MoneySmart Financial is an Exempt Financial Adviser and Registered Insurance Broker licensed by Monetary Authority of Singapore ("MAS").

Get the Best Annual Travel Insurance in Singapore 2024

Compare Travel Insurance prices on MoneySmart to get the best deal to cover you against coronavirus (COVID-19), lost baggage, medical emergencies, flight delays, pre-existing conditions, pregnancy claims and more.

- Korea, Republic of

- United States

- Afghanistan

- Aland Islands

- American Samoa

- Antigua and Barbuda

- Bonaire, Sint Eustatius and Saba

- Bosnia and Herzegovina

- Bouvet Island

- British Indian Ocean Territory

- Brunei Darussalam

- Burkina Faso

- Cayman Islands

- Central African Republic

- Christmas Island

- Cocos (Keeling) Islands

- Congo, The Democratic Republic Of The

- Cook Islands

- Czech Republic

- Côte D'Ivoire

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Falkland Islands (Malvinas)

- Faroe Islands

- French Guiana

- French Polynesia

- French Southern Territories

- Guinea-Bissau

- Heard and McDonald Islands

- Holy See (Vatican City State)

- Iran, Islamic Republic Of

- Isle of Man

- Korea, Democratic People's Republic Of

- Lao People's Democratic Republic

- Liechtenstein

- Macedonia, the Former Yugoslav Republic Of

- Marshall Islands

- Micronesia, Federated States Of

- Moldova, Republic of

- Netherlands

- Netherlands Antilles

- New Caledonia

- New Zealand

- Norfolk Island

- Northern Mariana Islands

- Palestine, State of

- Papua New Guinea

- Philippines

- Puerto Rico

- Russian Federation

- Saint Barthélemy

- Saint Helena

- Saint Kitts And Nevis

- Saint Lucia

- Saint Martin

- Saint Pierre And Miquelon

- Saint Vincent And The Grenedines

- Sao Tome and Principe

- Saudi Arabia

- Sierra Leone

- Sint Maarten

- Solomon Islands

- South Africa

- South Georgia and the South Sandwich Islands

- South Sudan

- Svalbard And Jan Mayen

- Switzerland

- Syrian Arab Republic

- Tanzania, United Republic of

- Timor-Leste

- Trinidad and Tobago

- Turkmenistan

- Turks and Caicos Islands

- United Arab Emirates

- United Kingdom

- United States Minor Outlying Islands

- Venezuela, Bolivarian Republic of

- Virgin Islands, British

- Virgin Islands, U.S.

- Wallis and Futuna

- Western Sahara

- No matches found! Please try another search.

Refine Your Results

.png)

Total Premium

HL Assurance Travel Protect360 Basic

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy up to 50% off your policy premium • Get S$10 via PayNow and S$30 Revolut cash reward with eligible premiums spent. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Are your trip details correct?

Destination: Thailand

Duration: 08 Jul 2024 - 10 Jul 2024

FWD Premium

[GIVEAWAY | FLASH SALE | MoneySmart Exclusive] • Enjoy up to 35% off your Single Trip policy premium. • Get S$30 Revolut cash reward and an Eskimo Global 1GB eSIM with every policy purchased . T&Cs apply. BONUS: For a limited time only, there are S$3,200 worth of gifts to be given away on top of existing rewards: • 4x Samsonite Apinex 69/25 Luggage (worth S$600). T&Cs apply. • S$100 Revolut cash reward when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

DirectAsia Voyager 1000 Annual Plan

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 40% off your policy premium • Get up to S$20 via PayNow and S$30 Revolut cash reward with eligible premiums spent. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Great Eastern TravelSmart Premier Classic

[GIVEAWAY | MoneySmart Exclusive] • Enjoy up to 30% off your policy premium. • Get S$30 Revolut cash reward with every policy purchased . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Singlife Travel Plus

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 25% off your policy premium • Get S$30 Revolut cash reward and an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$30 via PayNow with eligible premiums spent. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

AIG Travel Guard® Direct - Supreme

[GIVEAWAY | Receive your cash as fast as 30 days*] • Get an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$150 via PayNow and S$30 Revolut cash reward with eligible premiums spent. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Allianz Travel Basic

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy an exclusive 57% off your policy premium • Get S$30 Revolut cash reward and an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$40 via PayNow with eligible premiums spent. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

[GIVEAWAY | MoneySmart Exclusive]

• Enjoy 40% off your Single Trip policy premium and 80% off Covid-19 add-on for Annual Plans. T&Cs apply • Get S$30 Revolut cash reward with every policy purchased. T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply. [Etiqa's 10th Year 2024 Grand Draw] Stand a chance to win S$10,000 cash or a Singapore Mint Lunar Dragon 1 gram 999.9 fine gold medallion (worth S$173) with eligible Etiqa/Tiq by Etiqa plans purchased. T&Cs apply.

Total Premium*

The Wise Traveller Premium

Starr TraveLead Comprehensive Bronze

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 45% off your policy premium • Get S$30 Revolut cash reward and an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$20 via PayNow with eligible premiums spent. T&Cs apply. BONUS: For a limited time only, there are S$3,200 worth of gifts to be given away on top of existing rewards: • 4x Samsonite Apinex 69/25 Luggage (worth S$600). T&Cs apply. • S$100 Revolut cash reward when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Great Eastern TravelSmart Premier Elite

HL Assurance Travel Protect360 Premier

Starr TraveLead Comprehensive Silver

Allianz Travel Platinum

DirectAsia Voyager 250 Annual Plan

The Wise Traveller Secure

FWD Business

AIG Travel Guard® Direct - Enhanced

Starr TraveLead Comprehensive Gold

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

We're gifting 1,000 FREE Eskimo eSIMs to all our MoneySmart readers!

All you need to do is follow us on our Telegram and fill out a form. Hurry! Grab your before it runs out.

Buy Travel Insurance Plan Online

What customers say about their travel insurance purchase, review by doreenngsk ng.

"Purchased travel insurance on Moneysmart with cash rebate deal. Great value after discount. MS is good platform to peruse available travel policies to choose from, giving us choices to consider appropriate for our requirements."

As seen on Google

Review by Ron Tay

"I always use MoneySmart when i need a travel insurance..... It easy and convenient to use, let me easy to compare each travel insurance package..... Highly recommended!"

Review by Jodel Tan

"Purchasing travel insurance was easy, fast and smooth... had a good deal of getting cashback by purchasing the insurance. Steps from claiming to receiving the cashback was simple too. A good experience overall."

What Do Travel Insurance Plans Cover?

While pricing is a an important factor when comparing travel insurance plans, other features such as overseas medical coverage, trip cancellation coverage and many other related aspects are as important. These benefits and the extent of coverage for each type of benefit usually varies from insurer to insurer. Here are a few aspects you’ll want to look out for when it comes to choosing a suitable travel insurance with adequate coverage .

Overseas medical expenses

In the event you get diagnosed with some sort of unexpected disease, you’ll be able to claim for the necessary and reasonable overseas medical costs incurred within a certain number of days of your trip (usually 90 days) up to the limit as specified according to your selected plan. For some plans there are also tiered coverage limits for different age groups.

In-hospital cash overseas or allowance

Reimbursements for in terms of cash for hospital stays is another benefit that many insurers include in their plans now, especially after the Covid-19 pandemic.

Emergency medical evacuation and emergency medical repatriation

This is one of the fundamental aspects of every coverage plan. Any costs incurred for emergency medical evacuation and repatriation (including repatriation of mortal remains back to Singapore) that are related to your severe injury/illness diagnosis will be covered.

