Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Buying the Best Travel Medical Insurance for You [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

37 Published Articles 3323 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![travel medical insurance best Buying the Best Travel Medical Insurance for You [2024]](https://upgradedpoints.com/wp-content/uploads/2020/12/Travel-Medical-Insurance.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

What is travel medical insurance, what does travel medical insurance cover, what doesn’t travel medical insurance cover, what travel medical insurance isn’t, how does travel medical insurance work, how much does travel medical insurance cost, which company has the best travel medical insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The thought of getting sick or injured while traveling can be one of the most stressful aspects of planning a trip. Often, travelers assume that their primary health insurance will cover all costs of medical expenses on their trip, but not every health insurance plan covers every country and situation.

To ensure you have coverage if you need it, you may need to consider purchasing travel medical insurance. This can fill the gap between your regular insurance and any coverage you may have with your credit cards . We’ll break down all of the important details and tell you everything you should know about travel medical insurance.

If you are traveling domestically within your own country, you will likely be covered by your primary health insurance. If you are traveling abroad, your coverage may not extend to those other countries. This is primarily where travel medical insurance comes into play.

Travel medical insurance is a type of international insurance designed to cover emergency health care costs you might face when you are traveling or vacationing abroad.

A travel medical policy can be an important addition to your trip since your primary health plan may not cover you fully if you need assistance outside of your home country. An uninsured injury or illness abroad can result in a huge financial burden that can be significantly reduced by having travel medical insurance.

Bottom Line: Travel medical insurance is recommended by the U.S. Department of State, the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO).

According to Allianz Travel, the most common overseas medical emergencies that are claimed include:

- Fractures from falls

- Cardiovascular problems such as a heart attack or stroke

- Trauma involving motor vehicles

- Respiratory problems such as a collapsed lung

So going with that first item, let’s say you’re exploring Europe and end up twisting your ankle on the beautiful, but uneven cobblestone streets in Rome. Depending on the plan you choose, you may be covered for:

- The cost of a local ambulance to transport you to the hospital

- Your emergency room co-payment

- The bill for your hospital room and board

- Any other eligible medical expenses, up to your plan limits

But there are limitations to travel medical insurance. Before you purchase a plan, it’s important to know exactly what you are buying — including which things are and aren’t included in your coverage.

Travel medical plans are designed to help in the event of an unforeseen illness or injury while traveling abroad. Travel medical insurance offers emergency medical expense coverage as well as emergency evacuation coverage. This means that the plan will reimburse you for reasonable and customary costs of emergency medical and dental care (up to the plan limits — discussed below).

It is important to look closely at all plans you are interested in since many important things are hidden in the details. You might also find it helpful to brush up on your insurance lingo before doing this.

Plan Limits

Travel medical insurance covers emergency medical costs up to the plan limit. Plan limits vary greatly by plan but typically fall between $50,000 and $2,000,000. This is obviously a HUGE range, so you will have to determine the correct amount of coverage based on a few key items:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country? As we discussed above, Medicare doesn’t cover you at all outside of the U.S., so this would be an instance where you might want your plan’s coverage limit to be higher.

- How long is your trip? If you’re going to be away for more than 1 to 2 months, you might want a higher plan limit to account for the greater exposure to risk.

- Do you need extra coverage due to risky activities? For example, if you expect to ski, mountain climb, or do any other risky activities where you might get injured, you might want a higher plan limit.

- What do you feel comfortable with? If you feel safer having $100,000 as opposed to $50,000, then that may be the right decision for you. This insurance plan should provide you a sense of security so you can enjoy your trip.

- Deductibles

Most medical single trip plans have some sort of deductible that you must pay before any benefits will be paid. After this, your travel medical insurance will cover any remaining costs, up to the plan’s limit.

However, you will be offered the option to increase, decrease, or remove the deductible altogether. Based on this choice, the price you pay (aka the premium) will be affected accordingly. For example, if you choose a higher deductible, your premium will decrease. If you choose a lower (or no) deductible, your premium will increase.

Length of Trip

You are covered by travel medical insurance based on the type of plan you purchase. These come in 3 types:

Single-Trip Coverage

This is the most common type of travel medical insurance. When you leave your home, go on a trip, and then return home, this is considered to be a single trip. While on your trip, you can still visit multiple countries and destinations all under the umbrella of this single trip. You will be covered for the duration of this trip under a single trip travel medical insurance plan.

Multi-Trip Coverage

Multi-trip coverage is for multiple trips and often purchased in 3-, 6-, and 12-month segments.

Long-Term Coverage

This is continuous medical coverage for the long-term traveler (think expats or people working abroad) and is typically paid on a monthly basis.

Does Travel Medical Insurance Cover COVID-19?

Many travel insurance policies offer good medical coverage, but not all plans cover expenses related to COVID-19 . If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract COVID-19.

In general, cancellations due to fear of travel are not covered. However, some plans cover you if you or your covered traveling companion were to become sick as a result of COVID-19. This means that you could still receive benefits for the losses that are covered by the plan.

Many countries around the world , such as Costa Rica and the United Arab Emirates, are even requiring travelers to hold a specific level of medical coverage to account for COVID-19-related medical care and evacuation.

In addition, “ Cancel for Any Reason ” has become a hot topic. This optional coverage is not available with all plans but lets you cancel a trip for a partial refund no matter what your reason — including unexpected travel bans, lengthy quarantine periods, or cancellations due to concerns over COVID-19.

Since travel medical insurance is meant to cover emergencies, certain types of expenses are excluded from most travel medical policies. In addition, for insurance purposes, a pre-existing condition is general defined as any condition:

- For which medical advice, diagnosis, care, or treatment was recommended or received within a defined period of time prior to your coverage date (varies from plan to plan, but is typically within 60 days to 2 years)

- That would cause a “reasonably prudent person” to seek medical advice, diagnosis, care, or treatment prior to your coverage date

- That existed prior to your effective date of coverage, whether or not it was known to you (commonly includes pregnancy)

Hot Tip: You do not need a medical examination in order to purchase travel insurance. If you have a claim, the insurance company will investigate to ensure that your claim occurred during the coverage period of your policy and wasn’t a result of any pre-existing conditions.

Here are some of the most frequent exclusions:

- Pre-existing conditions as defined above

- Routine medical examinations and care (i.e. wellness exams, ongoing prescriptions, etc.)

- Routine prenatal, pregnancy, childbirth, and post-natal care

- Medical expenses for injury or illness caused by extreme sports

- Mental health disorders

- Injury caused by the effects of intoxication or illegal drugs

- Payments exceeding the plan limit

Unless you’ve purchased a comprehensive travel insurance plan, other exclusions include claims related to:

- Trip cancellation

- Lost luggage

- Rental car damage

Be sure to read the description of coverage for any plan you’re considering before you make the purchase. While reading the entire document front to back can be tedious, it’s better to know what’s excluded before you attempt to make a claim.

Now that we’ve let you know what is and isn’t covered by travel medical insurance, we’ll also breakdown the difference between travel medical insurance and other similar options.

Comprehensive Travel Insurance

Comprehensive travel insurance plans offer the most benefits of all plan types and will typically include medical coverage. It can offer you additional coverage for things like trip cancellation, trip delay and cancellation, lost luggage, and more. It’s the best way to cover a host of potential common travel-related problems.

Some comprehensive plans also offer additional coverage for things like rental car damage, Cancel for Any Reason, or a pre-existing condition waiver.

Bottom Line: Comprehensive travel insurance is a full-service plan and includes travel medical coverage as well as other coverages that will protect all aspects of your trip.

Health Insurance

You might be thinking that already have medical insurance provided by your employer or through Medicare. However, when you travel to other countries, your primary health insurance might not go with you. Before your trip, check to see whether your domestic plan provides any coverage once you’ve left your home country since many offer limited or no coverage.

In case of a medical emergency, you will want to be able to lay your hands quickly on your travel insurance plan’s contact information for the 24-hour Emergency Assistance program as well as your policy number, so make sure to keep this information somewhere that is easily accessible. Also, be sure you know how to place a call to that number from outside the country.

This is important because you’ll be required to call your travel insurance provider and notify them that you need to be seen by a medical professional as soon as possible. Obviously, you may not be medically able to call before you seek emergency medical treatment, but you should do so as soon as you are able to.

The earlier you can call, the more likely it is that you can avoid any issues for payment of claims and you can also get help and advice from the company’s emergency assistance program.

Bottom Line: Specific details on when and how to contact your insurance provider in case of a medical emergency vary by plan and provider, so thoroughly review these details in your plan information.

For example, in the event of an emergency that requires emergency medical evacuation, your insurance provider will have to approve the evacuation and even make those arrangements for you. If you don’t call ahead to have them do this, the company may not approve the expense and you may be stuck paying for the evacuation in full.

Once you are actually at a medical facility to receive care, make sure to document the experience as thoroughly as possible. This means asking for copies of all of your records before you check out. You’ll need to provide these records to the insurance company when you eventually file your claim and having proof of treatment and costs will assist you in filing a successful claim and getting your money back as soon as possible.

Travel medical insurance plans can vary widely in price, but in general, plans cost anywhere between 4-10% of your total non-refundable trip cost. The pricing of any plan takes into consideration many things, including a few that we discussed above, to determine the cost. These include:

- Age of travelers

- Plan limits

- Supplemental plans such as “Cancel For Any Reason” coverage or coverage for pre-existing conditions

- Length of trip

In addition, if you decide that a comprehensive plan is a better choice for you, this will also increase the price.

The best travel medical insurance company for you may be determined by what type and how much coverage you’d like to have. Let’s review a few options and companies to consider.

