Spring Break Safety Guide

- Clever Canadian Guide

- Travel Scams

- Cross Border Trips

- Refund Policy

- 1Cover Travel Group

- Media Enquiries

Annual Border Hop Travel Insurance

10 Years Expertise

1 Million Customers

Travel Insurance Specialist

Underwritten By

Annual borderhop features & benefits.

When you go on a trip, you want peace of mind. That’s why having travel insurance from a trusted, experienced insurance company like 1Cover Travel Insurance is so important. It’s not just about playing it safe, it’s about making sure that you have the best experience possible every time you travel.

A travel budget can be a burden, especially for the regular traveller who enjoys getting out and spreading their wings as much as possible. Great news for frequent travellers – vacationing and exploring the world may be expensive, but travel insurance doesn’t have to be! 1Cover Travel Insurance offers affordable, reliable coverage for the adventure-loving Canadian traveller. The Annual BorderHop plan provides year-long protection for unlimited trips to almost anywhere in the world. It is one of the most competitive plans available, and it comes with the ultra-friendly service that 1Cover is known for.

Our Annual BorderHop policy offers the following product features and benefits:

With the Annual BorderHop plan, you get everything you need for your trip plus the extras that will make you feel not just protected, but appreciated.

Emergency medical protection: including hospital expenses, emergency dental treatment, and even coverage for return home if need be.

Need someone at your bedside because of an unexpected hospital stay? No worries - flights, insurance, and basic meals are covered for your bedside companion.

A convenient 24/7 travel hotline. If you need to make last minute travel arrangements, switch hotel reservations, re-book flights, or require assistance with anything travel-related, you’ve got it with the BorderHop coverage.

BagTrak services. You know how often luggage gets lost. It's great having a team to help you track down your lost luggage when you travel!

Need assistance finding concert tickets or want to watch the game while you are travelling? No problem. 24/7 concierge service is included in all BorderHop Travel Insurance plans.

Passport pal makes travelling abroad with your insurance documents a breeze. Fit your certificate of coverage snugly into your passport wallet, hop in your plane, train, or automobile, and enjoy the ride. You are covered!

It's nice having a plan that covers you in an emergency, and that looks after you. No wonder 1Cover Travel Insurance has over one million happy customers worldwide!

Our Annual BorderHop travel insurance provides cover for emergency medical, in case you have a medical emergency while away from home. Explore our Table Of Benefits to see all the cover provided.

Table Of Benefits

Read the full policy wording in our Product Disclosure Statement for more details including full terms and conditions, limits and exclusions that apply.

Policy Wording

More About Annual BorderHop Travel Insurance

Faqs about annual borderhop trip cover, further reading, why choose 1cover travel insurance, what is the annual border hop policy.

At 1Cover Travel Insurance, our Annual BorderHop Insurance policy is an emergency medical policy that covers you for an unlimited number of trips for a 12 month period.

Is There A Limit On Trip Length During The 12 Month Policy?

There is a limit on the length of your trip. However, the BorderHop Policy offers three different options regarding the length of your trip: up to 9 days, up to 16 days, and up to 30 days. Choose the trip length that suits your needs best! And if you need to top-up for a particular trip, just give us a call and pay for any additional days that you need.

Does The Policy Cover Hospital Expenses?

If you’re in the hospital for at least 48 hours, the Annual BorderHop insurance policy covers up to $50 per day for additional hospital expenses like phone calls, rentals on the television, and more.

Does The Policy Cover Emergency Dental Care?

Emergency dental care is covered, up to $1,000 for an accidental blow to the face, and up to $300 when the dental care is required for another reason.

Does The Policy Cover An Emergency Evacuation?

If you need to be evacuated and returned home due to a pre-approved medical condition, the cost is covered under your policy.

Who Is The Annual BorderHop Policy For?

Anyone who plans to travel outside of their home province more than once per year can benefit from this policy. Those aged 60 and over can still benefit from an Annual BorderHop policy, simply call 1-877-328-2530 to complete a quick medical questionnaire.

How Can The Annual BorderHop Policy Help If I’m Injured, Sick, Or Hospitalized?

The Annual BorderHop Policy can help you in several ways if you’re in the hospital or otherwise unable to manage your responsibilities. If you’re travelling by yourself, your policy can cover the cost of flights, insurance, and subsistence for a companion to stay with you in the hospital after three days. If your hospital stay lasts for longer than 24 hours, your policy can cover the cost of flying your dependents back to their departure point. If you’re unable to return your vehicle to its departure point due to a medical emergency, your policy can cover the cost of returning it for you. If you need to return home due to a medical condition, your policy can cover the cost of transporting your pet back to the departure point.

How Can The Policy Help With Trip Planning?

If you need assistance during your trip, we’re here to help! Ask us about bank services, request driving directions, inquire about travel advice, get help with ticket bookings and dinner reservations.

