Allianz vs Travel Guard: What is Best in 2023?

Allianz and Travel Guard are two of the most popular travel insurance companies, but Travel Guard comes out on top

So you’ve done your travel insurance research and reached the point of asking “which company is better– Allianz vs Travel Guard?”.

Both companies appear often in searches for travel insurance. You’ll also see both Allianz and Travel Guard sold through travel suppliers like United Airlines & Expedia. I also have complete reviews for both Allianz and Travel Guard .

This page will show you how these two travel insurance companies compare. Which company has the best coverage? How does the cost compare? Are they both reputable companies?

My analysis shows that Travel Guard is the best choice between Allianz & Travel Guard. They have better cancellation coverage for weather & hurricanes. Their emergency medical coverage is higher than Allianz. They offer the popular Cancel For Any Reason coverage, which I believe is an important choice to have. Allianz might cost a little less, but this is because their coverage is not as good.

Criteria for comparing

For this comparison, we’ll be looking at travel insurance for a single trip such as a family vacation or cruise. Both companies have other plan options, but most travelers buy single-trip travel insurance.

When I compare, I consider the coverage, the amount of coverage, unique features, optional upgrades, and the cost. Finally, I look at value because there’s no need to spend more on coverage you don’t need.

Let’s get started.

Plan Options with Allianz vs Travel Guard

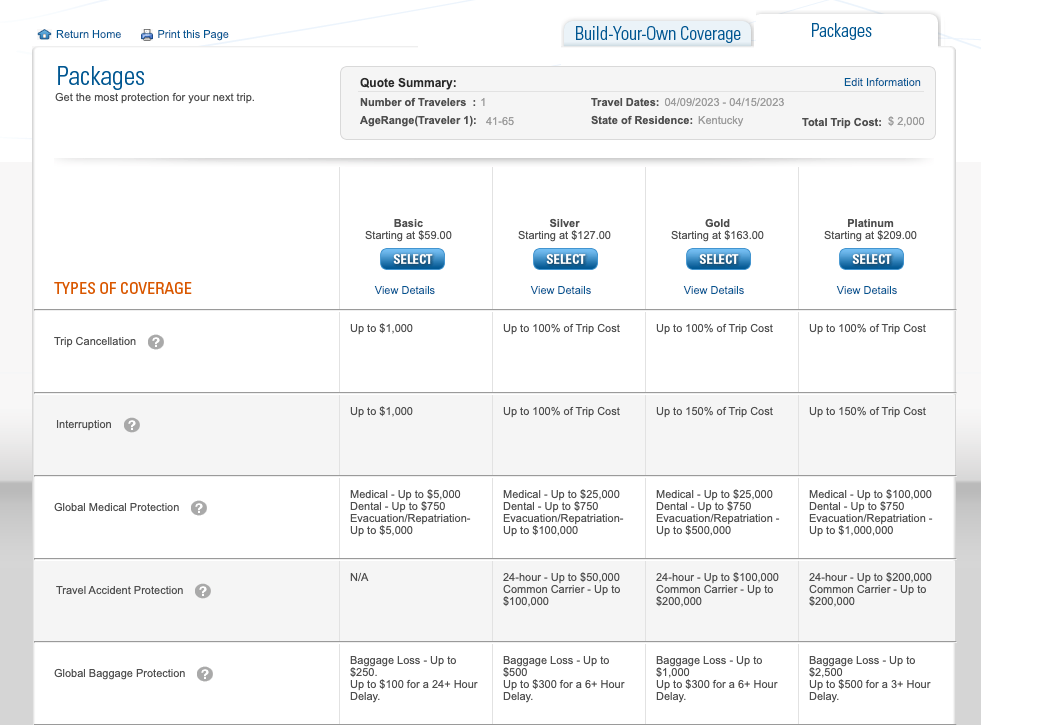

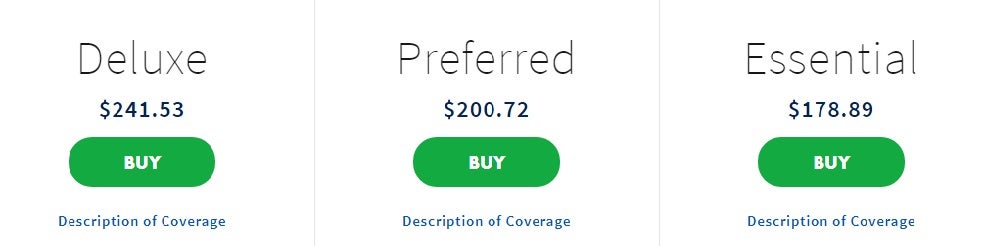

Both Allianz and Travel Guard follow the popular format of “good-better-best” for their travel insurance plans.