Credit Card Coverage

Many premium cards have some medical coverage, so be sure to look over all of the best credit cards for travel insurance coverage and protection.

For example, cardholders of The Platinum Card ® from American Express may already have $15,000 of secondary medical coverage . For many, this may be enough, but for others, you may not feel comfortable at this level of coverage and want to purchase a travel medical insurance policy.

Travel Medical Insurance Policies

If you are looking to purchase a plan from a reputable company, a few options include:

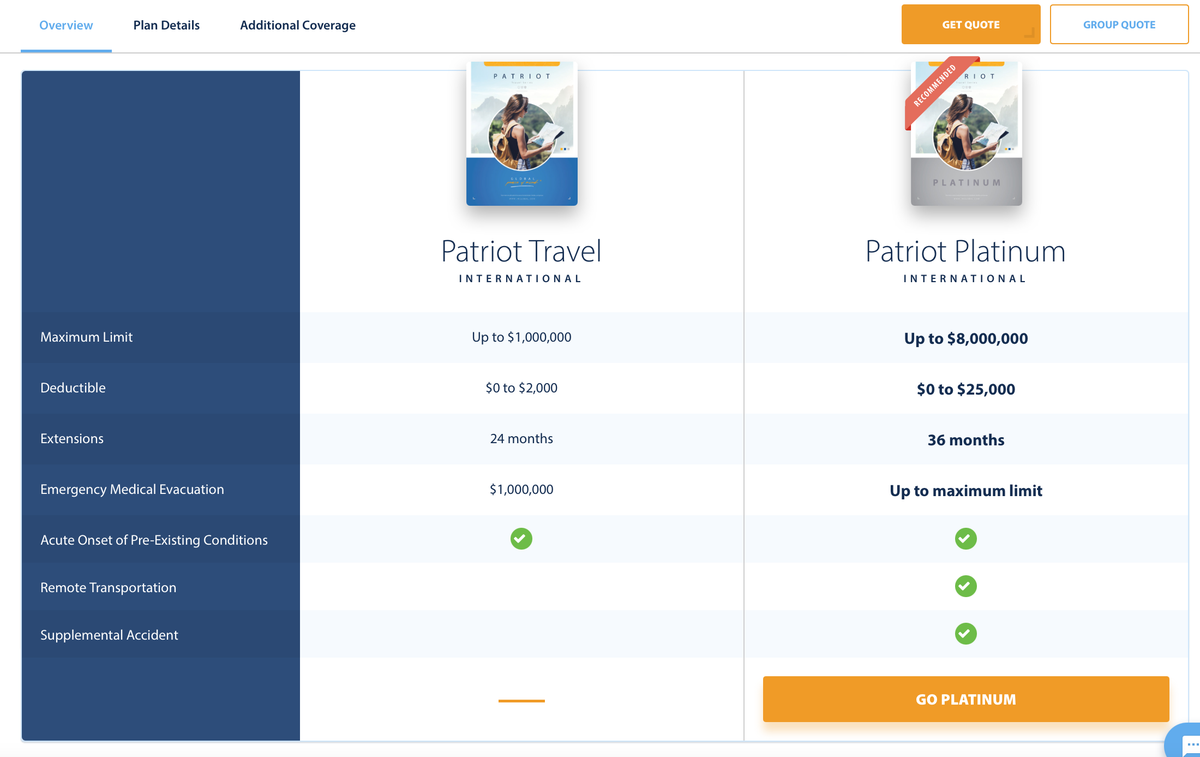

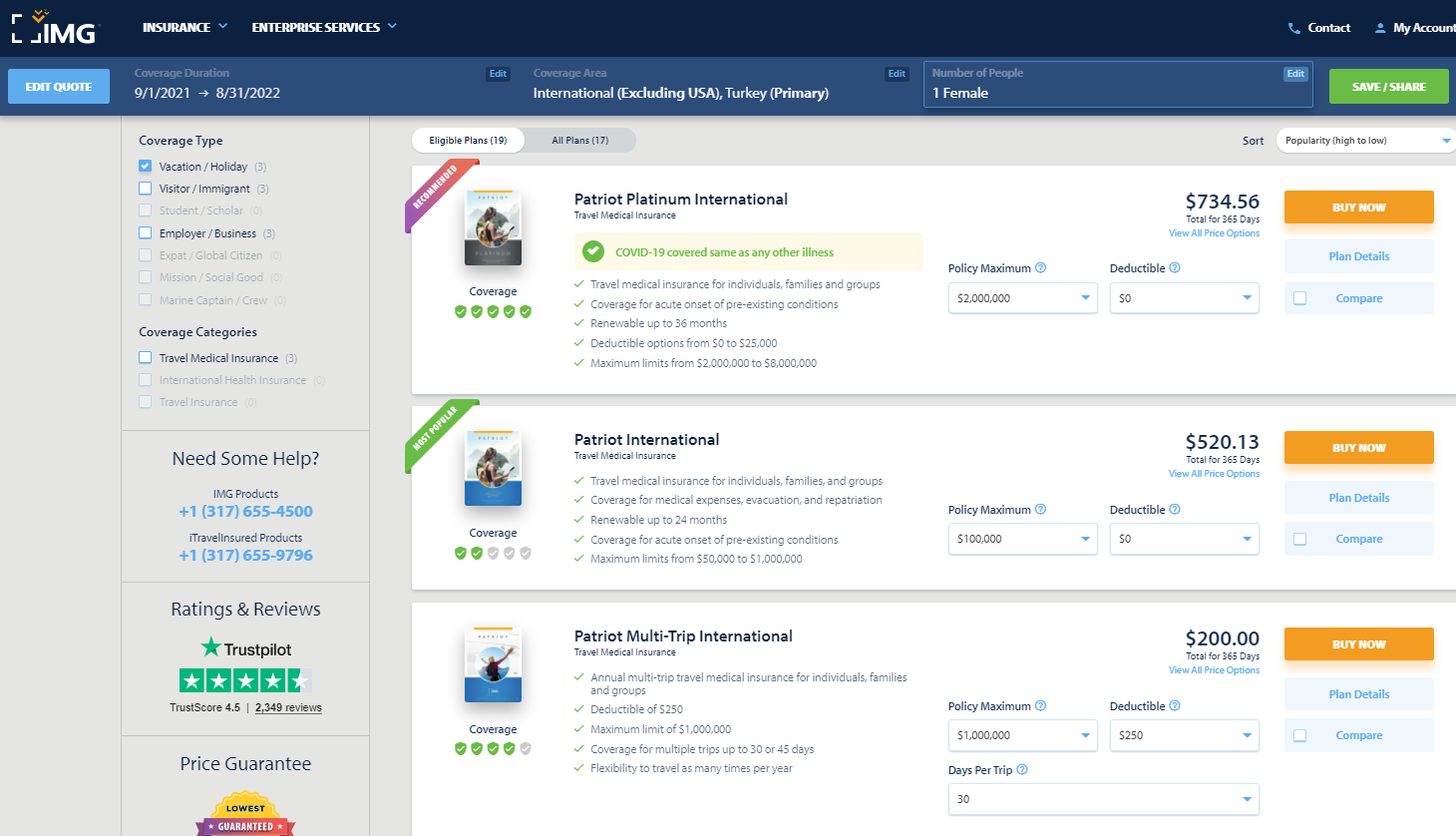

1. Patriot Travel Medical Insurance from IMG Global

For the out-of-country plans, Patriot offers:

- Short-term travel medical coverage

- Coverage for individuals, groups, and their dependents

- Daily or monthly rates

- Freedom to seek treatment with the hospital or doctor of your choice

The following plans are available based on the level of coverage that you desire and you can request a quote through their website linked above.