How Can The Policy Help If Travel Plans Need To Be Modified?

We include 24/7 assistance re-booking flights, reserving hotels, and many other travel related questions or issues.

Does The Policy Offer Luggage Protection?

Your policy includes a team dedicated to the timely, accurate, and efficient tracking and follow-up to find your lost luggage.

What If I Don’t Have A Government Health Insurance Plan (GHIP)?

If you don’t have a government health insurance policy for your entire trip, your policy can cover you for up to $20,000 in emergency medical benefits.

The Ultimate 5 RV Road Trips Rated

Find out the best places to travel when taking a U.S. roadtrip.

Travel Budget Guide

Where To Go In The U.S. From January To March

How Border Monitoring Affects You

Crossing the border between Canada and the U.S can be problematic if you do not understand the new border monitoring changes. Find out how they may affect you.

BagTrak Service

Lost luggage is an unfortunate reality of travelling. Don't spend your holiday on the phone with the airline, BagTrak services can help to locate and deliver lost or delayed luggage.

One Million Customers

We are proud to say that we have provided cover to over one million customers around the world. We have a travel insurance policy to suit your needs.

Concierge Service

If you need help trying to find hard-to-get tickets to concerts or sporting events while travelling, our Concierge Service is available 24/7 to help you do all of these and more!

L iveTravel Team

If something goes wrong while you are travelling our LiveTravel™ team will assist you with most travel-related problems, such as re-booking flights, making last minute hotel reservations, land transportation, and more.

Coverage For The Family

Children under 21 are covered at no additional cost on our BorderHop™ and Medical plans. Up to 5 children are covered at no additional cost when travelling with two adults. Children must be related to, and accompanied by the policy holder or primary insured.

24 Hour Emergency Help

You can rest assured knowing that you have 24/7 emergency assistance. We are there for you when you need us most.

Pack Travel Insurance You Can Count On.

Visitors Travel Insurance

Secret traveller.

Annual Travel Insurance

Get coverage for multiple trips under one policy. Annual travel insurance policies are a convenient and cost-effective travel insurance option for frequent travelers.

Annual policies are a cost-effective way to get most travel insurance benefits on one policy for several trips.

Annual policies are well-suited for frequent leisure and business travelers taking multiple short trips.

Most annual travel insurance plans include generous medical coverage, among other important benefits.

Annual Travel Insurance Benefits

Is an Annual Travel Insurance Policy Worth It?

An annual policy is recommended for:

Leisure or business travelers taking multiple short trips over the course of one year

Frequent international travelers who need medical coverage while overseas

Travelers who don’t need high Trip Cancellation or Trip Interruption coverage

An annual policy is not recommended for:

Travelers who will only be traveling once or twice over the course of a year

Travelers taking extended trips, lasting longer than 90 days

Travelers with existing travel insurance coverage through a credit card

Annual policies are designed to provide long-term travel insurance benefits for travelers taking two or more trips throughout a 12-month time period. Rather than purchasing individual policies for each trip, travelers can purchase an annual plan and be covered for all trips taken within a year.

To get started, travelers should enter their intended coverage start date, their maximum trip length, their state of residence, and a few other key details. Keep in mind, most annual policies cover trips up to 30 days, while some more lenient policies will allow up to a 90-day trip length.

In general, these plans are ideal for frequent travelers looking for medical coverage while abroad. Some policies will also include coverage for trip delays and cancellations, as well as add additional policy upgrades such as pre-existing condition coverage.

Travelers who need to insure a high trip cost, have specific cancellation needs, or need medical benefits for an extended trip should not purchase an annual travel insurance policy. Travelers who do not meet the recommendations for an annual policy should consider a single trip policy. Single trip travel insurance policies can cover longer trips and provide travelers with comprehensive coverage that includes cancellation, medical, delay, and other important benefits.

Likewise, annual policies are not recommended for travelers taking a cruise , participating in adventure and hazardous sports , or traveling with a large group , as these situations are better covered by other travel insurance policy types.

How Does Annual Travel Insurance Work?

- " id="mainPhoneNumber">

- Annual Travel Insurance

- Cruise Travel Insurance

- Family Travel Insurance

- Seniors Travel Insurance

- Ski Travel Insurance

- Budget Direct

- Fast Cover Travel Insurance

- Insure4Less

- InsureandGo

- Simply Travel Insurance

- Ski-Insurance

- Travel Insurance Saver

- Travel Insuranz

- Wise Traveller

- Zoom Travel Insurance

- See more companies...

- Travel Insurance Tips

- Covid-19 Help

- Read Reviews

- Write a Review

Need Quotes?

Use our travel insurance comparision to help you save time, worry & loads of money!

Please Note - If you are cruising around Australia you need to select Pacific. With Regions, variances can apply for Bali, Indonesia, Japan and Middle East. You are not required to enter stop-over countries if your stop-over is less than 48 hours.