This is popular because it gives you insurance options to fit every budget. The lower cost plans will have lower limits, options, and even lack some coverage. The highest cost plans will have high limits, extra coverages, and more options.

The most popular is in the middle. This is where you can find good value. These plans have the right mix of coverage, coverage limits, options, and price.

Here are the plans we’re comparing:

Both Travel Guard and Allianz also offer specialty plans.

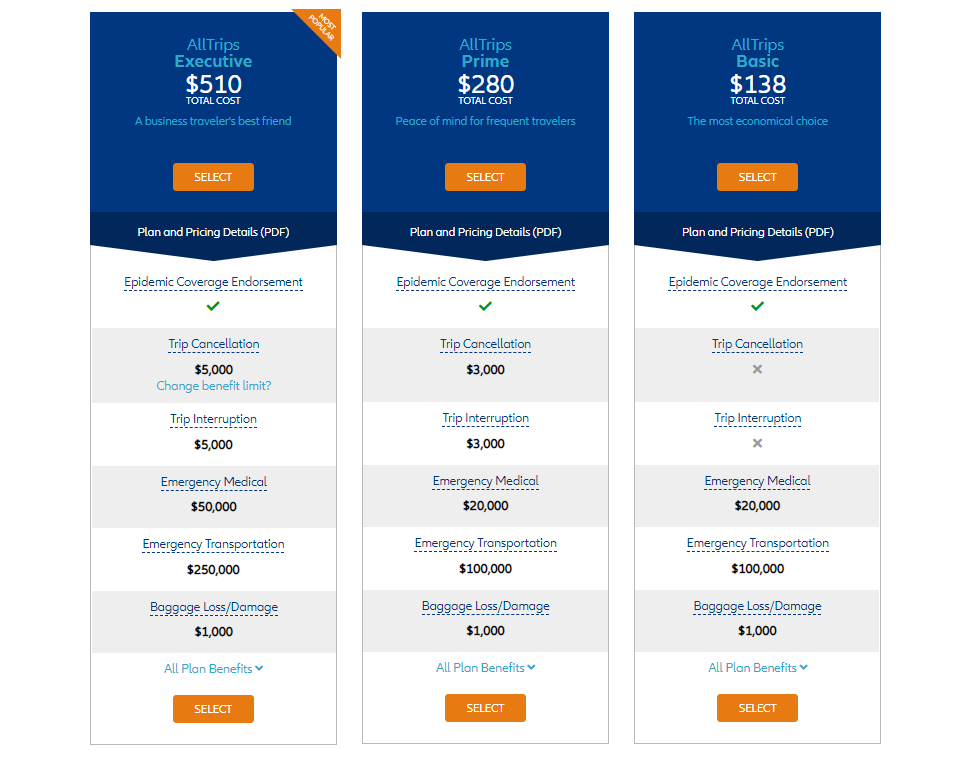

Allianz has a travel medical plan called OneTrip Emergency Medical, which is for travelers who don’t need cancellation coverage. They also offer annual/multi-trip plans called AllTrips– which also follow the good-better-best format. These are for travelers taking several trips throughout the year that want emergency medical coverage. Finally, they offer a rental car plan called OneTrip Rental Car Protector.

Travel Guard also offers a plan without cancellation coverage called Pack N’ Go, meant for last-minute trips. Finally, they offer and annual plans called Annual Travel Plan.

Winner : This is a Tie . Both Allianz and Travel Guard offer three plans that fit the needs of most travelers taking a trip. Allianz has more options for annual policies, but since we’re focusing on single-trip plans this is a tie.