Keep in mind to have someone on your behalf to contact the insurer’s emergency service to provide your full name, dates of trip, NRIC/FIN number, policy number, name of the place and the telephone number that your insurance provider can reach you, as well as the nature of help required during the emergency, in case you are unable to do so during the emergency.

Trip cancellation/alteration/interruption/delay

Trip cancellations, postponements, delays, and interruptions are often covered if you as the traveller or you relatives travelling with you are diagnosed with a severe illness/get severely injured before the date of departure, subject to terms and conditions.

Pre-existing conditions

This benefit is not commonly included in most travel insurance plans, but currently there are several insurers providing such plans and they include MSIG TravelEasy® Pre-Ex, Income Insurance Enhanced PreX® (formally known as Income) and Etiqa Pre-Ex. The premiums are higher than regular plans, but they provide overseas medical expenses that cover pre-existing conditions.

Does Travel Insurance Cover Cancelled Flights?

Not always! While all travel insurance policies have a "Trip Cancellation" benefit, you can only claim for this if it's for an insured event, such as a serious illness or accident, or unforeseen events such as riots or natural disasters. However, different insurers exclude different scenarios, so it's best to read the policy wording carefully. The following are types of flight cancellations that are NOT covered by travel insurance.

Flight Cancellation Due to Known Event

Flight cancellations due to events which are already made known as public knowledge are not covered by travel insurance, as you are expected to have known about these at the point of buying your tickets. However, if you bought your flights and activated your travel insurance before they became public knowledge, you might still be able to make a claim.

Flight Cancellation with Refund / Replacement

If your flight was cancelled but you were put on a replacement flight, or your fare was refunded, you will not be able to make a travel insurance claim under the trip cancellation benefit. In general, travel insurance is only for unrecoverable costs. However, you may claim for trip delay benefits, such as an extra night's accommodation or extra meals.

You Cancelled Your Own Flight / Trip

Travel insurance typically covers insured events that are beyond your control. If you are the one who changed your mind about your trip, you generally won't be able to claim anything - unless your insurer offers a "Cancellation for Any Reason" benefit. However, in public health emergencies like the COVID-19 outbreak, airlines usually waive the usual penalties for flight cancellations, out of goodwill.

Different Types Of Travel Insurance Coverage

Single trip plans.

If you’re thinking of only taking one or two trips in a year, single-trip travel insurance is probably more suitable for you. As the name suggests, single-trip insurance plans are made for individual travellers, and those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

It makes more economic sense for those who don't travel very often, plus, single-trip insurance plans can be purchased easily online, with less time in planning and consideration as compared to annual multi-trip plans. But on the flip side, you’ll face the hassle of getting a new travel insurance policy every time you go on an overseas trip. For some, a single-trip insurance plan can get relatively expensive if the trips are short.

Annual Multi-trip plans

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, are designed for those who travel several times in a year. The great thing about this kind of travel insurance is that you only need to do the purchase once, and you’re covered for the next 12 months. It is a good option if you’re a frequent traveller who intends to make many long trips or short weekend getaways abroad in a year.

Individual plans

Going solo as an occasional traveller or frequent traveller means that you’ll most likely need a single-trip individual travel insurance plan or an annual multi-trip travel insurance plan, depending on the frequency of travel.

Family plans

Family travel insurance plans usually cover you and the members of your family who travel with you on your trip, with a maximum number of adults and children to be insured per policy purchased. The people who are insured under a family travel insurance plan may comprise of you and your spouse, and/or your children or grandchildren.

You may want to consider purchasing a family travel insurance plan if you are travelling with your family and thinking of getting a single policy for your family members who are travelling with you, as getting a family travel insurance plan can be more cost-effective than getting separate single trip plans for each family member. What if you and your loved ones are travelling very often as a family? Some travel insurers also offer annual multi-trip travel insurance for families who are frequent travellers.

Single-trip or Annual multi-trip plan - Which one should you pick?

Now that we've detailed out what the different types of travel insurance plans are, it’ll be easier for you to make a decision. If not, here are some examples to help you understand better.

Joshua flies frequently in and out of the country for his business trips. As he works as a legal advisor, his job requires him to travel between Singapore and Thailand twice or once a month. Each trip will last for about a week. In this case, multi-trip travel insurance works best for him as he wouldn't have to keep getting travel insurance before every trip.

Lisa and Amanda are university friends planning to take a long post-graduation trip to Australia. They seldom travel and even if they did, they go on overseas vacations once a year with their own families. For them, the single travel insurance policy is a more suitable choice Australia .

How Do I Choose The Best Travel Insurance?

When choosing travel insurance plans for your holiday or business trips, there are several factors to consider, depending on your priorities. Here are four simple steps to pick a suitable travel insurance plan.

Check general coverage

Instead of deciding solely by price, you should compare the benefits and reimbursement limits for common claims like medical expenses, trip cancellations, flight delays and baggage theft and/or damage.

Compare policy premiums

How much your travel insurance costs depends on your destination and length of stay. Most travel insurance companies have 2 to 3 tiers of plans at different price points, with varying comprehensiveness and reimbursement limits.

Special activities coverage

The breadth of coverage needed largely depends on your itinerary. For instance, if you’re planning to go skydiving, make sure you get a policy that covers aerial sports like MSIG’s TravelEasy® Standard, Elite and Premier plans. Or if you’re going golfing overseas, pick a policy that insures your equipment.

Consider the trip duration

This is one of the important determining factors of which kind of travel insurance you get. Single trip travel insurance plans are usually for short trips. If you’re the kind who travels far and for months, it might be worthwhile to consider buying annual travel insurance.

Unlike single trip travel insurance, annual travel insurance often charges a flat premium and insures you for an entire year of travel. It usually costs about $200 to $300 per year, which is more suitable for a frequent traveller who is probably going to travel overseas more than 7 or 8 times a year, at least.

Best Travel Insurance Plans in Singapore Benefits Coverage

Travel insurance recommendations.

- Best Travel Insurance with Pre-Existing Coverage

- Best Pregnancy Travel Insurance for Expecting Mothers

- Best Covid-19 Coverage Travel Insurance

- Best Travel Insurance For Flight Cancellation Coverage

- Best Extreme Sports/ Adventure Sports Travel Insurance

- Best Cruise Travel Insurance

- Best Travel Insurance for Seniors and Elderly

- Best Travel Insurance For Phones, Laptops, Tablets

- Best Travel Insurance For Roadtrips

- Best Bali Travel Insurance (Indonesia): Top 7 Value Plans

- Best Malaysia Travel Insurance: JB, KL, Penang & more

- Best Japan Travel Insurance – Best Value, Cheap Plan s

- Best Thailand Travel Insurance– What To Look Out For

- Best Australia Travel Insurance– Plan Benefits, Travel Tips

- Best Korea Travel Insurance To Get– Most Affordable

- Best Travel Insurance To Buy Travelling To The UK: Top 5 Plans

- Best Taiwan Travel Insurance– Cost, Coverage, Compare

- Best Vietnam Travel Insurance

- Batam Travel Guide: What To Do, Where To Go

Travel Tips

- Travel Essential Packing List 101

- How To Renew Your Singapore Passport

- Top Travel Hacks To Save Money

- 15 Rookie Mistakes To Avoid While Travelling in Europe

- 10 Cost Savings Tips For Your Year End Holiday

- Travel Safety: Tips for Women, LGBTQ+, and Persons with Disabilities

- Best Travel Insurance Plans For Female Solo Travellers

- Should I get travel insurance from all-in travel agency packages?

- Moneysmart's Travel Insurance Promotion

- Starter Guide :How To Claim Travel Insurance

- Top 5 Reasons Why Travel Insurance Claims Are Rejected

- Are Travel Aggregators Harder to Claim From?

