Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

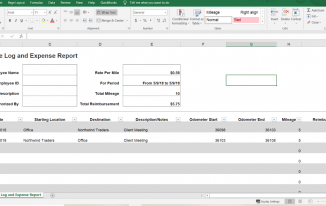

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

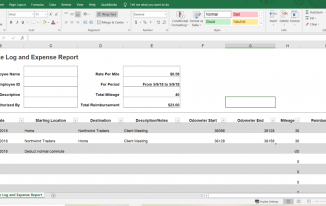

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

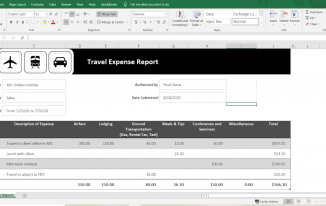

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting software

- Accounting Software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

Shape America's future

- Save your favorite jobs and searches

- Upload your resumes and documents

- Make your resume searchable

- Apply for jobs in the federal government

Explore career fields that are hiring now.

The government is looking to fill positions that are in high demand. Find your opportunity to shape America's future.

- Mathematics

- Computer science

- Mathematical statistics

Engineering

Human resources.

- Human resources management

Business, industry and programs

- Acquisitions and contracting

- National Security

Social Science

Medical, dental and public health.

- Fishery biologist

- General natural resources management and biological sciences

- General physical science

- Health physics

- Federal tech portal

- Information technology management

- Cross-functional positions

- Cybersecurity

- Cyber effects

- Information technology

- Other cyber opportunities

Learn more about the federal hiring process.

Below is an overview of the federal hiring process. This process is in place to make sure all applicants receive fair and equal opportunity.

Create a USAJOBS profile

First, create and complete your profile to apply for any job on USAJOBS.

With a USAJOBS profile, you can save jobs, automate job searches, and manage everything you need to complete your application, including resumes and required documents.

Search for jobs

Once you create your profile, you can search for jobs.

It's best to sign into your profile before searching. Why? We can use your information to improve your job search results.

You can also use filters such as location, salary, work schedule or agency to narrow your results.

Review the job announcement

If you find a job you're interested in, read the entire announcement to determine if you're eligible and meet the qualifications. It's important to read the announcement because there are required qualifications you must meet and include in your application.

Prepare your application in USAJOBS

Read the How to Apply section of the job announcement before starting your application. Click Apply , and we'll walk you through a five-step process where you'll attach a resume and any required documents.

During the application process, you can review, edit and delete your information. We'll automatically save your progress as you go so that you won't lose any changes.

Submit application to the agency

When your application is ready, you'll be directed from USAJOBS to the hiring agency's system to submit your application. Before you submit, you may need to complete other agency-required steps such as a questionnaire or uploading additional documents.

The time it takes to submit depends on the job you are applying for and the hiring agency's requirements.

You can check your application using the Track This Application link in your USAJOBS profile or contact the hiring agency listed on the job announcement.

Transition to agency

Agency reviews application.

The hiring agency begins reviewing applications when the job announcement closes. The hiring agency will review your application to make sure you're eligible and meet the qualifications for the position.

The hiring agency will place applicants into quality categories. Those placed in the highest category are sent to the hiring official.

The hiring official will review the highest qualified applications and select applicants to interview based on agency policy. The hiring agency will contact applicants directly to schedule interviews.

You may be interviewed by a panel, in-person, video or phone interview, and there may be more than one interview round. For example, an applicant may have a phone interview and then an in-person interview.

Scheduling an interview may take some time, depending on the number of applicants to interview.

Agency selects candidates

After all interviews are completed, the agency will select a candidate(s) and contact them to start the job offer process.

For those not selected, the hiring agency will update the job's status to Hiring Complete .

What jobs can you apply for?

Hiring paths help you understand what jobs you are eligible to apply for and why. You may fall under multiple hiring paths.

Explore unique careers with the government

Infrastructure jobs.

Intelligence careers

Are you a current federal employee?

Find professional development opportunities with the federal government. Develop new skills and experience with hands-on training, share your expertise and work with others across agencies.