Trip Cancellation & Interruption Coverage

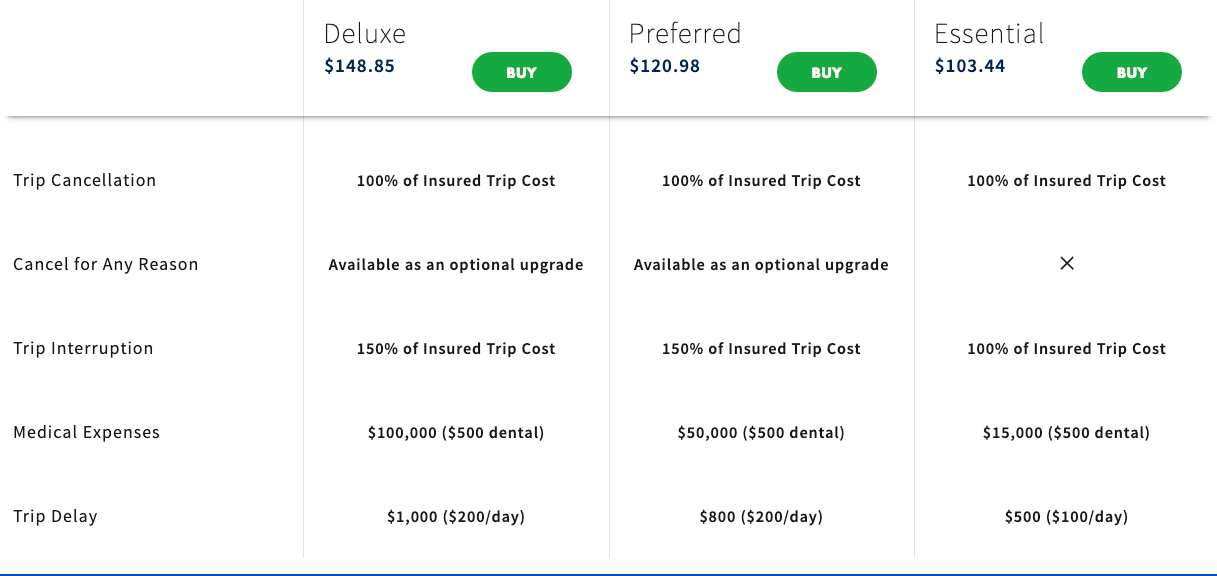

Both Allianz and Travel Guard will reimburse your trip costs if you need to cancel for a covered reason. They cover 100% of your pre-paid and non-refundable trip costs.

This covers events like getting sick before departure, a death in the family, hurricanes & severe weather, or getting called for jury duty. There is a long list of covered reasons for trip cancellation , but the most common is someone getting sick or injured.

The details are important here. For example, one company covers cancelling for a hurricane warning, and one doesn’t (more below).

Trip interruption coverage reimburses you if the trip is cut short for a covered reason. The reasons are similar– someone getting sick or injured, a parent death back home, a house fire back home, and more.

Both companies cover 150% of your insured trip cost for interruption on their two higher-coverage plans. This is because you can incur extra expenses, such as a last-minute flight back home. Both companies cover 100% of your trip cost for interruption in their lower-cost plans.

Winner : Both companies have similar broad coverage here, but Travel Guard has better hurricane coverage. I’ll go into more detail about this below.

Cancel For Any Reason Coverage

Travel insurance covers a long list of events for cancellation. The most common is someone getting sick before the trip, but it also covers a death in the family, house fire, hurricane, terrorism, and more.

To expand this coverage and give travelers more peace-of-mind, insurance companies came up with Cancel For Any Reason (CFAR) coverage . This is an upgrade that costs more, but gives you more coverage.

With CFAR coverage, you can cancel for any reason up until 48 hours before your trip. You will receive up to 75% of your trip cost back. The other 25% acts as a deductible.

Cancel For Any Reason has become more popular, especially since the Covid-19 pandemic. Travelers want the option to cancel if they feel unsafe, which is not a standard covered reason.

Travel Guard offers this coverage with their Preferred and Deluxe plans for an optional upgrade. CFAR is usually not available on low-cost plans.

Allianz does not offer Cancel For Any Reason with any of their plans.

I believe CFAR is an important option to have. Not all travelers choose to purchase it, but it is always smart to have it as an option.

Winner : Travel Guard is the obvious choice here. This is an important (and popular) option to have, and Allianz does not have it with any of their plans.