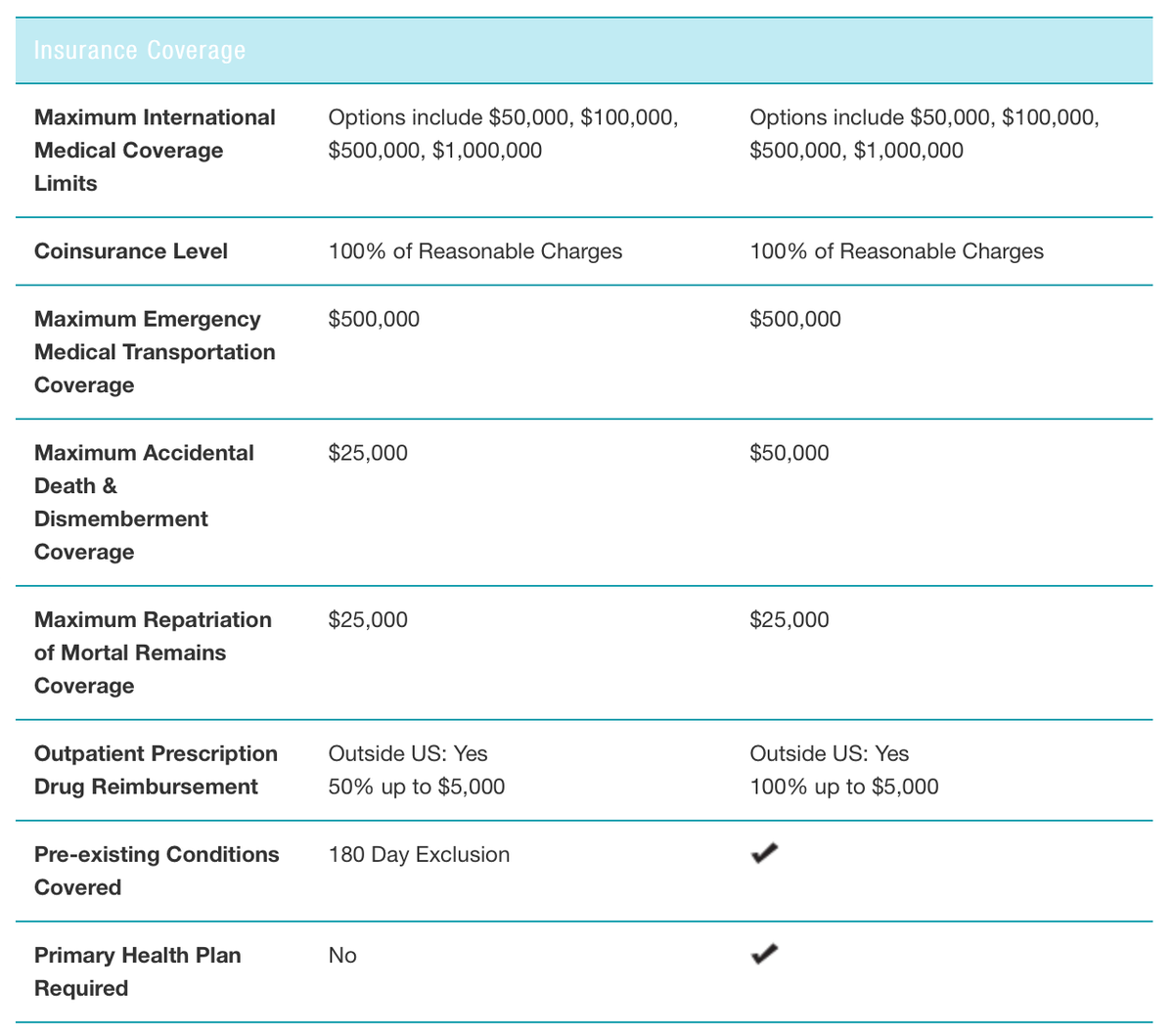

2. GeoBlue Single Trip Traveler Medical Insurance

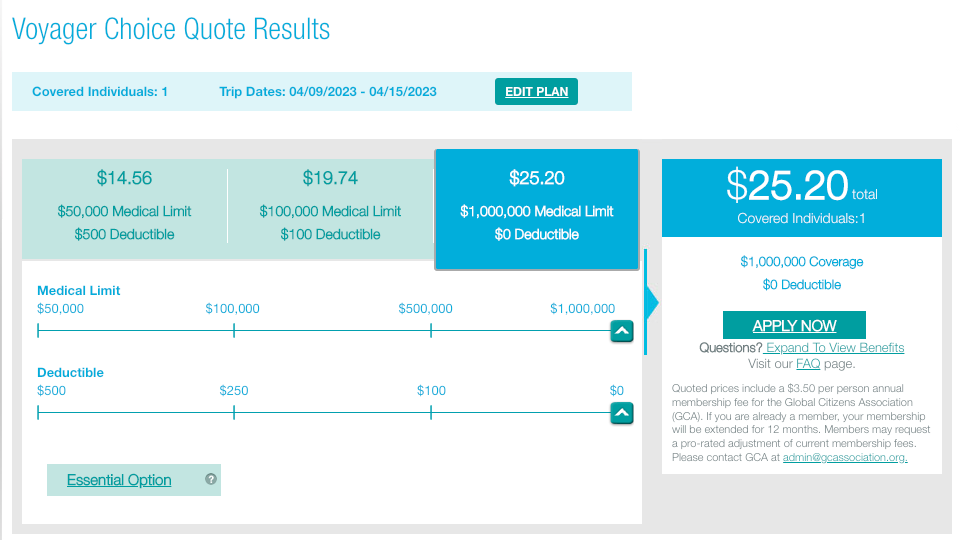

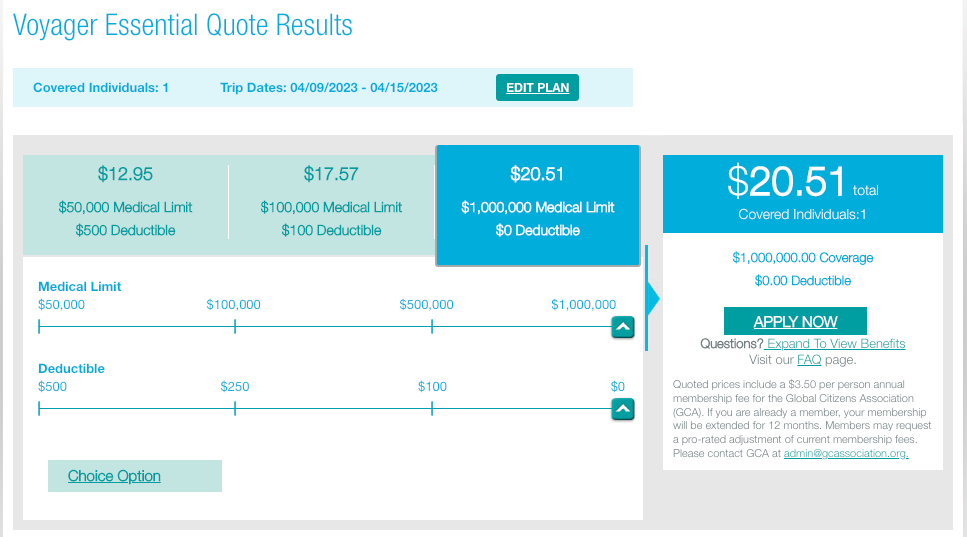

GeoBlue offers both the “Voyager Choice” and “Voyager Essential” single trip plans. Both plans allow you to choose your level of medical coverage (from $50,000 up to $1 million) and offer $500,000 in emergency medical transportation and repatriation coverage.

The main difference between the 2 plans is that the Choice plan does not require you to be covered by a primary health plan, but doesn’t cover pre-existing conditions. The Voyager plan will cover all pre-existing conditions, but functions as a secondary coverage after your primary health plan.