Visit Open Opportunities

Your session is about to expire!

Your USAJOBS session will expire due to inactivity in 8 minutes . Any unsaved data will be lost if you allow the session to expire. Click the button below to continue your session.

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

Travel resources

Per diem look-up, 1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

City Pair airfares

Visit City Pair Program to learn about its competitive, federally-negotiated airline rates for 7,500+ domestic and international cities, equating to over 13,000 city pairs.

- Search for contract fares

Note: All fares are listed one-way and are valid in either direction. Disclaimer - taxes and fees may apply to the final price

Taxes and fees may apply to the final price

Your agency’s authorized travel management system will show the final price, excluding baggage fees. Commercial baggage fees can be found on the Airline information page.

Domestic fares include all existing Federal, State, and local taxes, as well as airport maintenance fees and other administrative fees. Domestic fares do not include fees such as passenger facility charges, segment fees, and passenger security service fees.

International

International fares do not include taxes and fees, but include fuel surcharge fees.

Note for international fares: City codes, such as Washington (WAS), are used for international routes.

Federal travelers should use their authorized travel management system when booking airfare.

- E-Gov Travel Service for civilian agencies.

- Defense Travel System for the Department of Defense.

If these services are not fully implemented, travelers should use these links:

- Travel Management Center for civilian agencies.

- Defense Travel Management Office for the Department of Defense.

GSA lodging programs

Shop for lodging at competitive, often below-market hotel rates negotiated by the federal government.

FedRooms provides federal travelers on official business with FTR compliant hotel rooms for transient and extended stays (up to 29 days). The program uses FEMA and ADA-compliant rooms with flexible booking terms at or below per diem rates. Federal employees should make reservations, including FedRooms reservations, via their travel management service.

Visit GSALodging for more details on FedRooms and for additional programs offering meeting space, long term lodging, and emergency lodging.

Privately owned vehicle (POV) mileage reimbursement rates

GSA has adjusted all POV mileage reimbursement rates effective January 1, 2024.

* Airplane nautical miles (NMs) should be converted into statute miles (SMs) or regular miles when submitting a voucher using the formula (1 NM equals 1.15077945 SMs).

For calculating the mileage difference between airports, please visit the U.S. Department of Transportation's Inter-Airport Distance website.

Plan a trip

Research and prepare for government travel.

Per diem, meals & incidental expenses (M&IE) Passenger transportation (airfare rates, POV rates, etc.) Lodging Conferences/meetings Travel charge card State tax exemption

Services for government agencies

Programs providing commercial travel services.

Travel Category Schedule (Schedule L) E-Gov Travel Service (ETS) Emergency Lodging Services (ELS) Employee relocation

Travel reporting

Federal Travel Regulation Table of contents Chapter 300—General Chapter 301—Temporary Duty (TDY) Travel allowances Chapter 302 - Relocation allowances

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 511, Business travel expenses

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

You're traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day's work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you normally need to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time you spend at each location.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite. Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but aren't limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

- The airport or train station and your hotel,

- The hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Shipping of baggage, and sample or display material between your regular and temporary work locations.

- Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls while on your business trip. (This includes business communications by fax machine or other communication devices.)

- Tips you pay for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, public stenographer's fees, computer rental fees, and operating and maintaining a house trailer.)

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming .

If you're a member of the National Guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040 , Form 1040-SR , or Form 1040-NR as an adjustment to income.

Good records are essential. Refer to Topic no. 305 for information on recordkeeping. For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses .

- Yekaterinburg

- Novosibirsk

- Vladivostok

- Tours to Russia

- Practicalities

- Russia in Lists

Rusmania • Deep into Russia

Out of the Centre

Savvino-storozhevsky monastery and museum.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar Alexis, who chose the monastery as his family church and often went on pilgrimage there and made lots of donations to it. Most of the monastery’s buildings date from this time. The monastery is heavily fortified with thick walls and six towers, the most impressive of which is the Krasny Tower which also serves as the eastern entrance. The monastery was closed in 1918 and only reopened in 1995. In 1998 Patriarch Alexius II took part in a service to return the relics of St Sabbas to the monastery. Today the monastery has the status of a stauropegic monastery, which is second in status to a lavra. In addition to being a working monastery, it also holds the Zvenigorod Historical, Architectural and Art Museum.