Medical & Evacuation Coverage

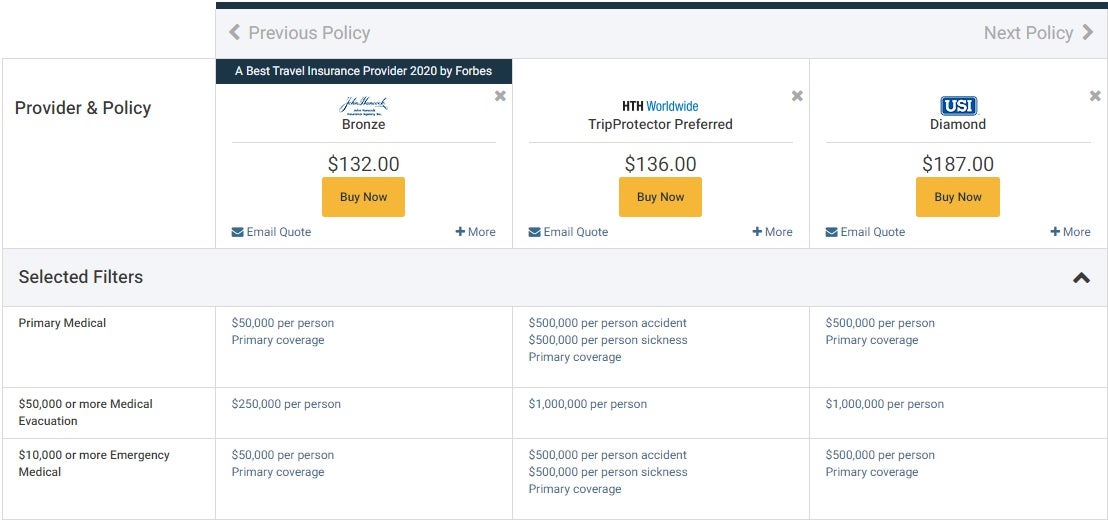

Emergency medical coverage pays for emergency medical expenses that happen on your trip. This could be a slip & fall, a stroke, food poisoning, and anything else. This is important when you leave your home country, because your insurance from home might not cover you.

Evacuation coverage pays medical transport expenses. This might be a local ambulance, a rescue flight from a remote location, or a medical flight back home. Even if your insurance from home covers medical expenses, it won’t cover evacuation costs.

Coverage Comparison

* Coverage is Secondary. This means the coverage pays after any other insurance you might have. The other plans are Primary, meaning it pays first. Either way you are covered, but Primary is easier. Many low-cost plans have Secondary medical coverage.

Travel Guard has higher coverage limits on their low and high end plans. Both companies are the same with the middle level plan

Winner : Because they have higher coverage limits on a couple plans, Travel Guard wins here. Even though their Essential plan has Secondary coverage, most travelers will be using Preferred which is Primary coverage.

Covid Coverage with Allianz vs Travel Guard

Travel insurance covers cancellation if you, a family member, or traveling companion get sick prior to departure and a doctor advises they don’t travel. This is common with injuries and illnesses, and is the most common reason people cancel trips.

Both Travel Guard and Allianz treat Covid-19 like any other illness and cover it.

Travel insurance has emergency medical coverage, which pays medical expenses if you get sick or injured on your trip.

Both Allianz and Travel Guard cover Covid-19 as they would any other illness.

Winner : Tie . Both companies treat Covid-19 as they would any other illness for both trip cancellation coverage and emergency medical.

Hurricane & Weather Coverage

Coverage for hurricanes and severe weather are part of trip cancellation and interruption coverage. If your trip is delayed, canceled, or cut short because of these weather events you are covered.

But the details matter. It’s not enough to just say “it’s covered” and call it a day. Insurance companies are all about definitions. Is a 10 minute delay the same as a 12 hour delay? Of course not. Is heavy rain the same as a category 3 hurricane? Same thing.

The two main factors I look at are: 1) the length of delay before the coverage is in effect, and 2) the events that are covered.

Delay “trigger”

Every policy has a different amount of time that “triggers” the cancellation coverage. One might say a common carrier delay of 6 hours, another might say 48 hours. Shorter is better, because your coverage kicks in sooner.

Covered events

Most plans will list hurricane, severe weather, or inclement weather that causes a delay and causes you to cancel your trip.

But imagine a hurricane is heading towards your destination in the Caribbean. It is not affecting your departure city, so there’s no coverage there. And for the coverage to kick in at your destination, the hurricane needs to strike and cause damage closing your resort.