Travel Surveys

- Top 12 Airlines With Most Cancellations and Delays

Travel Insurance Claims

How do travel claims work.

Before you make a claim from your travel insurance provider, there are several important things to take note of, whether it is for claims related to your COVID-19 diagnosis, loss of baggage, trip cancellation, or other reasons. These include knowing what type of plan you purchased, when did the incident/illness occur (pre-trip, during-trip or post-trip), what belongings or items to claim for, and who are involved.

Here are 3 simple steps to submit your travel insurance claim

Get your supporting documents ready.

Most travel insurers require claims within 30 days. Submit via mail, WhatsApp, their app, or online portal to avoid policy breaches. Keep originals for 6 months in the event the travel insurance provider needs to sight them. Required documents often include personal info, medical reports, ownership proof, trip records, and reports (e.g., police, airline).

Fill in your details and attach your supporting documents in your submission

Log in to your insurer's claims app or portal. Fill in your info, and the necessary details for the claims (email address. policy number, departure date or policy purchase date), upload soft copies of your documents and submit. Alternatively, mail hard copies of your original documents.

Receive an acknowledgement email and await for settlement

After submitting, you'll receive an acknowledgment email. Your claim will be reviewed. For COVID-19-related claims, contact the provided hotline or email. Upon approval, your insurer will coordinate payments, often offering cashless reimbursement through PayNow or iBanking for speed and convenience.

Frequently Asked Questions

What is travel insurance and how does it help me, what's the difference between single-trip or annual multi-trip travel insurance.

When you buy travel insurance you can choose from 2 types of policies, either the single trip or annual multi-trip travel insurance plan. Single trip travel insurance covers you for a single trip and is usually for individual travellers, or those who are travelling as families, who need travel coverage for a single trip or holiday, especially for long overseas trips (usually up to 180 days).

Annual travel insurance plans, which are also known as multi-trip travel insurance plans, cover you for all trips starting and ending in Singapore, and are designed for those who travel several times in a year, each trip lasting for about less than 180 days. You should consider buying Annual Travel Insurance if you travel frequently (more than 10 times a year). You will enjoy significant savings, and you won't have to worry about purchasing travel insurance every single time as you’ll be covered for the entire year.

Are family travel insurance plans cheaper?

Can i buy travel insurance once i'm overseas, how do i compare travel insurance policies, what are the best travel insurance for east and southeast asia countries.

We have written a quick guide on buying the best travel insurance to the nearby countries whether you are travelling to Malaysia , taking a weekend trip to Thailand , holidaying in Bali , planning a trip to Japan or a getaway to South Korea . Before jetting off, here are the 5 must have list of travel essentials that you will need when on holiday.

Does travel insurance cover flight cancellation due to illness?

Is there a difference between family travel insurance plans and group travel insurance plans, we asked singaporeans about flight disruptions, and they answered..

Find out the worst airlines with delays and cancellations according to Singaporean travellers.

- Latest Articles

- Market Review and Trends

- Shares & Derivatives

- Technical Analysis

- Career & Education

- Saving & Spending

- Side Hustle

- Travel & Lifestyle

- Cryptocurrency

- Sponsored Post

Cancel reply

Your email address will not be published. Required fields are marked *

Your Email Address will not be published *

Save my name, email, and website in this browser for the next time I comment.

TheFinance.sg

10 Best Travel Insurance in Singapore for that Next Flight Out [2024]

With the gradual opening up of travel, we see travel starved Singaporeans rushing to get that flight ticket out of Singapore.

Singapore Business Owners

Getting the right travel insurance during this period becomes all the more important, so read on for our top travel insurance in Singapore picks to cover you on your next trip!

1. AXA Wanderlust Travel Insurance

Choose from their range of affordable plans based on your travel needs. They offer 3 plans – Lite, Easy and Pro plan. If you would like more medical expenses coverage, you can opt for the Easy or Pro plans which offer S$250,000 and S$300,000 respectively for medical expenses coverage.

Furthermore, the Pro plan covers up to S$500,000 for personal accident coverage.

2. AXA SmartTraveller Travel Insurance

Be a smart traveller and make sure to take all the necessary precautions with AXA’s SmartTraveller insurance. One can consider their essential plan which provides the most basic coverage or opt for the comprehensive plan which provides more extensive coverage.

The comprehensive plan is quite value for money, covering medical expenses up to S$600,000, twice that of what the essential plan covers with just a small top-up. Indeed one of our top travel insurance in Singapore picks!

3. MSIG Travel Easy

TravelEasy provides comprehensive cover with over 50 benefits and also COVID-19 coverage which is automatically included for Single Trip plans.

Furthermore, they are running a promotion now where one can enjoy 20% off for Single Trip plans and also get a free Polymerase Chain Reaction (PCR) test (worth S$138) when you purchase the Annual Plan.

4. Starr Cruise-to-No-Where

With the slowing down of air travel, cruises to nowhere have been all the hype. Insurers such as Starr Insurance have cruise insurance tailored for each individual.

Other than the above-stated benefits, they provide 24 hours Global Emergency Assistance Services for medical treatment and transportation.

We also like them for the seamless payment process which can be done through PayNow, indeed one of our top travel insurance in Singapore!

5. Starr TravelLead Insurance

Like many other insurance plans, the Starr Insurance travel insurance plan allows for customisation between an annual trip plan and also single trip plans. All of their plans have medical coverage which covers:

- Accidental Death and Disablement

- Compassionate Death Cash due to Accident

- Medical Expenses

- Starr Global Emergency Assistance Services

Easily choose add-ons for your plans such as gold protection, cruise vacations, scuba diving and also snow sports! We like them for their flexible coverage which allows you to create a travel insurance plan with different types of coverage and add-ons.

6. FWD Travel Insurance

FWD offers 3 types of insurance plans – from the most basic premium plan to the mid-tier business plan and the first plan which offers the most coverage.

Some things we like about FWD’s travel insurance is the range of convenient payment modes that they offer, allowing clients to pay with PayNow and Grabpay etc. The prices offered are also pretty affordable with no hidden costs!

7. Allianz Travel

Find a travel insurance plan that suits you with their comprehensive bronze, silver and platinum plans. Allianz’s travel insurance is catered to different needs, for frequent travellers, one-off trips and also family coverage that comes with affordable premiums.

8. Income’s Travel Insurance

Income Travel Insurance is now running a promotion of 40% off the Classic, Deluxe and Preferred single trip plans with COVID-19 coverage to ensure you get the necessary protection.

One thing we like about them is their Enhanced PreX plans which provides comprehensive coverage for pre-existing injuries and illnesses that you knew about or sought treatment for before your trip.

9. Sompo TravelJoy

If you’re travelling to Japan, Sompo’s TravelJoy insurance may be the most suited one as they offer Japan specific coverage. Their Go Japan! plan is specially tailored plan for travellers to Japan, covering cashless services at 740 clinics and hospitals.

Furthermore, they also provide free over the phone translation services while you’re in Japan for your holiday. We also like their trip distribution cover of $100 which covers un-utilised paid event tickets to theme parks or concerts etc.

10. Great Eastern TravelSmart Premier

Great Eastern’s TravelSmart Premier allows you to head on your VTL trip with a peace of mind, with no additional premium. We like them for their COVID-19 coverage that covers you for COVID-19 related conditions during your trip.

They also offer a range of plans of which you can choose from – TravelSmart Premier Basic, Classic and Elite Plans of which you can choose one based on your travel needs.

In support of Singapore’s COVID-19 vaccination efforts, enjoy a premium discount for Elite and Classic plans if you have been fully vaccinated against COVID-19. Indeed one of our top travel insurance in Singapore!