Belfry and Neighbouring Churches

Located near the main entrance is the monastery's belfry which is perhaps the calling card of the monastery due to its uniqueness. It was built in the 1650s and the St Sergius of Radonezh’s Church was opened on the middle tier in the mid-17th century, although it was originally dedicated to the Trinity. The belfry's 35-tonne Great Bladgovestny Bell fell in 1941 and was only restored and returned in 2003. Attached to the belfry is a large refectory and the Transfiguration Church, both of which were built on the orders of Tsar Alexis in the 1650s.

To the left of the belfry is another, smaller, refectory which is attached to the Trinity Gate-Church, which was also constructed in the 1650s on the orders of Tsar Alexis who made it his own family church. The church is elaborately decorated with colourful trims and underneath the archway is a beautiful 19th century fresco.

Nativity of Virgin Mary Cathedral

The Nativity of Virgin Mary Cathedral is the oldest building in the monastery and among the oldest buildings in the Moscow Region. It was built between 1404 and 1405 during the lifetime of St Sabbas and using the funds of Prince Yury of Zvenigorod. The white-stone cathedral is a standard four-pillar design with a single golden dome. After the death of St Sabbas he was interred in the cathedral and a new altar dedicated to him was added.

Under the reign of Tsar Alexis the cathedral was decorated with frescoes by Stepan Ryazanets, some of which remain today. Tsar Alexis also presented the cathedral with a five-tier iconostasis, the top row of icons have been preserved.

Tsaritsa's Chambers

The Nativity of Virgin Mary Cathedral is located between the Tsaritsa's Chambers of the left and the Palace of Tsar Alexis on the right. The Tsaritsa's Chambers were built in the mid-17th century for the wife of Tsar Alexey - Tsaritsa Maria Ilinichna Miloskavskaya. The design of the building is influenced by the ancient Russian architectural style. Is prettier than the Tsar's chambers opposite, being red in colour with elaborately decorated window frames and entrance.

At present the Tsaritsa's Chambers houses the Zvenigorod Historical, Architectural and Art Museum. Among its displays is an accurate recreation of the interior of a noble lady's chambers including furniture, decorations and a decorated tiled oven, and an exhibition on the history of Zvenigorod and the monastery.

Palace of Tsar Alexis

The Palace of Tsar Alexis was built in the 1650s and is now one of the best surviving examples of non-religious architecture of that era. It was built especially for Tsar Alexis who often visited the monastery on religious pilgrimages. Its most striking feature is its pretty row of nine chimney spouts which resemble towers.

Plan your next trip to Russia

Ready-to-book tours.

Your holiday in Russia starts here. Choose and book your tour to Russia.

The Unique Burial of a Child of Early Scythian Time at the Cemetery of Saryg-Bulun (Tuva)

<< Previous page

Pages: 379-406

In 1988, the Tuvan Archaeological Expedition (led by M. E. Kilunovskaya and V. A. Semenov) discovered a unique burial of the early Iron Age at Saryg-Bulun in Central Tuva. There are two burial mounds of the Aldy-Bel culture dated by 7th century BC. Within the barrows, which adjoined one another, forming a figure-of-eight, there were discovered 7 burials, from which a representative collection of artifacts was recovered. Burial 5 was the most unique, it was found in a coffin made of a larch trunk, with a tightly closed lid. Due to the preservative properties of larch and lack of air access, the coffin contained a well-preserved mummy of a child with an accompanying set of grave goods. The interred individual retained the skin on his face and had a leather headdress painted with red pigment and a coat, sewn from jerboa fur. The coat was belted with a leather belt with bronze ornaments and buckles. Besides that, a leather quiver with arrows with the shafts decorated with painted ornaments, fully preserved battle pick and a bow were buried in the coffin. Unexpectedly, the full-genomic analysis, showed that the individual was female. This fact opens a new aspect in the study of the social history of the Scythian society and perhaps brings us back to the myth of the Amazons, discussed by Herodotus. Of course, this discovery is unique in its preservation for the Scythian culture of Tuva and requires careful study and conservation.