The best plans cover hurricane warnings from the NOAA . This way, even if it never strikes your destination, you have coverage if your destination is included in a hurricane warning. This expands your coverage, and gives you more ways to cancel and get your money back.

As you can see, Travel Guard’s top two plans cover canceled flights due to weather after a delay of any length. They also include NOAA hurricane warnings as a covered reason for cancellation.

Winner : The clear winner here is Travel Guard . The extra coverage with weather and hurricanes expands your coverage, and protects your trip investment better.

Baggage & Delay Coverage

The two main areas of travel insurance coverage are trip cancellation/interruption, and emergency medical/evacuation. We covered that above.

Travel insurance also covers your baggage and travel delays. Here’s how the coverage compares with Allianz vs Travel Guard:

Lost, stolen, or damaged baggage

This covers your baggage throughout the trip. Airlines may reimburse you for lost bags on flights, but they wouldn’t help you once you left the flight. This coverage has a per/traveler limit.

Delayed baggage

This covers extra expenses caused by a delayed bag. For example: If you’re attending a wedding and your suit is in the delayed bag, you can get a new suit and shoes. This coverage has a per/traveler limit, as well as a minimum delay time trigger.

Travel delay

This covers extra expenses caused by a delayed trips. For example: If your departure is delayed for a covered reason, it would pay costs for extra hotel stays and meals. This coverage has a limit, as well as a minimum delay time trigger.

Winner : This one is a Tie . Travel Guard has better coverage for baggage and baggage delay. Allianz has better coverage for travel delays.

Cost of Allianz vs Travel Guard

Travel insurance usually costs 4-10% of your insured trip cost. Here are the factors that determine the cost of travel insurance:

- Number of travelers

- Ages of travelers

- Trip length

- Coverage limits

- Optional upgrades

Depending on various factors or optional upgrades like CFAR, the cost can be over 10%. Let’s look at how the costs compare with Allianz vs Travel Guard.

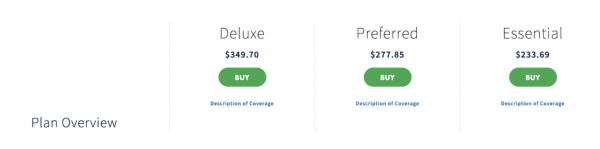

Sample trip: The following quote is for two travelers, both 70 years old. They are taking a two week trip to Spain. The total trip cost they are insuring is $5,000.

As you can see, the cost of Allianz’s mid-range plan is $430, or a little over 8% of the insured trip cost. Travel Guard’s similar plan is $531, or a little over 10% of the trip cost. These quotes are at the higher end due to the age of the travelers.

Winner : Here, Allianz has slightly lower-cost plans. This because they have lower coverage in many areas, and don’t offer upgrades like Cancel For Any Reason insurance.

Reputation & Trust

Both Allianz and Travel Guard are reputable companies that have been in business for a long time.

Allianz is one of the largest insurance companies in the world and has tremendous financial backing. This would explain their partnerships with so many travel suppliers, which is why you see them in the checkout process as an add-on purchase.

Travel Guard started as a private company, and was purchased by AIG – also one of the world’s largest insurance companies. They are financially sound, and will not be disappearing anytime soon.

Travel insurance policies are contracts, just like any insurance policy. You make a promise to the company to pay a premium, and they make a promise to meet the terms of their coverage.

This does not mean every claim is paid. Insurance companies receive many claims that are not legitimate and cannot be paid.

Even though mistakes are made, most denied claims with travel insurance happen because travelers don’t understand what is covered. The most common misunderstanding here is covered reasons for trip cancellation . Travelers think they can cancel if “something happens”, but that something needs to be a covered reason.

Winner : Tie . Both Allianz and Travel Guard are reputable companies that will pay legitimate claims.

Final Thoughts: Allianz vs Travel Guard

Travel Guard wins pretty much all around. They have better cancellation coverage for hurricanes and weather. They offer the Cancel For Any Reason upgrade while Allianz doesn’t even have the option. They have higher limits for medical coverage.

Allianz is slightly cheaper, but the coverage is lower in many ways. I also think the lack of Cancel For Any Reason as an option is a deal-breaker.

Quote & Purchase

I am a licensed travel insurance agent. If you found this comparison helpful and are ready to purchase, consider using my link below. I earn a commission, but it does not cost you anything because the company pays that. Insurance is regulated, and you won’t find the same plan available anywhere else for less.