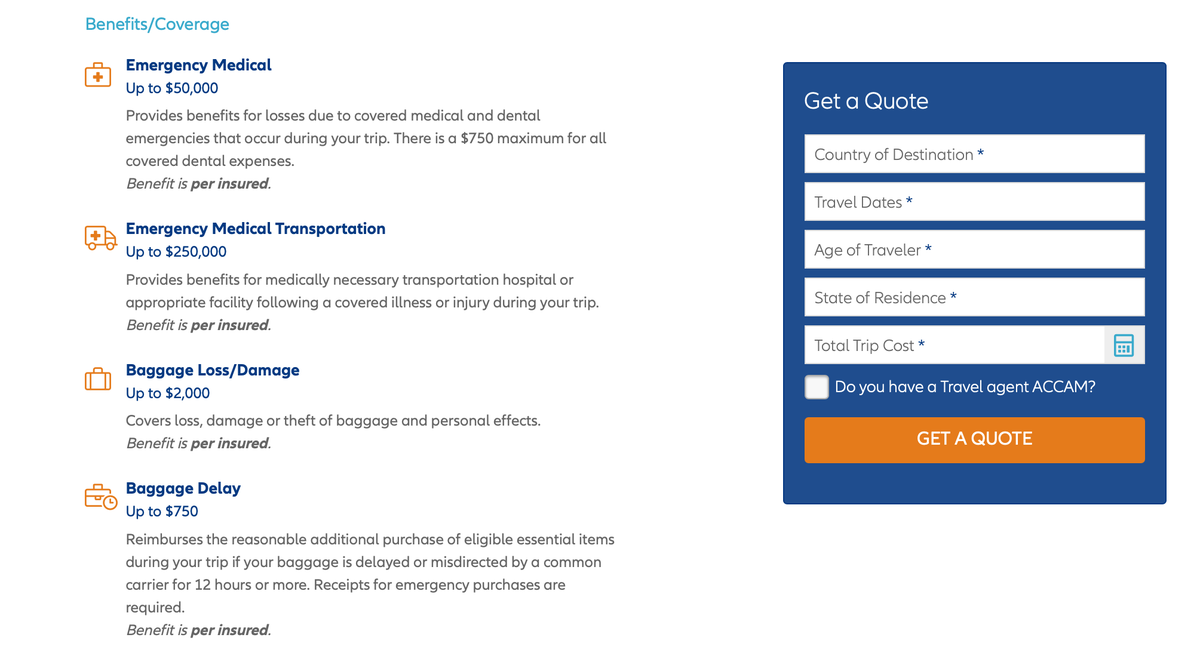

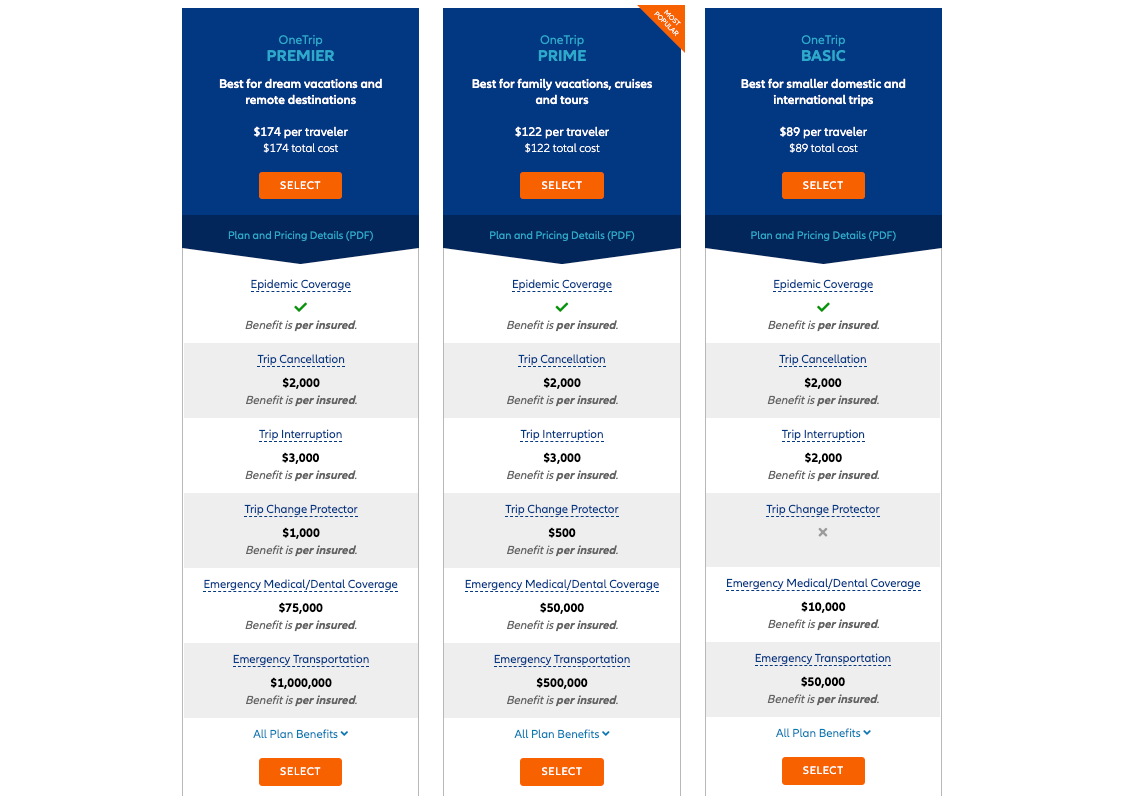

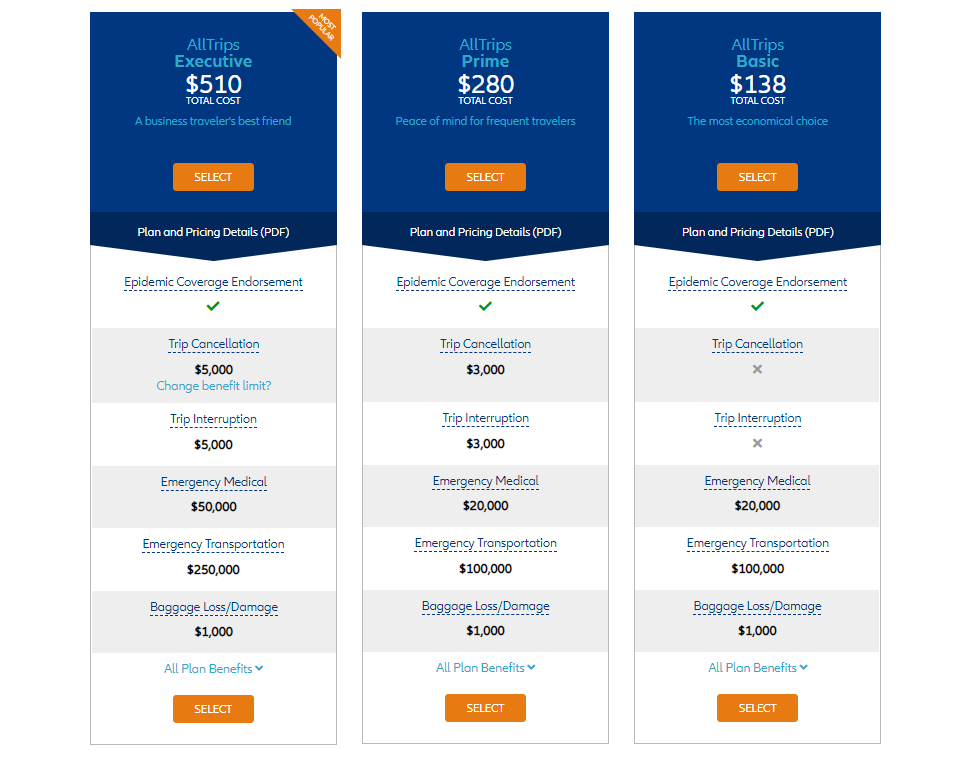

3. Allianz Travel Medical Insurance

Allianz offers an Emergency Medical plan that offers additional benefits that extend beyond simply medical coverage. This plan is a comprehensive plan that covers lost baggage and trip cancellation and delay, in addition to emergency medical coverage. See just a few of these benefits below:

In addition, many companies, such as AAA, offer travel insurance through Allianz, so you may receive a further discount if you reference your AAA policy.

Travel medical insurance can be beneficial for most travelers when traveling internationally as most primary health insurance plans won’t cover you abroad. We hope we’ve given you the tools you need to select a plan that works best for you and your travel needs.

At the end of the day, a travel medical plan is a great option if you’re traveling abroad and are not worried about covering trip costs due to a cancellation or added expenses due to a travel delay. Anyone looking for robust coverage for baggage or interruption should consider an upgrade to a more comprehensive plan.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

How much travel medical insurance do i need.

When considering the amount of coverage you’d like for your travel medical insurance plan, consider the following:

- How much (if any) will your own health insurance plan or credit card cover when you’re traveling outside of your home country?

- How long is your trip?

- Do you need extra coverage due to risky activities?

- What amount of coverage do you feel comfortable with?

Refer to the section titled “Plan Limits” for more detailed considerations.

How long does it take to receive travel medical insurance?

Travel medical insurance coverage starts the day of your trip, so you want to make sure you sign up for it before you leave. Most plans allow you to buy insurance up until the day before your trip.

However, the best time to buy travel medical insurance is within 15 days of making the first payment on your trip, since buying early can often qualify you for bonus coverages.

Is travel medical insurance worth it?

Depending on your primary health insurance and any secondary coverage you might be eligible for, travel medical insurance can still be a great tool to protect you from financial hits caused by injury or illness.

In addition, travel medical insurance can help organize assistance in extreme circumstances (such as medical evacuation). You can also pick the appropriate level of coverage to make you feel comfortable.

Does AAA offer travel medical insurance?

Yes, AAA offers travel medical insurance, but it is usually serviced by another company such as IMG Global or Allianz. You will normally receive a greater discount if you mention your AAA insurance policy, so don’t forget to include this when you request a quote!

Can you get travel insurance when already abroad?

Most companies do not offer travel insurance policies once your trip has already begun. There are a few reputable companies, such as World Nomads and SafetyWing , that are set up for long-term travel.

These companies allow you to purchase plans once your trip has already begun, but the rates may be higher than a plan that was purchased prior to leaving for your trip.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!) .

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best International Travel Insurance Companies for 2024

Allianz Travel Insurance »

AIG Travel Guard »

Generali Global Assistance »

World Nomads Travel Insurance »

GeoBlue »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best International Travel Insurance Companies.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

With demand for international travel still on the rise, buying travel insurance makes more sense now than ever before. Having an international travel policy in place will ensure you won't lose the money you spent if your trip is canceled or interrupted for reasons beyond your control – or if your bags are delayed or lost entirely by your airline or cruise line .

Other protective benefits come from the best international travel insurance policies as well, including travel medical coverage for unexpected medical expenses and emergency medical evacuation. You may even find that the destination you plan to visit requires travel insurance, although most countries have dropped travel insurance requirements they initially put in place due to the pandemic.

U.S. News editors compared more than 20 of the top providers to find the best travel insurance companies for trips around the world. If you're hoping to secure the best international travel policy for your needs this year, the policies outlined below provide a solid foundation for you to start your research.

Frequently Asked Questions

While many countries began mandating travel insurance for visitors during the COVID-19 pandemic, most have loosened entry requirements and dropped this condition by now. Countries that still require international visitors to have travel insurance include the following:

- Antarctica: Travel medical insurance is generally required by cruise lines and tour operators for trips to Antarctica , with a standard minimum of $100,000 in emergency medical and evacuation coverage.

- Ecuador: You do not need travel insurance to visit the country of Ecuador, but you do need insurance with medical coverage to visit the Galápagos Islands .

- Qatar: Travelers visiting Qatar for more than 30 days are required to have a travel insurance policy that is approved by the country's Ministry of Public Health.

- Saudi Arabia: Visitors to Saudi Arabia from eligible countries must pay for an eVisa, and the cost includes compulsory travel insurance coverage.

International travel insurance works the same as travel insurance for domestic trips. These plans include various coverage options and coverage limits, and a deductible may or may not apply. Travelers can choose to purchase international travel insurance for a single trip or multiple trips; long-term plans for expats and missionaries are available from some providers.

While travel insurance policies can include a broad range of coverages, the main protections you'll want for international trips include the following:

- Trip cancellation and interruption coverage: This type of protection can reimburse you for prepaid travel expenses when a trip is canceled or interrupted for a covered reason beyond your control.

- Baggage delay insurance: This coverage can pay for incidental expenses that occur when your bags are delayed for a specific period of time (usually six hours or longer).

- Lost luggage coverage: This protection can replace your luggage and your belongings or reimburse you for costs if your bags are lost by a common carrier.

- Rental car insurance: This type of insurance may provide primary coverage when you rent an eligible rental car.

- Emergency medical and dental coverage: This type of insurance will pay for emergency medical treatment or dental expenses that may arise during your trip.

- Emergency evacuation coverage: This protection can pay for emergency transportation costs when you're sick or injured during your trip.

Also note that many travelers booking an international trip choose to purchase travel insurance that offers cancel for any reason protection, so they can cancel a trip for any reason at all, even if they just decide they don't want to go. That said, adding CFAR coverage to your policy will make your travel insurance plan more expensive. Most plans also have limits on how much of your prepaid travel expenses can be refunded, which are usually capped between 60% to 80% of your trip costs.