Keywords: Tuva, Early Iron Age, early Scythian period, Aldy-Bel culture, barrow, burial in the coffin, mummy, full genome sequencing, aDNA

Information about authors: Marina Kilunovskaya (Saint Petersburg, Russian Federation). Candidate of Historical Sciences. Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Vladimir Semenov (Saint Petersburg, Russian Federation). Candidate of Historical Sciences. Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Varvara Busova (Moscow, Russian Federation). (Saint Petersburg, Russian Federation). Institute for the History of Material Culture of the Russian Academy of Sciences. Dvortsovaya Emb., 18, Saint Petersburg, 191186, Russian Federation E-mail: [email protected] Kharis Mustafin (Moscow, Russian Federation). Candidate of Technical Sciences. Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected] Irina Alborova (Moscow, Russian Federation). Candidate of Biological Sciences. Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected] Alina Matzvai (Moscow, Russian Federation). Moscow Institute of Physics and Technology. Institutsky Lane, 9, Dolgoprudny, 141701, Moscow Oblast, Russian Federation E-mail: [email protected]

Shopping Cart Items: 0 Cart Total: 0,00 € place your order

Price pdf version

student - 2,75 € individual - 3,00 € institutional - 7,00 €

Copyright В© 1999-2022. Stratum Publishing House

MOSCOW - RUSSIA

Ewf b.v east west forwarding.

Edelveis, Right Entrance, 2nd Floor Davidkovskaja, 121352 Moscow, Russia

- Phone: +7 495 938-99-66

- Mobile: +7 495-997-0977

- Fax: +7 495 938-99-67

- email: [email protected]

- web: www.eastwestforwarding.com

Company Profile

- LIST WITH US

To: EWF B.V EAST WEST FORWARDING

Enter the security code:

+7 495 938-99-67

+7 495-997-0977

+7 495 938-99-66

Directory of Freight Forwarders, Cargo Agents, Shipping Companies, Air, Ocean, Land, Logistics and Transportation Brokers

IMAGES

COMMENTS

13,095 Travel Reimbursement Specialist jobs available on Indeed.com. Apply to Travel Consultant, Board Certified Behavior Analyst, Specialist and more!

246,879 "travel Reimbursement" jobs available on Indeed.com. Apply to Customer Service Representative, Inspector Entry Level, Production Operator and more!

288,443 Travel Reimbursement Jobs jobs available on Indeed.com. Apply to Production Operator, X-ray Technician, Sales Representative and more!

Program Manager - Travel & Expenses. UW Health 3.5. Hybrid work in Middleton, WI 53562. Typically responds within 3 days. $56,300 - $84,400 a year. Full-time. Monday to Friday. Stay up to date with IRS regulations impacting travel and expense reimbursements. Minimum - Three (3) years of experience in travel and expense.

143,862 Travel & Reimbursement jobs available on Indeed.com. Apply to Senior Claims Specialist, Functional Manager, Digital Products and more!

Today's top 39,000+ Travel Reimbursement Specialist jobs in United States. Leverage your professional network, and get hired. New Travel Reimbursement Specialist jobs added daily.

Today's top 11,000+ Travel Expense Reimbursement jobs in United States. Leverage your professional network, and get hired. New Travel Expense Reimbursement jobs added daily.

Browse 385,693 TRAVEL REIMBURSEMENT jobs ($18-$32/hr) from companies with openings that are hiring now. Find job postings near you and 1-click apply!

Personal Vehicle (approved business/travel expense) $0.67. Personal Vehicle (state-approved relocation) $0.21. Private Aircraft (per statute mile)*. *$1.76 . *Unless otherwise stated in the applicable MOU, the personal aircraft mileage reimbursement rate is the applicable "Private Aircraft" rate provided in this chart .