Travel Guard

- Covid covered for sickness cancellation and emergency medical

- Great medical limits

- Cancel For Any Reason available

- Weather coverage includes NOAA hurricane warnings

DamianTysdal

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.

Allianz vs Trawick: The Best Pick in 2023

- 24 March 2022

Allianz vs Seven Corners: Best Pick in 2023

Allianz vs generali travel insurance (updated 2023).

- 23 March 2022

Travel with peace-of-mind... Compare quotes for free

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , John Hancock , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Allianz Global Assistance vs. Travel Guard Insurance

Compare Allianz Global Assistance vs. Travel Guard Insurance Travel Insurance

- Trip cancelations, delays, medical emergencies, lost baggage, unexpected crises, and more

Access to a worldwide network of prescreened hospitals

Quick claim payments for qualifying delays

24-7 emergency assistance services

- Medical, cancellation, and baggage coverage

- Travel concierge services with premium plans

- Emergency evacuation and medical repatriation

- Offers cancellation coverage due to terrorism and natural disasters

ConsumersAdvocate.org Ratings

Customer reviews, final verdict.

Allianz Global Assistance Travel Insurance and AIG Travel Guard Travel Insurance are very close in quality and have the same overall rating. That said, Allianz Global Assistance scores better than Travel Guard Insurance across: Financial Strength. Both companies score similarly on Coverage, Extra Benefits, and Price & Reputation.

Customer Comments & Reviews

May We Suggest?

Is this it, how about this, search results.

Our reviewers evaluate products and services based on unbiased research. Top Consumer Reviews may earn money when you click on a link. Learn more about our process.

Allianz Travel vs Travel Guard

Friday, April 19th

2024 Travel Insurance Plan Reviews

- Allianz Travel

- 10 plans to choose from, including single-trip, annual/multi-trip, and rental car coverage

- "A+" rated and accredited by the BBB

- In business for 100+ years

Allianz Travel insures more than 55 million people annually, from families taking their once-a-year vacation to business executives crisscrossing the globe year-round. The company has 10 different policies to choose from, including a standalone car rental plan. Most policyholders making claims say that the reimbursement process goes smoothly with Allianz, though some experience long delays. While you'll get a wider range of travel insurance options with some rival companies, Allianz can be trusted to get the job done.

- Travel Guard

- 3 main travel insurance policies available, with add-ons like Name Your Family bundling and coverage for Adventure Sports and Destination Weddings

Travel Guard is frequently recommended by travel agents as the best option for insurance. But, with only three main policy choices and some disappointing experiences related by customers, this insurer just doesn't keep up with its competitors in the travel insurance industry. There are other big names (and even small ones) you'll be able to count on to protect your trip, and we recommend leaving Travel Guard as a backup.

More Travel Insurance Plan Reviews

- Squaremouth

- Insure My Trip

- Travel Insurance

- Travelex Insurance Services

- Insured Nomads

- Quote Wright

- Seven Corners

- World Nomads

- Travel Insurance Center

- Axa Travel Insurance

The 13 Best Travel Insurance Plans

Who offers the best travel insurance.

With daily news stories of delayed and canceled flights, lost baggage, and travelers stranded overseas in the middle of a natural disaster, it's easy to see why travel insurance is so important. Like most types of insurance, travel insurance is bought in the hopes that you'll never need it. But, for most travelers, it's worth the price for the protection it provides.

Have you ever thought that this coverage was just an unnecessary, added expense? That's fairly common: most people assume that they've got protection through their credit card company, their regular health insurance, even their homeowners' policy. In some situations, that may be accurate - but unless you know the details of those types of coverage, you're more likely to be left paying out-of-pocket expenses you thought were taken care of... but aren't included.

Travel Insurance Plan FAQ

What is travel insurance, what does travel insurance cover, what does travel insurance not cover, can i get travel insurance if i have a pre-existing medical condition, is travel insurance expensive, my chocolate is going someplace warm. will it melt, where can i buy travel insurance, is it safe to get travel insurance online.

Continued from above...

And, even if you do have that kind of protection, travel insurance policies can amplify your benefits. For example, if you choose a plan that offers $500,000 in primary medical coverage, you might not need to touch your regular health insurance: your bills will be reimbursed up to that amount, no matter what your everyday health plan includes. Car rental insurance can go above and beyond what's paid for by your credit card company or even your own vehicle's coverage - and that can be critical if you're driving in another country and have an accident.