While coverages offered through international travel insurance plans tend to be broad, keep in mind that this type of insurance won't cover every situation that could arise. Some common issues that are not covered by international travel insurance plans include:

- Acts of war

- Claims due to air or water pollution

- Claims due to natural disasters

- Epidemics not specifically included in coverage

- Extreme, high-risk sports

- Government regulations or proclamations

- Nuclear radiation and contamination

- Terrorist events

- Travel bulletins or alerts

Many travel credit cards offer international travel insurance benefits, but you should know that these coverages have some limitations. For example, travel insurance plans from credit cards never provide meaningful amounts of coverage for medical emergencies or dental emergencies. You also have to pay for each trip with your travel credit card for coverage to apply.

The best international health insurance plan depends on factors like the length of your trip, where you're traveling and how much coverage you need. While you can take the time to get quotes from several different companies, websites like TravelInsurance.com and Squaremouth make it easy to compare coverage details, limits and pricing among several providers all in one place.

The cost of international travel insurance varies and can depend on your age, the length of your trip, your total trip cost and other factors. Consider getting multiple travel insurance quotes through TravelInsurance.com to get an idea of the cost of coverage for your upcoming travel plans.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for the Cost

- Generali Global Assistance: Best for Medical

- World Nomads Travel Insurance: Best for Active Travelers

- GeoBlue: Best for Expats

Buy coverage for single trips or multiple trips at once

Annual plans available

Lower coverage amounts for emergency medical expenses than some other plans

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage up to $50,000

- Emergency medical transportation coverage up to $500,000

- Trip change protector coverage worth up to $500

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $300 (12-hour delay required)

- Travel delay coverage up to $800 ($200 per day)

SEE FULL REVIEW »

Add-on coverage available for lodging expenses, preexisting medical conditions and rental cars

Optional CFAR coverage available with some plans

Coverage limits for its lowest-tier Essential plan may be insufficient for some trips

Add-on coverage for preexisting conditions must be purchased within 15 days of the initial trip payment

- Trip cancellation coverage worth up to 100% of the trip cost

- Trip interruption coverage worth up to 100% of the trip cost

- Baggage coverage worth up to $750

- Up to $200 in coverage for baggage delays

- Travel medical expense coverage worth up to $15,000

- Up to $150,000 in coverage for emergency medical evacuation

Choose medical coverage limits based on your needs

Generous limits for emergency medical expenses and medical evacuation across all plans

CFAR coverage must be purchased within 24 hours of initial trip deposit and is only available with Premium plan

Rental car coverage only included in top-tier Premium plan

- Trip cancellation coverage up to 100% of the trip cost

- Trip interruption coverage up to 175% of the trip cost

- Travel delay coverage up to $1,000 per traveler ($300 daily limit)

- Up to $2,000 per person in baggage protection

- Up to $2,000 in coverage for sporting equipment

- Up to $500 per person for baggage delays

- Up to $500 per person for sporting equipment delays

- Up to $1,000 per person in protection for missed connections

- Up to $250,000 per person in coverage for emergency medical and dental procedures

- Up to $1 million in coverage for emergency assistance and transportation

- Up to $25,000 per person in rental car coverage

- Up to $100,000 per plan in accidental death and dismemberment coverage

24-hour travel assistance services included

More than 200 sports and activities covered in every plan

Coverage limits within standard plans may be insufficient

No coverage for most preexisting conditions

- Up to $10,000 in coverage for trip cancellation

- Up to $100,000 in coverage for emergency medical expenses

- Up to $500,000 in protection for emergency medical evacuation

- Up to $3,000 in protection for damage or theft to your bags or gear

Purchase international travel medical insurance for individual trips, multiple trips or long-term travel

Coverage is mostly for emergency medical expenses abroad

Some plans require a primary U.S. health insurance plan

Why Trust U.S. News Travel

Holly Johnson is an award-winning content creator who has covered travel and travel insurance for more than a decade. Johnson has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, and she has experience navigating the claims and reimbursement process. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson also works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – in their family media business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings.

Travel Insurance for Europe: 4 Best Options for 2024

Learn about a range of coverage options for traveling abroad.

The Best Travel Insurance for Mexico in 2024

Find coverage options for medical emergencies, travel delays, lost baggage and more.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