The Travel Reimbursement Supervisor oversees and coordinates the day-to-day operations of the accounts payable/employee travel reimbursement team. The incumbent provides training, guidance, and ...

Travel nursing is a win-win: understaffed hospitals get the support they need, and travel nurses get the experience of exploring a new place. You can also get paid more doing it. Many healthcare professionals choose travel nursing for its perks, which can include competitive pay, tax-free housing and meal stipends, and travel reimbursement.

Excess Reimbursement. If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn't returned in a reasonable amount of time, it's taxable. A reasonable period of time in this instance is ...

Plans for Reimbursing an Employee for Deductible Travel Expenses The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to

Read the How to Apply section of the job announcement before starting your application. Click Apply, and we'll walk you through a five-step process where you'll attach a resume and any required documents.. During the application process, you can review, edit and delete your information. We'll automatically save your progress as you go so that you won't lose any changes.

Per diem rates look-up Allowances for lodging, meal and incidental costs while on official government travel. Mileage reimbursement rates Reimbursement rates for the use of your own vehicle while on official government travel. Technology ... Your agency's authorized travel management system will show the final price, excluding baggage fees.

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away. Travel expenses must be ordinary and necessary.

Travel expenses defined. For tax purposes, travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your business.

Topic no. 511, Business travel expenses. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes. You're traveling away from home if your duties require you to be away from the general ...

Provides either 50% reimbursement up to $75,000 or 75% reimbursement up to $112,500 for prepaid, non-refundable trip costs. You must buy your travel insurance policy within 15 days of your first ...

The ideal candidate will possess exceptional organizational skills, a customer service mindset, and the ability to maintain confidentiality.Key Responsibilities:- Manage travel reimbursement, ordering, and financial reconciliation processes for CAIA and the VAES Director through platforms such as Chrome River, HokieMart, and FINTRACS.-

How to apply for reimbursement. Apply for reimbursement of travel and accommodation costs from the TE Office or local government pilot within one month of the end of the trip. The authority may pay the compensation in full or in part in advance. Apply for reimbursement of the costs primarily using an electronic form in the e-service.

50+ Best Resume Templates For 2024 (Free & Premium Downloads) Get started on building a great resume with our free and premium templates. Compatible with Microsoft Word and Google Docs, our ATS-friendly templates make it easy to create a professional resume that showcases your best qualifications.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar ...

Travel Expenses Paid jobs. Sort by: relevance - date. 19,000+ jobs. At-Sea Processor F/T North Star. Glacier Fish 3.9. Washington State. $7,800 - $8,600 a month. Full-time. Rotating shift +1. Easily apply. ... This includes reimbursement for travel expenses incurred to and from test sessions/interviews.

Microsoft Forms is a web-based application that allows you to: Create and share online surveys, quizzes, polls, and forms. Collect feedback, measure satisfaction, test knowledge, and more. Easily design your forms with various question types, themes, and branching logic. Analyze your results with built-in charts and reports, or export them to ...

Moscow Oblast ( Russian: Моско́вская о́бласть, Moskovskaya oblast) is a federal subject of Russia. It is located in western Russia, and it completely surrounds Moscow. The oblast has no capital, and oblast officials reside in Moscow or in other cities within the oblast. [1] As of 2015, the oblast has a population of 7,231,068 ...

Burial 5 was the most unique, it was found in a coffin made of a larch trunk, with a tightly closed lid. Due to the preservative properties of larch and lack of air access, the coffin contained a well-preserved mummy of a child with an accompanying set of grave goods. The interred individual retained the skin on his face and had a leather ...

EWF B.V EAST WEST FORWARDING. Edelveis, Right Entrance, 2nd Floor Davidkovskaja, 121352 Moscow, Russia. Phone: +7 495 938-99-66; Mobile: +7 495-997-0977

Reimbursement jobs. Sort by: relevance - date. 503,544 jobs. Housekeeping Assistant. Sunset Health Care Center 3.2. Union, MO 63084. Pay information not provided. Full-time. Easily apply. Up to $5,000 per in tuition/education reimbursement per calendar year for approved program of study. ... Ability to travel up to 60% of the time.