Do you have any reviews and comments to share regarding our choices for the best travel insurance in Singapore for that next flight out of Singapore?

While SBO is committed to supporting our local businesses, we welcome any feedback and anonymous sharing regarding your experience with the above-listed best travel insurance in Singapore.

We hope that this guide will be useful in helping you to make a better decision when it comes to finding the best travel insurance in Singapore.

Explore More Content

You may be interested in these, 10 best cancer insurance in singapore to protect yourself [2024], 7 best life insurance in singapore to get the necessary protection [2024], 8 best home insurance in singapore for a safer home [2024], 10 best maid insurance in singapore – our top picks [2024], 12 best personal accident insurance in singapore to give you a peace of mind [2024], the difference between a financial advisor and an insurance agent: which one is right for you, 9 best car insurance in singapore that are popular among car owners [2024], get latest updates from sbo sent right into your inbox.

- Travel Insurance

- Car Insurance

- Corporate Employee Insurance

- Critical Illness Protect360

- Early Protect360 Plus

- Cyber Insurance

- Fire Insurance

- Home Protect360

- Home ProtectLite

- Hospital Income Insurance

- Maid Insurance

- Mobile Phone Insurance

- Accident Protect360

- Family Protect360

- Singapore Travel Pass

- Business Packages

- Casualty Insurance

- Corporate Travel360

- Engineering Insurance

- Property Insurance

- Agent Recruitment

- Intermediary Login

- Our Corporate Profile

- Ethics Policy

- News and Media Releases

- HLAH Background and Regional Subsidiaries

- Check Claim Status

- Claim Forms

- Guide To Claims Process

- REGIONAL SERVICES

SAFE TRAVELS START WITH SINGAPORE'S BEST COVID-19 TRAVEL INSURANCE

PROTECT YOUR JOURNEY WITH THE BEST TRAVEL INSURANCE

Important Notice

The Ministry of Foreign Affairs has put up travel advisories against non-essential travel to Israel and Palestinian Territories. Please click here if you intend to or have purchased a travel plan to these areas.

current promotion

Purchase your travel insurance policy with HL Assurance and you’ll have the chance to win a flight ticket of your choice to your dream destination. The more you purchase, the more points you earn and the more chances of winning! Terms apply.

How to participate.

Get your dream holiday!

Protect you and your family with our COVIDSafe Travel Protect360.

Stand a chance to WIN a flight ticket of your choice

Single Trip

Travel insurance promotion 45% discount, ncd th customer + 1 buddy + ncd-->.

Be protected from COVID-19 with the new travel insurance offer in Singapore – COVIDSafe0 Travel Protect360! Not only will you be covered for Overseas Medical Expenses and Trip Cancellation due to COVID-19 under our travel protection plan, but we are also now rewarding you with No Claim Discount. *Terms apply.

Please refer to below Single Trip Travel Insurance Promotion Terms and Conditions for more redemption details.

Annual Unlimited

Annual travel insurance promotion 50% discount, ncd.

Travelling more than twice in a year? Get our annual multi-trip insurance policy and additional travel perks at just $0.52 / day. This travel insurance annual promotion in Singapore could be better value than buying single trip insurance for each holiday! Take advantage of our best annual travel insurance promotion and discounts today!

Please refer to below Annual Multi Trip Travel Insurance Promotion Terms and Conditions for details.

COVIDSafe Travel Protect360.

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

Enhanced Benefits with COVID-19 Cover

*NEW FEATURE* Making your vacation safe even during a pandemic

Get a peace of mind when you are travelling during the pandemic with our new COVID-19 benefits for Travel Protect360! Even if you require medical assistance or trip cancellation due to COVID-19, you can be assured that you are well covered!

Travel No Claims Discount

Get Rewarded for Safe Travels

We want to celebrate your safe travels with you! If you do not make any claims from your travel insurance, you get additional up to 10% off your next travel insurance purchase on top of our promotions.

Travel Inconvenience Protection

Be protected with comprehensive Travel Inconvenience cover

No traveller will wish for travel cancellations and travel interruptions and we are here to protect you from these inconveniences! No matter if it is the loss of baggage or insolvency of travel agencies, be assured that you are well protected!

Why You Should Choose Our COVID-19 Travel Insurance in Singapore?

Packed with all-inclusive enhanced benefits to give you peace of mind, COVIDSafe Travel Protect360 is the best travel insurance with COVID-19 coverage in Singapore. Choose from a variety of recommended plans that offer secure protection and peace of mind today: single trip, annual, long term, family, seniors and more. Buy your travel insurance online to ensure a hassle-free trip for you and your loved ones.

24/7 COVID-19 Travel Concierge

With regional alarm centres available 24/7, you can travel with peace of mind, knowing support is #OneClickAway. Connect with Global Teleconsultation via your communication method of choice. Click here to find out more.

Best COVID-19 Travel Insurance Coverage

Travelling during a pandemic can be stressful, not knowing if your insurance plans provide proper coverage. With our enhanced COVIDSafe Travel Protect360 Insurance, you can travel knowing that you are covered up to $200,000 in overseas medical expenses incurred due to COVID-19.

COVID-19 Quarantine Allowance

Be reimbursed with up to $1,500 even when you are quarantined overseas as part of our many COVID-19 travel insurance coverage benefits.

Enjoy No Claim Discount

If you do not make any claims from your travel insurance, you get up to 10% off your next travel insurance purchase with HL Assurance.

Greater Flexible Coverage

If you have to make changes to your trip due to the COVID-19 pandemic, COVIDSafe Travel Protect360 allows you to make adjustments to your policies. When your family is protected by COVIDSafe Travel Protect360 insurance, we are happy to make adjustments even when the trip needs to be cancelled because of one person in the family.

Stay Protected From Travel Inconvenience

Be it loss of baggage or insolvency of travel agencies, our comprehensive COVID-19 travel insurance cover ensures that you are well protected from travel cancellations, travel interruptions and other inconveniences! Buy your travel insurance online today.

Enhanced Benefits of our Travel Insurance

With our enhanced travel insurance, you can now be ready for all your adventures and travel with peace of mind. COVIDSafe Travel Protect360 insurance provides the comprehensive travel insurance coverage you need for your holiday.

COVID-19 Cover

Overseas Medical Expenses

Extensive Travel Inconvenience Benefits

What Our Customers Have To Say About Us

preferred travel insurance in singapore.

Customer Review by Lee Meng Tong

Thank you so much for your efforts in processing and finalising my travel claims. My wife and I are very appreciative of the care and excellent service provided by you and your staff. Rest assured that HL Assurance would be our preferred insurance for all our travels.

Hassle-Free Claims

Customer Review by Jack Wong

For my annual travel insurance, I always go with HLAS, their price is most reasonable with good enough coverage and the claim process is hassle-free. I always recommend my friends and colleagues to them.

Prompt And Excellent Service

Customer Review by H L

What professionalism! Prompt and excellent service for travel insurance as well as car insurance. I had immediate attention and was certainly impressed! 😀👌🏻

Seamlessly Easy And Convenient

Customer Review by Rasidah Maya

We get our travel insurance regularly from HL Assurance. Seamlessly easy and convenient online purchase. Thank you Jerry He for assisting me with the changes I needed and the advice given for my queries.

Good Choice For Travel Insurance

Customer Review by Choon Xiang

I am really inspired with HLAS travel NCD. You get rewarded for Safe Travels which everyone wishes. No doubt is your good choice for travel insurance.

No Claim Travel Insurance Discount Programme Terms and Conditions

Promotion terms and conditions.

- The promotion is held from now until 30 September 2024, customers who purchase any Travel Insurance policy (COVIDSafe Travel Protect360 Single Trip or Travel Protect360 Annual Trip) will automatically be enrolled into COVIDSafe Travel Protect360 No Claim Discount programme.