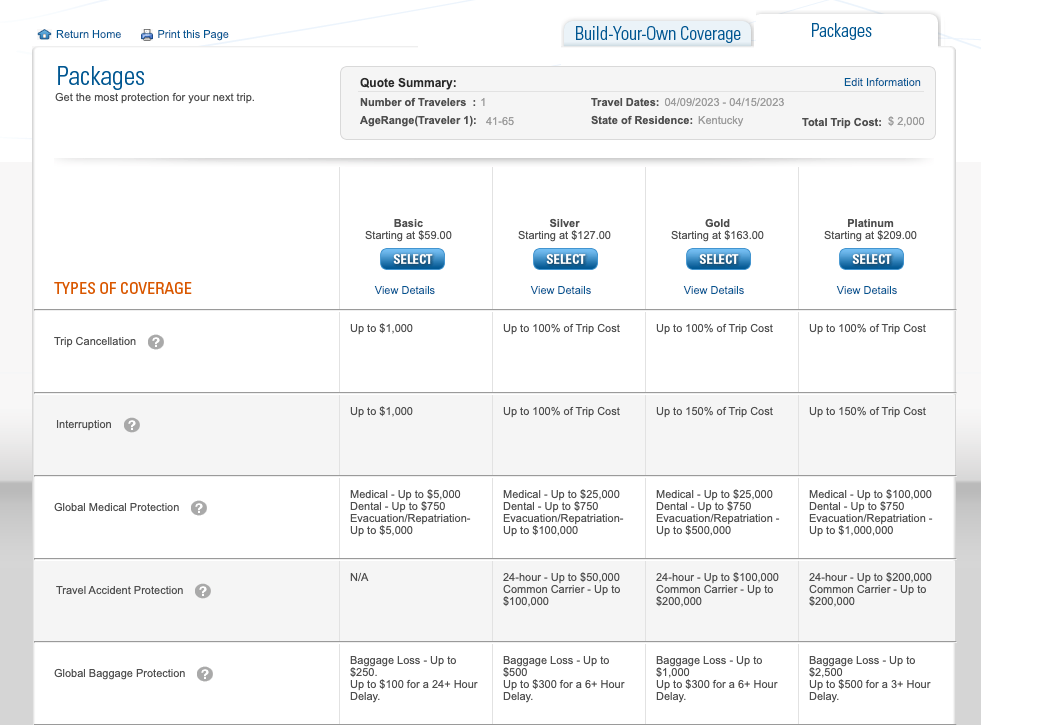

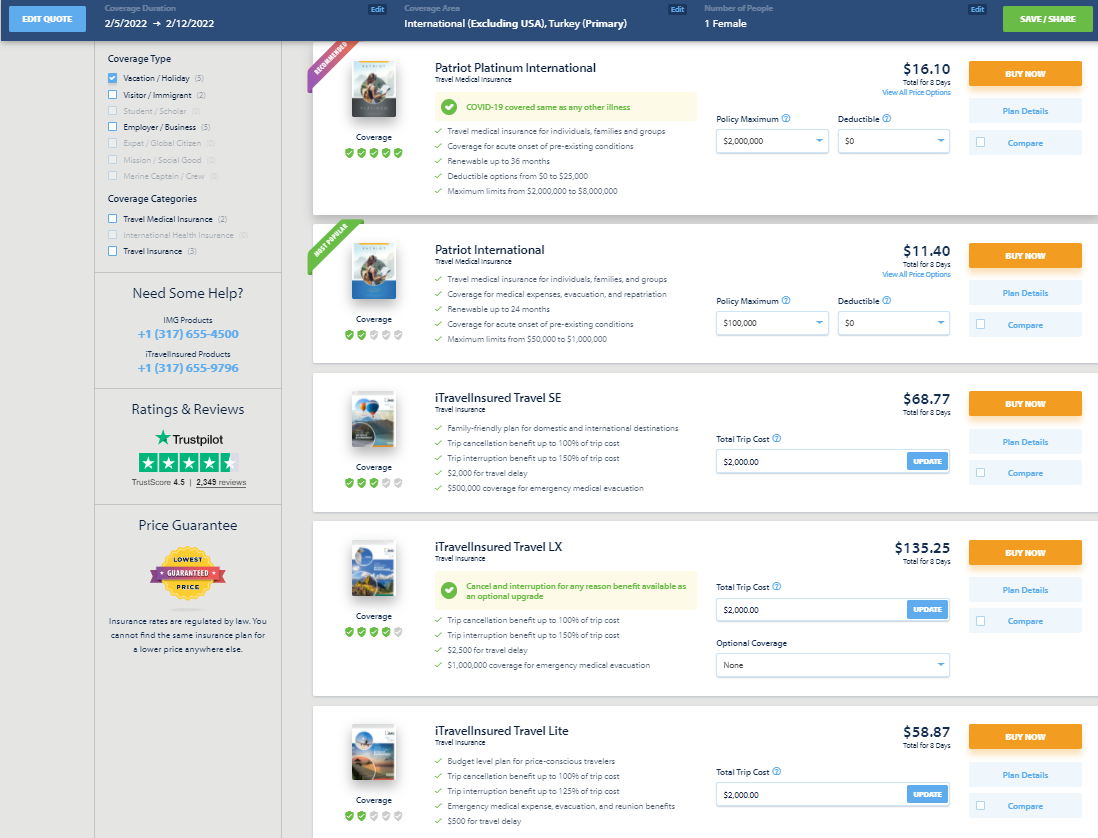

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

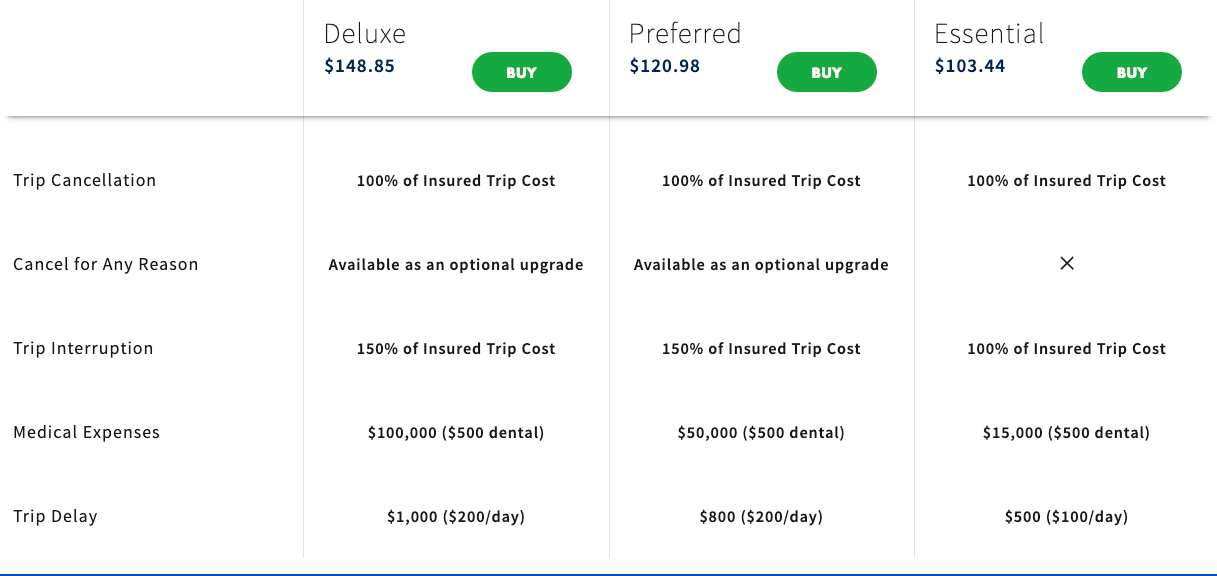

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

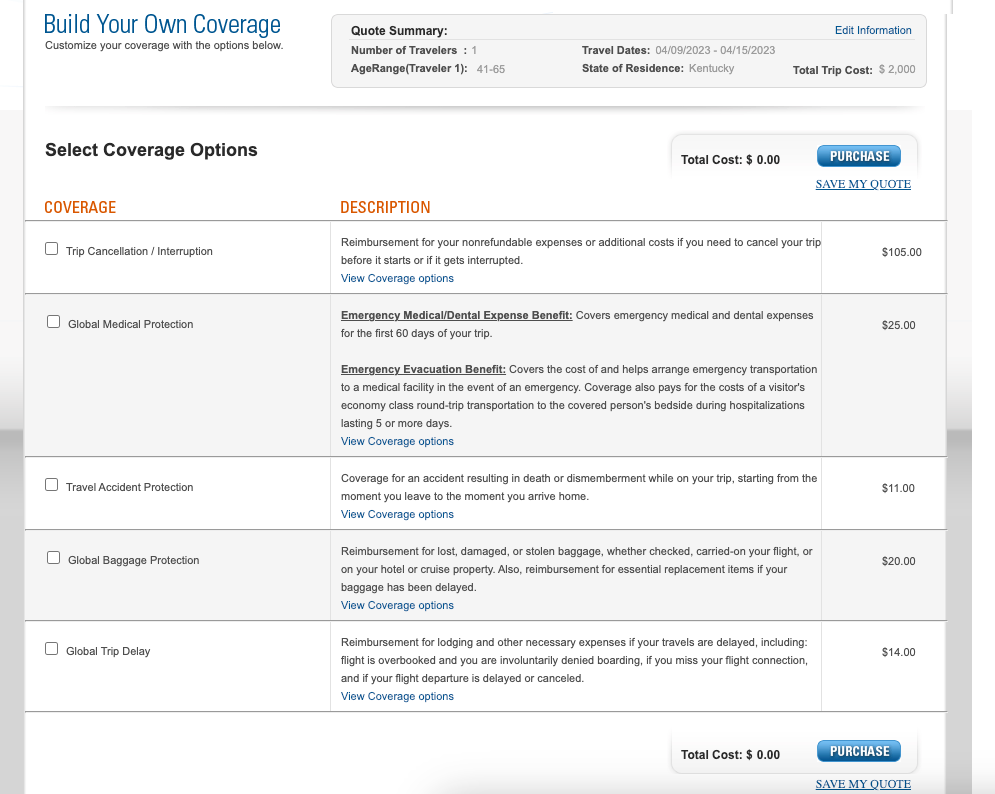

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

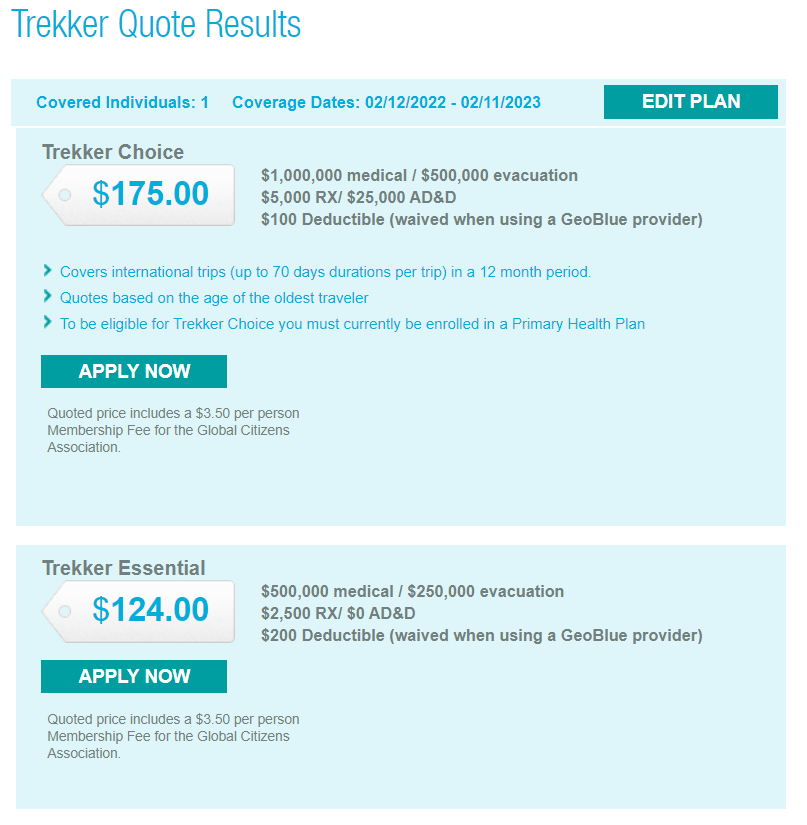

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

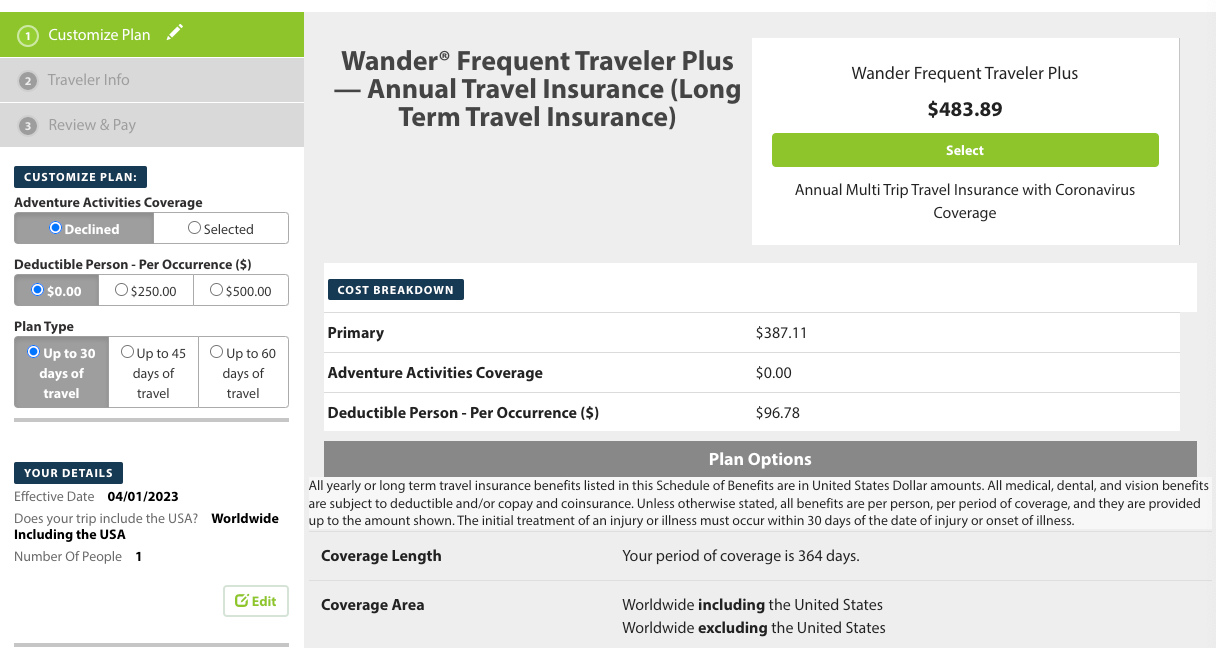

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

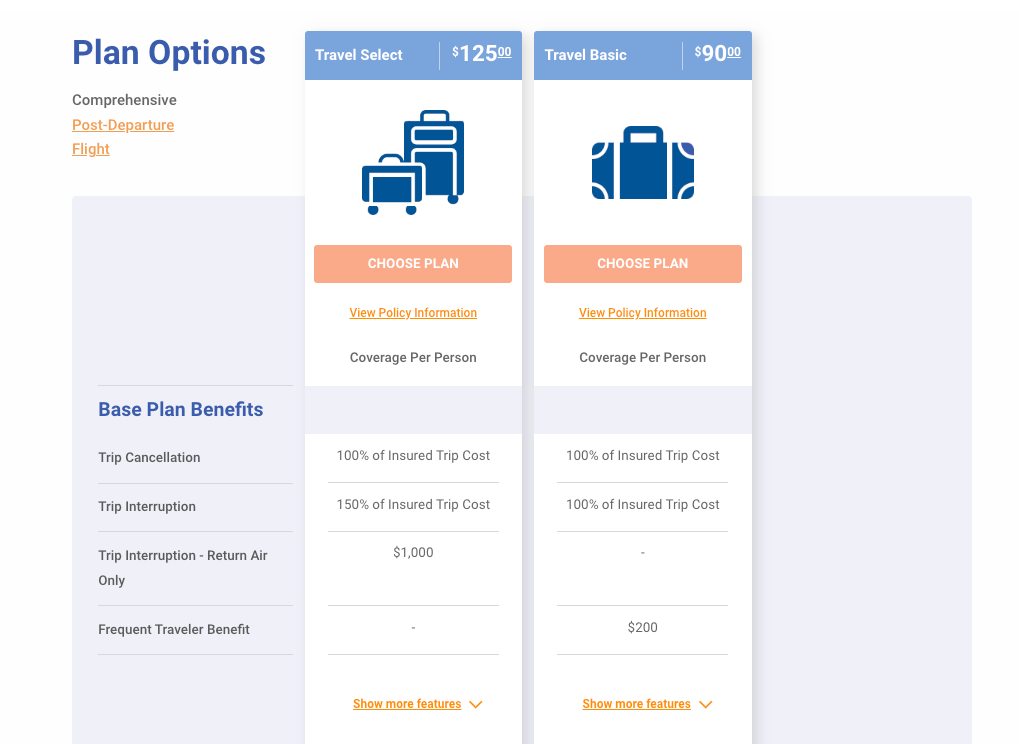

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

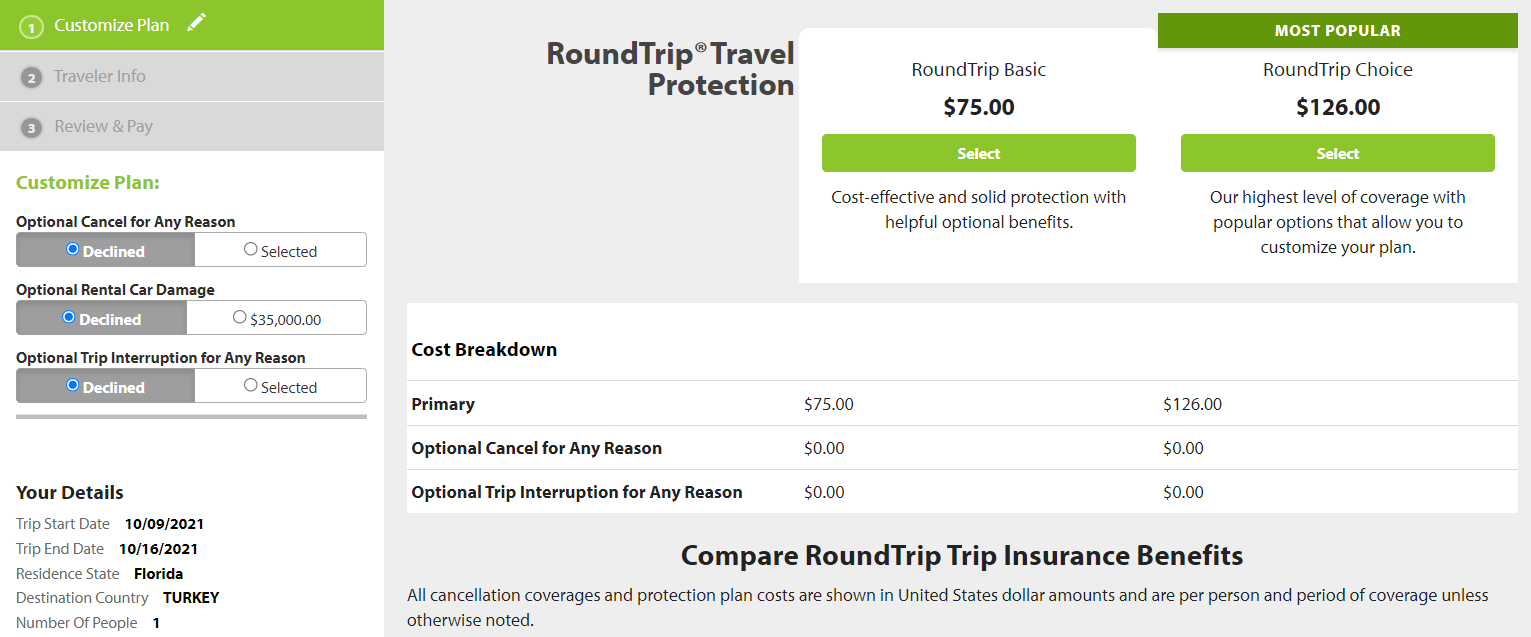

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

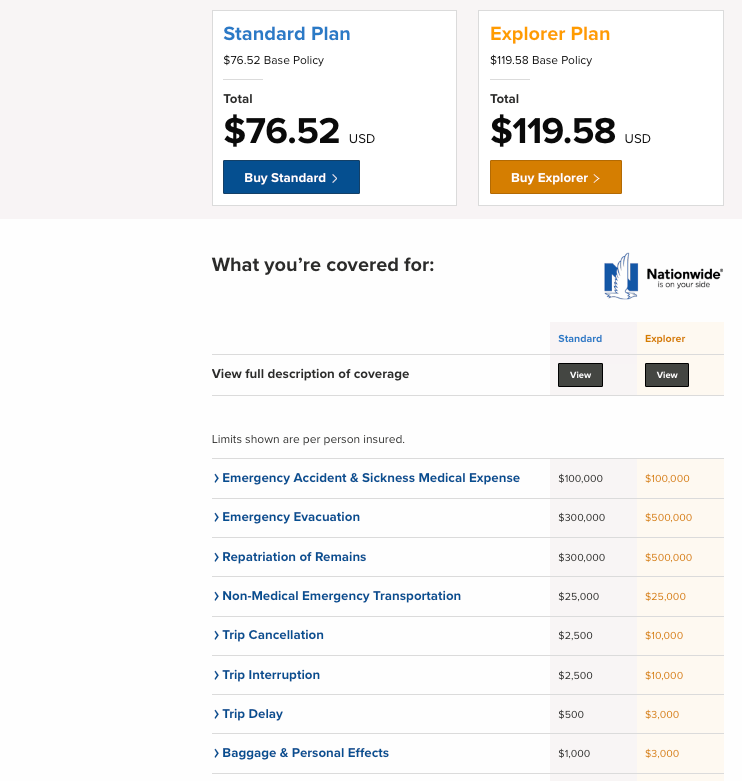

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Best Window Replacement Companies

- Cheap Window Replacement

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Best Car Insurance for New Drivers

- Cheap Same Day Car Insurance

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. Links in this article may result in us earning a commission. Learn More

The 10 Best Travel Insurance Companies of July 2024

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Mark Friedlander is a property/casualty insurance industry expert and a national media spokesperson on home, auto, business and life insurance matters. He is also an expert on hurricane insurance coverage and Florida insurance matters.

Key Takeaways:

- The best travel insurance company is Faye, according to our comprehensive analysis of over 49 policies.

- Travel insurance policies offer reimbursement if your trip gets canceled for a covered reason, you incur emergency medical bills, and for other situations such as missed flights or baggage delays.