What type of travel insurance do you need? Naturally, that depends on your trip, your travel party, and your budget. A single-trip policy will be more affordable than multi-trip coverage - but if you're traveling internationally more than once in a year, the annual policy becomes much more economical. Do you need to be able to cancel for any reason? Is it important to you to have a waiver of the pre-existing conditions exclusion? Are there any children under 18 in your party that might be included at no extra charge, depending on the insurer you select? These are all factors that will influence your decision when picking a travel insurance plan.

Confused yet? You do have a lot of options. Here are some criteria to help you sort through them and ultimately wind up with the travel insurance coverage you need:

- Quote process. How easy is it to get a quote that matches your insurance needs? Does the site explain the questions it asks, and does it display all of the possible plans in a way you can understand? Can you buy your policy right then and there, or do you have to click through to another site?

- Value. What's included for your premium? From one site to another, you will probably see the same price on any given plan because the states regulate travel insurance prices. However, it's worth your time to compare premium prices and benefits among different insurers, so that you get the most for your money.

- Reputation. It's easy for an insurance company to get high marks from customers if they never had to make a claim on the policy. What do clients who've filed claims say about the way they were treated? Were they reimbursed quickly? Did they get updates about the status of the claim? It's also good to check the Better Business Bureau's rating of any travel insurance service you're going to use.

To help you get the protection you need on your next adventure, TopConsumerReviews.com has evaluated and ranked today's most popular sources of travel insurance. We're confident that this information will make it easy to protect yourself and what you've spent on your trip - and to have backup if something goes off track on your journey. Bon voyage!

Compare Travel Insurance Plans

Select any 2 Travel Insurance Plans to compare them head to head

Travel Insurance Plan Articles

How travel insurance can save your vacation, what does travel insurance cost, what to look for in a travel insurance policy.

Trending Travel Insurance News

Best student travel insurance in April 2024

Discover the best student travel insurance plans for studying abroad. Protect your health, belongings and trip investment. Get a quote today.

Wed, 17 Apr 2024

Business Insider on ...

Best Cancel for Any Reason Travel Insurance

Your guide to the best cancel for any reason travel insurance. Understand key features, compare top providers, and learn how to choose your coverage.

Tue, 16 Apr 2024

How Forbes Advisor Rates Travel Insurance Companies

This methodology is only applicable to Forbes Advisor’s Best Travel Insurance Companies content. Why it’s important to consumers: Cost is always a key factor to consider when buying travel ...

Sun, 14 Apr 2024

finder.com.au

Can travel insurance cover conflicts abroad?

Travel insurance won't cover you for events related to the ongoing conflict, or any conflict for that matter. Acts of war and political unrest are never covered by travel insurance before or after you ...

Thu, 18 Apr 2024

Planning A Vacation? Here’s Your 2024 Summer Travel Insurance Guide

More than 9 out of 10 Americans say they'll travel more this year, according to a recent survey. If you're one of them, you'll probably need travel insurance.

Sat, 13 Apr 2024

I'm a financial planner, and I'd recommend annual travel insurance to ...

If you travel frequently, an annual travel insurance policy can be a lifesaver when the unexpected arises, especially if you need medical care.

Fri, 05 Apr 2024

YAHOO!Finance

SingSaver, a MoneyHero Group company, signs partnership with Allianz ...

SingSaver, a leading personal finance comparison platform in Singapore and a subsidiary of MoneyHero Group (Nasdaq: MNY), today announced that it has entered into a preferred partnership with Allianz ...

SiliconIndia

Is Travel Insurance Mandatory For a US Visa? Know its Benefits and ...

Is Travel Insurance Mandatory For a US Visa? Know its Benefits and More - Preparing to visit the US? Great! Well, we hope you know that the US is a vast place that receives millions ...

Related Travel Insurance Plan Reviews

Since you're interested in Travel Insurance Plans, here are some other reviews you might find interesting.

Greek Lessons

Where can you get the best Greek lessons? If the phrase, "It's all Greek to me" means you just don't understand whatever it is, why not turn that around?

Life Insurance Plans

Where can you get the best Life Insurance policy out there today? In an era where financial uncertainties and unexpected events can strike at any moment, securing your family's ...