- For COVIDSafe Travel Protect360 Single Trip Policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for a 5% discount promotion code.

- For subsequent travel purchases with the utilising the 5% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be eligible for an additional 10% discount promotion code.

- Thereafter for subsequent travel purchases utilising the 10% discount promotion code, where the policyholder(s) who return from Trip and has no claims within stipulated timeframe of 30 days from the policy end date, will be capped at 10% discount promotion code.

- For COVIDSafe Travel Protect360 Annual Plan Policyholder(s) who has completed the policy period of one (1) year and has no claims during the policy period and within stipulated timeframe of 30 days from the policy end date, will be eligible for a 10% discount promotion code refund upon the next Travel Protect360 Annual Plan renewal.

- Promotional codes provided for the Single Trip can only be utilised for the next Single Trip purchase and can only be used once.

- The promotional codes are not transferable.

- Should there be any claims incurred, the No-claims discount promotion code will no longer be applicable.

- Each policy is only eligible for one promotion code.

Note: Swipe left or right to view the full table on your mobile screen.

- HL Assurance, at any time, at its sole discretion and without prior notice, can vary, modify, delete or add to these terms and conditions. Please refer to the policy wording for full details.

- In the event of any dispute, HL Assurance management’s decision is final.

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2024 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- “HL Assurance” means HL Assurance Private Limited.

- HL Assurance’s Travel Insurance is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites (www.gia.org.sg or www.sdic.org.sg). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Single Trip)

- The promotion is held from now until 31 July 2024.

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Single Trip policies during the Promotion Period will be entitled to 45% discount.

- This promotion is only applicable for new purchases made via HL Assurance website at www.hlas.com.sg/personalinsurance/travelinsurance.

- New purchases refer to purchases via HL Assurance website (as per stated above), and are not applicable to any purchase from HL Assurance’s agency partner.

- This promotion is not valid with any ongoing travel discounts, schemes or privileges.

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2021 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Promotion (Annual Trip)

- The promotion is held from now until 30 September 2024.

- Eligible customers who successfully purchase any COVIDSafe Travel Protect360 Annual Trip policies during the Promotion Period will be entitled to a 50% discount, provided that the policy is not subsequently cancelled.

- New purchases refer to purchases via HL Assurance website (as per stated above), and is not applicable to any purchase from HL Assurance’s agency partner.

Terms and Conditions for COVIDSafe Travel Protect360 Get eSIM (Single/Annual Trip)

Please click the link for terms and conditions: COVIDSafe Travel Protect360 Get eSIM Terms and Conditions

Terms and Conditions for COVIDSafe Travel Protect360 Insurance Mid-Year Deal Promotion (Single Trip)

- The Mid-Year Deal Promotion is held from now until 29 May 2024.

- Eligible customers who successfully use the promo code ‘MIDYEAR5’ to purchase any COVIDSafe Travel Protect360 Single Trip policies during this Promotion Period will be entitled to an additional 5% off the base discount.

- This promotion is only applicable for new purchases made via HL Assurance website at www.hlas.com.sg/personal-insurance/travelinsurance .

- HL Assurance’s full disclaimers, terms, and conditions apply to individual products. © 2024 HL Assurance is a registered service mark of Hong Leong Group. HL Assurance Private Limited Co. Reg. No. 201229558W.

- HL Assurance’s Travel Insurance is underwritten by HL Assurance Pte. Ltd. Co. Reg. No. 201229558W. This policy is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic, and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ). This is not a contract of insurance. Accordingly, the information should be read and construed in the light of, and subject to, all terms and conditions contained in the Policy. Full details are stated in the Policy.

What our Travel Insurance in Singapore Covers

Read the full terms and conditions

Policy Owners’ Protection Scheme

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact HL Assurance Pte. Ltd. or visit the GIA or SDIC websites ( www.gia.org.sg or www.sdic.org.sg ).

Frequently Asked Questions for COVIDSafe Travel Protect360 Insurance

Q: can i continue my medical treatment for injury or sickness sustained overseas when i return to singapore.

A: Yes, the Company will indemnify you for follow-up treatment within thirty (30) days after Your return from the Trip, provided you have sought initial treatment overseas for Bodily Injury or Sickness which occurred outside Singapore during the Trip within the Period of Insurance and such initial treatment is claimable under the Overseas Medical Expenses benefits.

Q: If I was injured or sick overseas but did not seek medical treatment, can I do so upon my return to Singapore?

A: Yes. The Company will indemnify you up to the Benefits Payable under the Policy for the treatment sought within three (3) days after your return from the Trip where initial treatment for Bodily Injury or Sickness was not sought overseas, up to a maximum of thirty (30) days from the date of first treatment in Singapore, and subject to a limit of S$100 per visit.

Q: What is the time frame for submitting a travel claim when I return to Singapore?

A: You will need to submit a claim within thirty (30) days upon returning to Singapore.

Q: What should I do if I lose my money or travel documents during my trip?

A: If your loss arises out of robbery, burglary or theft, you should report the loss to the local police within 24 hours after the loss / incident and obtain a written statement from the police to substantiate your travel insurance claim.

Q: What should I do if I need assistance while overseas?

A: One of the benefits of our travel insurance is the 24 hours Travel, Emergency Medical and Evacuation Assistance which provides for loss of travel documents and baggage, air ticket arrangements, emergency medical evacuation, referral services for interpreters / translators, legal, embassy, hospital admission and other medical facilities etc. These services are available 24/7 by calling our Hotline at (65) 6922 6009.

Q: I am currently under medication for some medical conditions. Can I claim for medical expenses related to these medical conditions during the trip?

A: No. Our Travel Insurance Policy excludes all pre-existing medical conditions prior to the trip.

Q: If I am pregnant, am I covered for any medical treatment incurred overseas?

A: No. Our travel insurance policy does not cover any pregnancy-related issues.

Q: Is dental treatment covered while I am overseas?

A: Yes, dental treatment is covered (as a result of Bodily Injury only).

Q: Will I be covered if I am going overseas to receive medical treatment?

A: No. The travel insurance plan does not cover you if you are travelling contrary to the advice of any Qualified Medical Practitioner or for the purpose of obtaining medical treatment.

Q: Are adventure activities and indoor / outdoor sports covered by COVIDSafe Travel Protect360 insurance?

A: No. Our travel insurance does not cover adventure activities. You can find the list of exclusions in our policy wordings .

Q: Is there a waiting period for COVIDSafe Travel Protect360 Insurance coverage to take effect?

A: A 3-day waiting period applies only to trip cancellation, postponement, and curtailment due to COVID-19 in Enhanced Travel Inconvenience (for COVID-19).

Q: How to buy travel insurance from HL Assurance?

A: Buying your travel insurance from HL Assurance is a straightforward process. You can purchase your desired policy online. Simply visit our travel insurance section, select the plan that suits your needs, and follow the steps for a hassle-free purchase experience.

Q: Can I extend my travel insurance coverage if my trip is extended?

A: Yes. This is subject to our underwriter’s approval. You can call or email us before the policy expires. If you’re wondering where to buy travel insurance for extended trips, you can easily do so through our website or contact our customer support at 6702 0202 for assistance.

Q: Can I buy travel insurance after departure?

A: Generally, travel insurance should be purchased before your trip commences.

Q: Can I cancel my travel insurance policy if my plans change?

A: You may cancel the Policy before the start of your trip with administrative charges applicable.

Q: Annual Trip Insurance vs Single Trip Insurance - Which is better?

A: Single Trip Travel Insurance provides coverage for the destination you’ve indicated. Meanwhile, an Annual Trip Travel Insurance gives better value should you have already planned to go on more than two trips in the year.