- According to our survey of 1,000 travel insurance policyholders, 97% of respondents claim travel insurance is worth the cost.

Our Rankings of the Best Travel Insurance of 2024

After reviewing dozens of travel insurance providers operating throughout the U.S., the following are our top recommendations:

- Faye: Our top pick

- Travelex Insurance : Our pick for families

- Nationwide Travel Insurance : Our pick for cruise travel

- Tin Leg Travel Insurance : Our pick for customizable coverage

- Berkshire Hathaway Travel Protection : Our pick for luxury travelers

- Seven Corners Travel Insurance: Our pick for international travelers

- AIG Travel Guard: Our pick for families

- Trawick International: Our pick for college students

- Generali Global Assistance: Our pick for emergency assistance

- Travel Insured International: Our pick for well-rounded coverage

Our editorial team follows a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers have no effect on our rankings.

The Best International Travel Insurance Companies in Detail

Learn more about each of our top travel insurance companies, including the average policy costs our team determined by examining and averaging quotes for four unique trips.

Why We Picked Faye Travel Insurance

As a platform that prioritizes a digital, entirely online experience, Faye is worth considering if you’re shopping for last-minute coverage, according to our research. Simply answer a few questions about your upcoming trip, adjust your coverage limit and buy a comprehensive travel insurance plan in just a few minutes. In addition, Faye can send reimbursement directly to your phone’s digital wallet if you file a claim and it’s approved. While Faye offers only one plan choice, its general coverage inclusions may fit vacationers seeking quick coverage and a digital experience.