Q: Does COVIDSafe Travel Protect360 Insurance cover me if I travel to multiple countries?

A: Please indicate the countries you will be travelling to when you buy your travel insurance online. If you’re wondering where to buy travel insurance online, simply visit our website’s travel insurance section for a seamless online purchase experience.

Q: What are the Terms and Conditions for COVIDSafe Travel Protect360 Insurance?

A: You can find out more about our Terms and Conditions for COVIDSafe Travel Protect360 here .

Q: What does COVIDSafe Travel Protect360 Insurance cover?

A: We provide comprehensive travel insurance coverage of four (4) levels with diverse limits: Basic, Enhanced, Superior and Premier. Though the limits vary, the coverage is broad and has everything you’re looking for in a travel insurance plan.

All plans cover the following travel benefits:

- Overseas Medical Expenses (Child, Adult, Senior / Elderly)

- Medical Expenses in Singapore

- Personal Accident: Accidental Death & Permanent Disablement

- Travel Inconvenience

- Travel Postponement

- Travel Misconnections

- Insolvency of Travel Agency (Excluding Basic Plan)

- Trip Disruption

- Flight Inconvenience and Diversion

- Hijack of Common Carrier

- Kidnap & Hostage (Excluding Basic Plan)

- Personal Liability

- Loss of Home Contents

- Credit Card Protections (Excluding Basic Plan)

- Rental Car Excess

- Enhanced Medical Benefits due to COVID-19 (Excluding Basic Plan)

- Enhanced Travel Inconvenience, Cancellation, Postponement or Curtailment due to COVID-19 (Excluding Basic Plan)

Chat with us if you have any questions via WhatsApp and we will be happy to answer your queries!

For 24-Hour Emergency Travel Assistance Service, please contact 6922 6009 .

File a travel insurance claim, claims procedure and documentation.

Please submit your claim to us with the original Claim form and supporting documents within 30 days upon returning from your trip.

Common documents required for all Travel Insurance Claims:

- Copy of flight itinerary

- Proof of travel, i.e. original boarding pass, air tickets, copy of passport, etc.

Supporting documents needed when making a claim for:

- Medical Report and Medical Certificate

- Original Medical bills / receipts

- Death Certificate, autopsy report, coroner’s findings, if applicable (for death claim)

- Documentary proof of relationship between deceased and claimant (for death claim)

- Motor accident report / police report (for injury / death resulting from a traffic accident)

- Baggage loss or damage report / Property irregularity report from the carrier / airline

- Baggage tag(s) issued from the carrier / airline during check-in

- Written confirmation of carrier / airline’s settlement / rejection of claim for damage / loss of property

- Photographs of damaged items

- Original purchase receipts of damaged/lost items

- Copy of police report lodged at place of loss within 24 hours

- Receipts for replacement of passport / visa

- Transportation and / or hotel bills / receipts incurred for replacement of document

- Baggage delay report

- Written confirmation from carrier / airline on reason and duration of delay

- Acknowledgement receipt of baggage received

- Medical Report and other medical documents / Death Certificate

- Proof of relationship (if due to sickness, injury or death of related person)

- Written advice or medical certificate from a Registered Medical Practitioner to cancel / curtail trip

- Original tour booking invoice / receipt

- Travel agent and / or airline’s confirmation of the refund amount

- Original invoice / receipt for charges incurred in amending or purchasing additional air ticket (for trip curtailment)

- Written confirmation from carrier / airline on reason and duration of delay, overbooked flight, travel misconnection, and / or diversion

- Air ticket and Boarding pass

- Copy of police report lodged within 24 hours upon discovery

- Invoice of damaged items / quotations

- Original photographs of damaged items

- Do not admit any liability or make any offer, promise or payment without our prior consent

- Forward all correspondence / documents from third parties concerning the accident to us immediately

- Copy of police report lodged (if applicable)

We will contact you for any additional documents that may be required.

You may submit your claims online . Kindly note that it may take longer to process a claim if we require additional information or documents from you. For any claims enquiry, amendment of details or submission of supporting or original documents, please email our friendly claims officers at [email protected] with our acknowledgement reference number – MTC/YYYY/000000.

We will keep you updated on your claim(s) by email. You can also call our Hotline at 6922 6003 to check on your claim(s).

Thank you for insuring with us.

Discover more about Travel Insurance in Singapore

Travel Essentials: Must-See Cities and Insurance Insights for Japan

Japan is an archipelago stretching along the eastern coast of Asia, made up of four main islands: Honshu, Hokkaido, Kyushu, and Shikoku. This geographic diversity brings a range of climates and landscapes, from the snowy mountains of Hokkaido to the tropical beaches of Okinawa. Whether you’re a first-time traveller or a yearly visitor, Japan continually…

Travel to Bali: Essential Insurance Tips for a Tropical Escape

Bali, Indonesia’s famed island paradise, beckons travellers with its enchanting blend of lush landscapes, friendly people, and serene beaches. Known for its majestic temples, vibrant arts scene, and world-renowned surf spots, Bali offers a myriad of experiences for every type of holiday-goer. As you plan to bask in the island’s natural beauty and dive into…

Travel Smart in Taiwan: Key Insurance Insights and Tips for Your Journey

Taiwan is a land of stunning contrasts, delightful food and friendly people. The island boasts a landscape as diverse as its cultural heritage, from the soaring peaks of the Central Mountain Range to the serene beaches of Kenting. Prefer food to scenery? Taiwanese cuisine, a delightful blend of local flavours and foreign influences, offers foodies…

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- Best Annual Travel Insurance 2024

Annual travel insurance plans are a smart and economical option for frequent travellers. Below, you'll be able to compare our top picks out of the 80 thoroughly researched annual travel insurance plans available in Singapore based on where you are planning to go, the benefits you want and your budget.

* COVID-19 and Travel : While Singapore and certain neighboring countries are seeing success in decreasing COVID-19 transmission and are opening up their international borders, please note that COVID-19 transmission is still persisting in many countries. Therefore, we recommend following the Ministry of Health's travel advisories; following all pre- and post-travel guidelines at your destination and upon return to Singapore; and buying travel insurance that provides coverage for COVID-19.

- Allianz Travel Silver : Maximum trip inconvenience and medical benefits for the price-point

- The Wise Traveller Secure : Great deal for global trips, as plans cost 45% below average for worldwide coverage

- ERGO Essential : Good value for money option, cheapest annual plan for ASEAN cover

- Budget Direct : Cheapest annual travel insurance on the market

- Etiqa Basic : Modest coverage overall, but has above average personal accident coverage

- Allianz Travel Silver : Offers 20-30% higher benefit limits for trip inconvenience benefits like cancellations and delays

- Direct Asia 200 : Good option for families who want affordable plan for travel to Asian or ASEAN regions.

- FWD Business : Competitive price and generous sports equipment coverage makes it good value for adventurous travellers

- Aviva Travel Plus : Offers above average S$2,000,000 of medical coverage

- HL Assurance Enhanced : Offers promotions for hotels and car rentals, saving money on trip overall

- Wise Traveller : Best value for money for budget travellers, especially for global travellers

- Aviva Travel Gold : Offers unlimited medical, hospital and dental cvoerage for sickness and accidents

- Aviva Prestige : Offers 50-80% higher benefit limits for baggage-related claims and lets you cancel trip for any reason

- Income Pre-EX : Offers annual plans that cover pre-existing conditions; covers COVID-19 claims for certain countries

Picking the Best Annual Travel Insurance

We thoroughly researched 80 annual travel insurance products available in Singapore to help you compare and buy a policy that will be the best fit based on your budget, desired coverage and travel habits.