Pros and Cons

Our ratings, coverage overview.

Faye offers one plan with several optional add-on options.

Optional Add-Ons

- Cancel for any reason (CFAR)

- Rental car damage or theft

- Adventure and extreme sports protection

- Vacation rental damage protection

*Coverage limits and availability may vary by state of residence.

We obtained premium costs for seven trips as outlined in our review methodology, and Faye’s average trip cost is $297.87.

Why We Picked Travelex

Travelex is our top choice for travelers taking budget vacations and trying to prioritize policy price over other factors, according to our researchers. Travelex’s plans can be low-cost for some — depending on your vacation’s value, you could qualify for flat-rate coverage of $60 per traveler. It also offers a flat-rate Travel America plan for domestic trips. While Travelex’s Travel Basic plan provides affordable international coverage, note that optional adventure sports, additional medical protection and CFAR insurance are not available with this plan.

Travelex’s base plan, the Travel Basic coverage, includes 100% protection for both trip cancellation and interruption. It also includes $15,000 worth of emergency medical coverage, $100,000 in emergency evacuation coverage and $500 for lost baggage. Travelex’s Travel Select plan extends additional coverage, such as sporting equipment delay benefits of $200 and you can include kids with your policy.

Travelex offers the following add-ons for the Travel Select policy:

- CFAR coverage (50% reimbursement)

- Medical expense extension (extends coverage to $50,000)

- Adventure sports waiver for medical expenses coverage

- Accidental death and dismemberment (AD&D) extension (extends coverage to $25,000)

*Higher medical and evacuation coverage limits are available on other policies. Contact the company to learn more.

We obtained premium costs for seven trips as outlined in our review methodology, and Travelex’s average trip cost is $242.

Nationwide Travel Insurance

Why We Picked Nationwide

We named Nationwide travel insurance as our pick for the most coverage reimbursed. It offers 100% trip cancellation coverage and up to 200% trip interruption protection, depending on your plan choice. Nationwide also provides some of the best policies for cruisers, based on our research, with two levels of cruise-specific coverage. These cruise plans include coverage for mechanical breakdowns and terrorism in destination cities, which most travel insurance companies typically exclude.

Nationwide offers three levels of cruise coverage: the Universal, Choice and Luxury cruise policies. As the names suggest, each tier covers varying levels of cruise expenses. For example, the Universal policy covers $500 worth of expenses related to missed connections while the Luxury policy offers $2,000.

Nationwide offers the following add-ons for its cruise coverage:

- AD&D benefits

- CFAR coverage (up to 75% of trip costs)

- Vendor financial default coverage

- Interruption for any reason (IFAR) coverage

- Pre-existing conditions waiver

- Rental car collision damage

In addition to cruise coverage, Nationwide also offers the following two travel insurance plans, which include standard baggage and cancellation insurance.

Why We Picked Tin Leg

Tin Leg is a travel insurance provider that offers eight individual policy options. With a different level of coverage included in each plan, Tin Leg can make it easy to choose a plan that only includes the protections most important to you. Add-on options can tailor policies to your needs further, securing Tin Leg’s spot on our list as the travel insurance provider with the best customization options.

With eight travel insurance policies, Tin Leg’s medical insurance benefits range from $20,000 to $500,000, and its trip interruption coverage ranges from 100% to 150%. Most policies also include unique extra coverages not found with some other providers — like sports equipment loss and missed connections. The table below summarizes the key coverage included with three of Tin Leg’s most popular plans.

You can also upgrade your plan with the following add-on options — though available choices will vary depending on your base policy selection.

- CFAR coverage

- Financial defaults

- Cancel for work reasons

- Terrorism disruption

- Employment layoff

- Missed connections

- Sports and activities coverage

- Identity theft

- Rental car damage

*Higher evacuation coverage limits are available on other policies. Contact the company to learn more.

Berkshire Hathaway Travel Protection

Why We Picked Berkshire Hathaway

If you’re planning a luxury vacation, you may have trouble finding an insurance provider to insure your trip’s total value. Berkshire Hathaway’s LuxuryCare travel insurance plans cover 100% of your trip costs up to $100,000, which is why we’ve named the provider our pick for luxury travelers. It also offers a series of specialized standard travel plans, including an AdrenalineCare policy specifically for sports travelers and WaveCare for cruises.

Berkshire Hathaway offers three general plans and more specialized coverage options. You’ll find a series of nine total plan options in most parts of the country, but we recommend the all-inclusive LuxuryCare and ExactCare Extra plans for high-value vacations.

The table below summarizes the inclusions found on some of Berkshire Hathaway’s most popular travel insurance plans.

Berkshire Hathaway allows you to add the following add-on options to your plan:

- CFAR upgrade (up to 50% trip reimbursement)

Seven Corners Travel Insurance

Why We Picked Seven Corners

If you’re a frequent international traveler or traveling on a student visa outside the U.S., you may find it more affordable to purchase an annual plan rather than multiple single-trip plans. Seven Corners provides an annual plan with up to $500,000 in emergency medical coverage, $250,000 in travel medical coverage and more. Worldwide, 24/7 travel assistance is also included with all plans. While this plan does not include extensive delay protections, we consider it a cost-effective option for frequent travelers.

Seven Corners’ annual plan includes a wide range of coverages, including:

- $5,000 in trip interruption protection

- $1 million in medical and healthcare coverage

- $25,000 worth of AD&D coverage

- $100 per day in trip delay benefits (with a maximum of two days)

- $50 worth of coverage for each lost bag, up to $500

It also includes extra benefits for items like lost travel documents and baggage delays but does not cover trips within the U.S. Policies include a range of deductibles between $0 and $500 — note that selecting a lower deductible will come with a higher premium.

You can purchase the following add-ons to enhance travel insurance coverage with Seven Corners:

- Event ticket registration fee protection

- Sports and golf equipment rental

- IFAR coverage (up to 75% of trip costs)

In addition to multi-trip, annual plans, Seven Corners also offers the following single-trip options.

*Higher medical and evacuation coverage limits are available on other policies. Contact the company to learn more.

AIG Travel Guard

Why We Picked AIG

When shopping for travel insurance as a group or family, high combined premiums might deter some customers from purchasing coverage. We chose AIG Travel Guard as the best travel insurance provider for families because select plans — like the Deluxe policy — include one child under the age of 17 with the purchase of adult coverage. AIG also offers generous discounts on group travel coverage, which you can purchase with just a few clicks online. This can make AIG a solid choice for anyone looking for last-minute trip cancellation insurance.

AIG’s primary travel insurance product is its international travel plans, which provide 100% trip cancellation insurance, up to $1,000 in trip delay coverage, up to $1 million in medical evacuation coverage and other benefits commonly found with competitors. It also offers two unique policy options: the quick approval Pack-N-Go plan and an annual plan for frequent flyers.

AIG offers three travel insurance plans, all of which include family coverage:

It also offers the following add-ons:

- CFAR coverage (up to 50% reimbursement)

- Missed connection benefit ($150)

Trawick International

Why We Picked Trawick International

Trawick is our pick for student travel insurance. While it offers more than 20 individual travel insurance policies with standard inclusions, Trawick is most notable for its unique options for students studying abroad. The International Student and Scholar Medical Evacuation plan is one many students might find affordable and meets the requirements of multiple international visas stipulating evacuation insurance. It also offers annual trip cancellation plans and coverage formatted for other types of international visa requirements. However, this plan only provides medical evacuation coverage and not general emergency medical protection.

With more than 20 individual plan options, Trawick offers a range of coverage selections. We suggest reviewing each plan option to verify it has the coverage you need, especially if you are traveling on a visa. Compare a few of the company’s most popular policies using the table below.

Add-On Options

Coverage add-ons are not available on Collegiate Care plans.

Generali Global Assistance

Why We Picked Generali Global Assistance

We chose Generali Global Assistance as our pick for emergency assistance coverage because it offers 24/7, concierge-level service to help travelers in various situations. Generali’s travel professionals are multilingual, which can be a benefit if you’re traveling to an area where you cannot speak the primary language. In addition, Generali’s higher coverage tiers include protections such as rental car and sports equipment coverage, which other providers usually offer as add-ons.

Generali offers three plan tiers: Standard, Preferred and Premium. The Standard Plan includes a variety of benefits, including 125% trip interruption coverage, $150 per day toward delay-related expenses, $250,000 in medical evacuation coverage, $50,000 worth of medical coverage and more. Preferred and Premium plans extend benefits included with the Standard Plan and add some extras — like sports equipment coverage and rental car collision insurance.

Generali offers the following add-on options:

- CFAR coverage (up to 60% reimbursement)

Travel Insured International

Why We Picked Travel Insured International

We named Travel Insured International as our pick for well-rounded coverage. It offers coverage with various optional add-ons such as event ticket registration fee protection, interruption for any reason (IFAR) and CFAR coverage. It also provides 24/7 emergency assistance and extra perks such as concierge services, medical and legal aid and passport replacement help.

How To Choose the Best Travel Insurance

Knowing what to look for when comparing travel insurance providers can help you pick the best plan for your needs. We encourage you to compare brand pricing and policies between multiple providers to help narrow down your available coverage options.

Compare The Best Travel Insurance For International Trips

Comparing the costs of coverage offered by different providers can help you find the most affordable option for your travel insurance needs. See the table below for a direct cost comparison between the companies we’ve chosen as our top picks, as well as Better Business Bureau (BBB) ratings and notable coverage limits.