- Cheapest Annual Insurance FWD, Etiqa & more

- Best Value Annual Insurance Aviva, Allianz Travel & more

- Best Coverage & Benefits Aviva, Allianz Travel

- Best for Pre-X Conditions Income

- Best Annual Plans for Sports Direct Asia, Aviva & more

- Best Promotions FWD, Etiqa & more

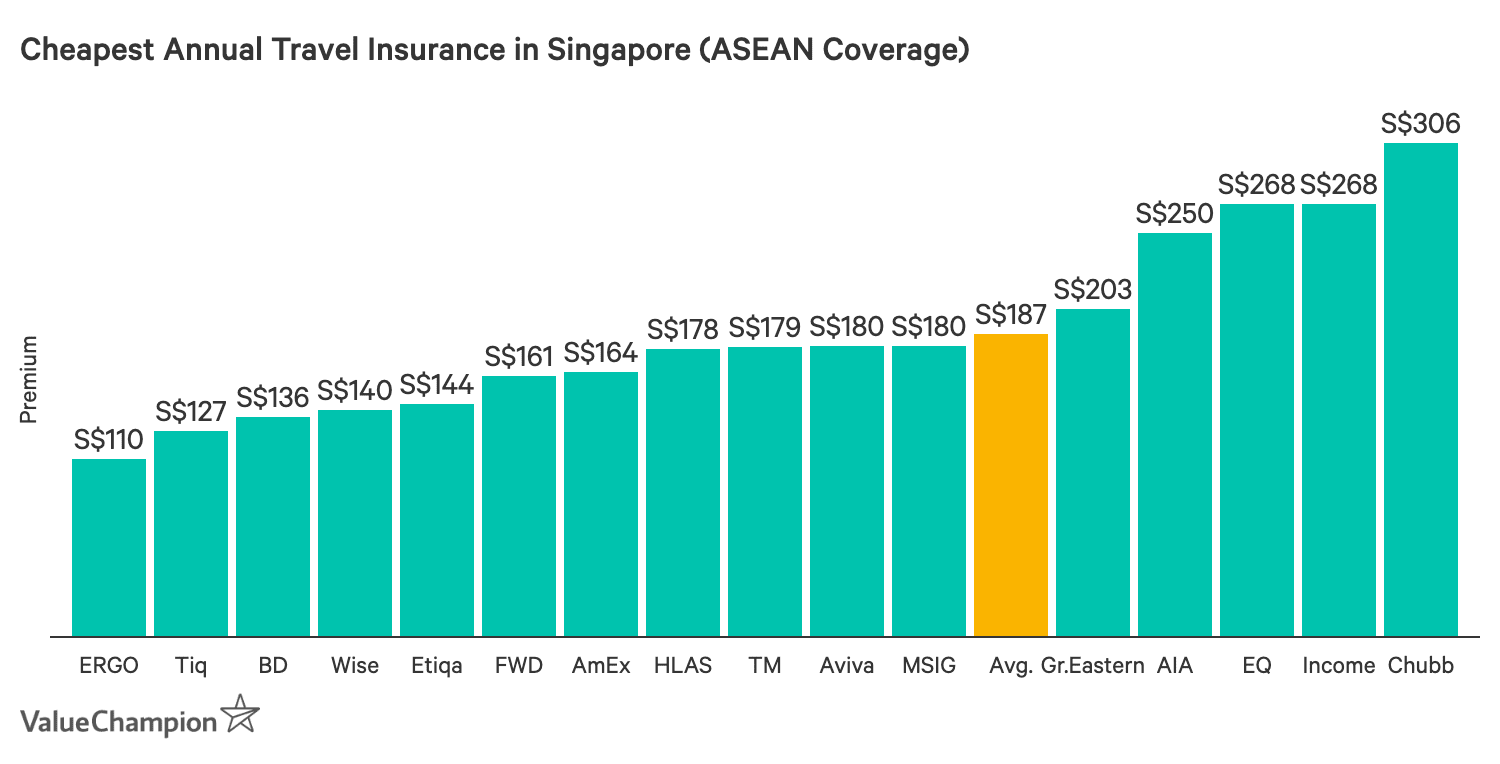

Cheapest Annual Travel Insurance

- BudgetDirect: Use Affinity Code VALUE5 for an extra 5% off (new customers only)

- with SGSaver Exclusive Promotion: Get up to S$35 via PayNow

For consumers looking for the cheapest annual travel policies, Etiqa, Wise, Budget Direct and ERGO can be good options to consider. For instance, their basic-tier ASEAN region annual travel insurance plans cost 37-42% less than the basic-tier industry average of S$190.

Budget Direct's Basic plan offers the cheapest annual plans on the market regardless of destination. However, due to its very modest coverage it may only work for consumers whose main priority is cost. For instance, it does not include coverage for trip cancellations or trip delays. However, it does cover injuries due to riots and passive war.

Etiqa's Tiq plan is another good choice for travellers who frequently fly outside of Asia as it offers the cheapest rates for global coverage. Furthermore, it is a good option for adventurous travellers since it offers coverage for a myriad of sports and activities like skiing, hiking (up to 3,000 metres) and snorkeling. For a small fee, you can also add modest sports equipment coverage.

ERGO's Essential plan is the cheapest option for travellers who tend to stick around the ASEAN region. Its premium is 42% cheaper than basic plans for ASEAN coverage and it offers modest coverage for a wide array of potential travel inconveniences, such as missed connections, delays, cancellations, medical emergencies and even pregnancy sicknesses. Furthermore, it includes adventurous activity and sports equipment coverage at no extra cost.

Premiums & Benefits

Best value annual travel insurance plans trips in asean and asia.

For frequent travellers within the ASEAN and Asia regions, Allianz, Aviva, Direct Asia and FWD will give you the highest value plans.

Due to its low price, Direct Asia's 200 plan is a great choice for consumers who want a budget-focused plan. It is especially competitive among Asian or ASEAN-region annual plans, as it costs S$149, S$100 less than average for those regions. Furthermore, it can be a good option for family travellers because its child limits are the same as adult limits, which is a fairly unique feature among travel insurance plans.

For consumers who want a good balance of both medical and trip inconvenience coverage, Allianz Travel Silver could be a good fit as it offers above average medical, travel delay/cancellation and baggage loss coverage. However, Allianz is only a good fit for people looking for annual plans that provide coverage throughout Asia, as it doesn't offer ASEAN annual plans. Furthermore, though it's priced on the more expensive side, it offers the best package we've seen for this climate-24/7 emergency assistance, a variety of cruise benefits (for domestic tourism) and medical/trip inconvenience coverage for pandemics.

FWD's Business plan offers sports equipment coverage as an add-on with higher than average personal accident coverage, making it a good option for frequent sports enthusiast travellers. To get the most for your money, we recommend waiting until FWD offers a promotion between 20-25%, as its current 10% discount makes its pricing less competitive compared to other insurers.

Aviva's Travel Plus plan is one of the highest value plans as it offers competitive pricing along with above average medical and trip inconvenience coverage. However, it has below average baggage coverage compared to Allianz.

FWD's Business plan offers sports equipment coverage as an add-on with higher than average personal accident coverage, making it a good option for frequent sports enthusiast travellers.

Best Value Annual Travel Insurance Plans for Global Trips

If you often fly outside of Asia and you want to maximise the coverage you get for your dollar, choosing either Allianz, Aviva, Wise Traveller or DirectAsia will ensure you get the most value for your dollar. The plans cost between S$209 and S$346 and have competitive trip inconvenience, medical and personal accident benefits.

If you are worried about trip inconvenience such as trip cancellations and baggage delays, Allianz Travel Silver offers 20-30% higher total coverage than the industry average.

If you want to maximise medical protection, Aviva's Travel Plus offers great above average medical coverage of S$2,000,000 with a comprehensive list of inclusions like burns, war, emergency pregnancy, motorcycle accidents and injury due to smoke, fumes or gas.

Wise Traveller Premium is best for a high value budget plan as it only costs S$215, almost 35% cheaper than the industry average for global annual plans. However, it is known for having fairly strict exclusions so travellers should read the policy wording before purchasing.

Lastly, while DirectAsia has some of the highest value plans for both individual travellers and families thanks to its affordable pricing and generous benefits. Its 500 plan offers everything you need to protect your trip including coverage for missed connections, trip delays, medical emergencies, damage to belongings and rental car excess with coverage limits that are more than high enough to ensure any emergency is covered.

Annual Travel Insurance with the Best Coverage

If you are not restricted by price and want the highest possible coverage, then Allianz and Aviva will give you the greatest protection whether you want maximum medical, travel inconvenience or personal accident coverage.

Allianz Travel Platinum is best for those who want medical protection, as it has unlimited medical, hospital and dental coverage for sickness and accidents, S$50,000 for outpatient expenses and S$100,000 in personal accident coverage. They also provide plenty of coverage for adventurous travellers, pandemics/endemics and cruise trips. However, please note they do not provide annual trip coverage for the ASEAN.

If you travel with expensive belongings and want to make sure they are well protected, Aviva's Prestige plan offers respectively 50% and 80% more baggage-related coverage than the industry average. Another notable perk for Aviva is that you can change or cancel your trip for any reason, although you'll be only be able to claim between S$3,000-S$5,000.

Best Annual Travel Insurance for Pre-Existing Medical Conditions

If you have pre-existing medical conditions, Income offers a line of travel insurance plans specifically for people with pre-existing conditions. The only caveat is that if you want to purchase the annual plan, you can only do so if you call them directly and you have to be ready to pay a 50% deductible if you file a claim for a reason arising out of a pre-existing condition. However, for travellers with chronic illnesses or other medical conditions that could complicate their trips, Income's annual travel insurance policies are a must-have.

Annual Travel Insurance with the Best Cover for Sports

- Etiqa: 45% off single-trip and 30% off annual-trip travel insurance; add'tl 10% off on Fridays

If you're planning to pursue high-octane activities like sky-diving or snowboarding while abroad, FWD , Etiqa , DBS , Direct Asia and MSIG are our picks for insurers with the best sports coverage. Additionally, you can also consider Aviva is great choice for sports equipment coverage as you can cover your own or rented winter or water sports equipment for an additional S$5-7.

In general, all of these insurers cover the basic winter, water, outdoor and miscellaneous adventurous activities such as hiking, skiing, scuba diving and sky-diving. However, you should always be sure to read the terms and conditions to make sure your specific activity will be covered. If you would like to read a more in-depth review on travel insurance policies that have generous extreme sports activity coverage, we've written a guide to some of the best policies in the market for this criteria.

If you're planning to pursue high-octane activities like sky-diving or snowboarding while abroad, FWD , Etiqa , , Direct Asia and DBS are our picks for insurers with the best sports coverage. Additionally, you can also consider Aviva is great choice for sports equipment coverage as you can cover your own or rented winter or water sports equipment for an additional S$5-7.

Annual Travel Insurance for Golf

If you frequently travel on golfing trips, you can consider annual plans that offer generous golf benefits. If you're planning to golf, want to make sure that your golf equipment is covered by your travel insurance plan, and wouldn't mind a few perks thrown in such as a credit for an unused green fee or rewards for getting a hole in one, FWD, Aviva, MSIG, American Express and AIG are all examples of insurers that have designed their travel insurance plans with golfers in mind.

If you want basic coverage for just your golfing equipment, FWD offers up to S$2,000 of sports equipment coverage and will cover you up to S$100/day for rentals. Since it doesn't have fully-fledged golf coverage, its low price and benefits makes it a better choice for travellers interested in trying golfing, rather than experienced golfers.

If you're a serious golfer looking for plans with abundant golf-related benefits, plans like Aviva , MSIG and American Express have very comprehensive coverage, which includes equipment (hired and owned), unused green fees and hole in one coverage.

Travel & COVID-19 Updates

As of June 15, 2020, all Singaporeans are advised to avoid travel. Several countries are experience increasing rates of infection and may be risky for travel. However, there is an exception for essential business and official travel operating under the Green/Fast Lane arrangements. Furthermore, please note that if you are planning a trip and have recently bought a travel insurance policy, you may not be eligible for claims related to Covid-19. Furthermore, upon return to Singapore, you will be require to serve a mandatory Stay-Home Notice (SHN) as well as a test.

Please note as of July 19th, 2020, travellers who stayed the past 14 days in Australia (besides Victoria), Brunei Darussalam, Macao SAR, mainland China, New Zealand, South Korea, Taiwan and Vietnam no longer need to serve their SHN at an SHN Dedicated Facility. Instead, Singaporean citizens and permanent residents can serve their 14 day SHN at home. To learn more please click here .

For travellers, please note that insurers who do provide coverage for COVID-19 (like Income ) will not cover COVID-19 claims of you travel to nations designated as high-risk by the World Health Organisation. Currently these nations are: Albania, Andorra, Armenia, Austria, Azerbaijan, Belarus, Belgium, Belize, Bermuda, Bosnia and Herzegovina, Botswana, Brazil, Bulgaria, Cabo Verde, Canada, Colombia, Costa Rica, Croatia, Curaçao, Cyprus, Czech Republic, Denmark, Estonia, France, French Guiana, French Polynesia, Georgia, Germany, Hungary, Italy, Jersey, Jordan, Kosovo, Latvia, Lebanon, Liechtenstein, Lithuania, Luxembourg, Malta, Mayotte, Montenegro, Netherlands, North Macedonia, Occupied Palestinian Territory, Panama, Poland, Portugal, Puerto Rico, Republic of Moldova, Romania, Russian Federation, Saint Barthélemy, Saint Martin, San Marino, Serbia, Sint Eustatius, Sint Maarten, Slovakia, Slovenia, Sweden, Switzerland, The United Kingdom, Turkey, Ukraine, United States of America, United States Virgin Islands.

Methodology

To arrive at a list of best annual travel insurance products in Singapore, we collected data on hundreds of insurance product offerings by more than 20 insurers in the country. The data we collected regarding benefits and coverage range from personal accident/death, medical, emergency repatriation, trip cancellation, lost or damaged baggage, trip/baggage delays to sports coverage. We also collected pricing information for each product by destination country and compared each plan to its competitors to arrive at our judgments of the plans that offer the best deal for Singapore consumers. For the full list of insurers we used, please see the table below.

In order to arrive at our picks for the top travel insurance plans in Singapore, we examined multiple factors. First, we considered the amount of money one is entitled to receive from the insurer when certain events or accidents occur (i.e. medical and inconvenience). Then, we create a ratio of benefits to cost of insurance to measure how good of a value each product offers. This measure is a proxy for how much an insured person can get for what he pays.

We weighed each benefit area in terms of frequency of claims : travel inconvenience is given a weighting of 60% while personal accident and medical benefit is given a weighting of 40%. According to some studies, about 20% of all flights globally are either canceled or delayed, and this statistic could be significantly higher for tropical regions. As a result, we felt the plans that had high coverage amounts for common occurrences like flight delays were of greater value compared to plans with high coverage for less likely occurrences like repatriation or death. Thus, our value ratio helped to figure out which plans offer the best value to customers based not only on coverage and cost, but also on the likelihood of use.

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- How to Pick the Best Travel Insurance

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services