Low Calorie Meal Delivery

What's the best place to find Low Calorie Meal Delivery today? In recent years, the popularity of low-calorie diets has surged.

Passport Services

Where can you get a passport fast? Maybe you've found a last-minute travel deal to that far-flung destination you've always dreamed of visiting.

Popular Diets

Which of today's popular diets is the best? In recent years, there has been an explosion of different diets in America.

Travel Visa Services

What's the easiest way to get a travel visa? Online travel visa providers have revolutionized the way individuals apply for visas when planning their international trips.

Newest Reviews

Arabic Lessons

Where Can You Find the Best Arabic Lessons? Are you interested in learning Arabic?

Genealogy Services

Where is the best place to discover your genealogy online? Everyone on earth seems to have an innate, yearning desire to deeply understand who they are and where they came from.

Home Improvement Loans

Where Can You Get the Best Home Improvement Loans? Need some extra cash to make some changes to your house?

Perfume Stores

Where Can You Find the Best Perfume Store? Finding the perfect fragrance is a journey for your olfactory senses.

Personal Loans

Where Can You Find the Best Personal Loans? Personal loans are a type of borrowing where you can get money from a bank, credit union, or online lender and pay it back over time with interest.

Prom Dress Stores

Where Can You Find the Best Prom Dresses? The quintessential high school experience, prom, is one of the most exciting moments for teenagers across the US.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

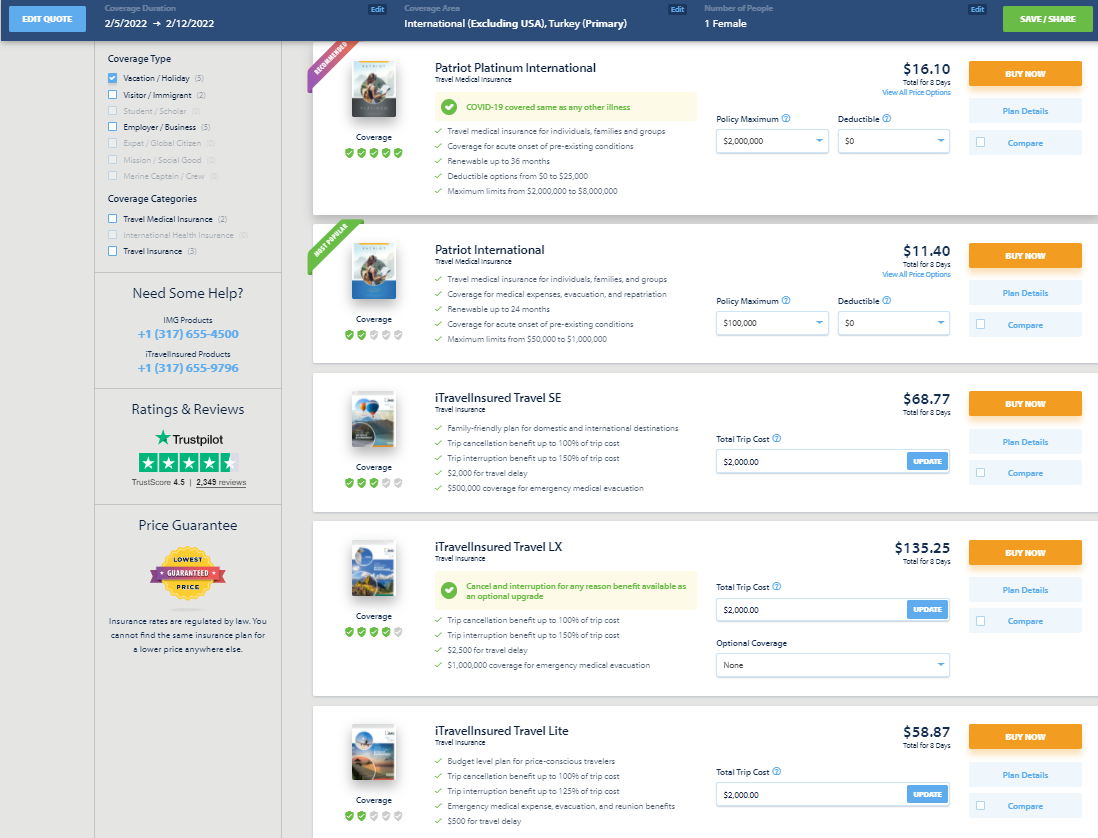

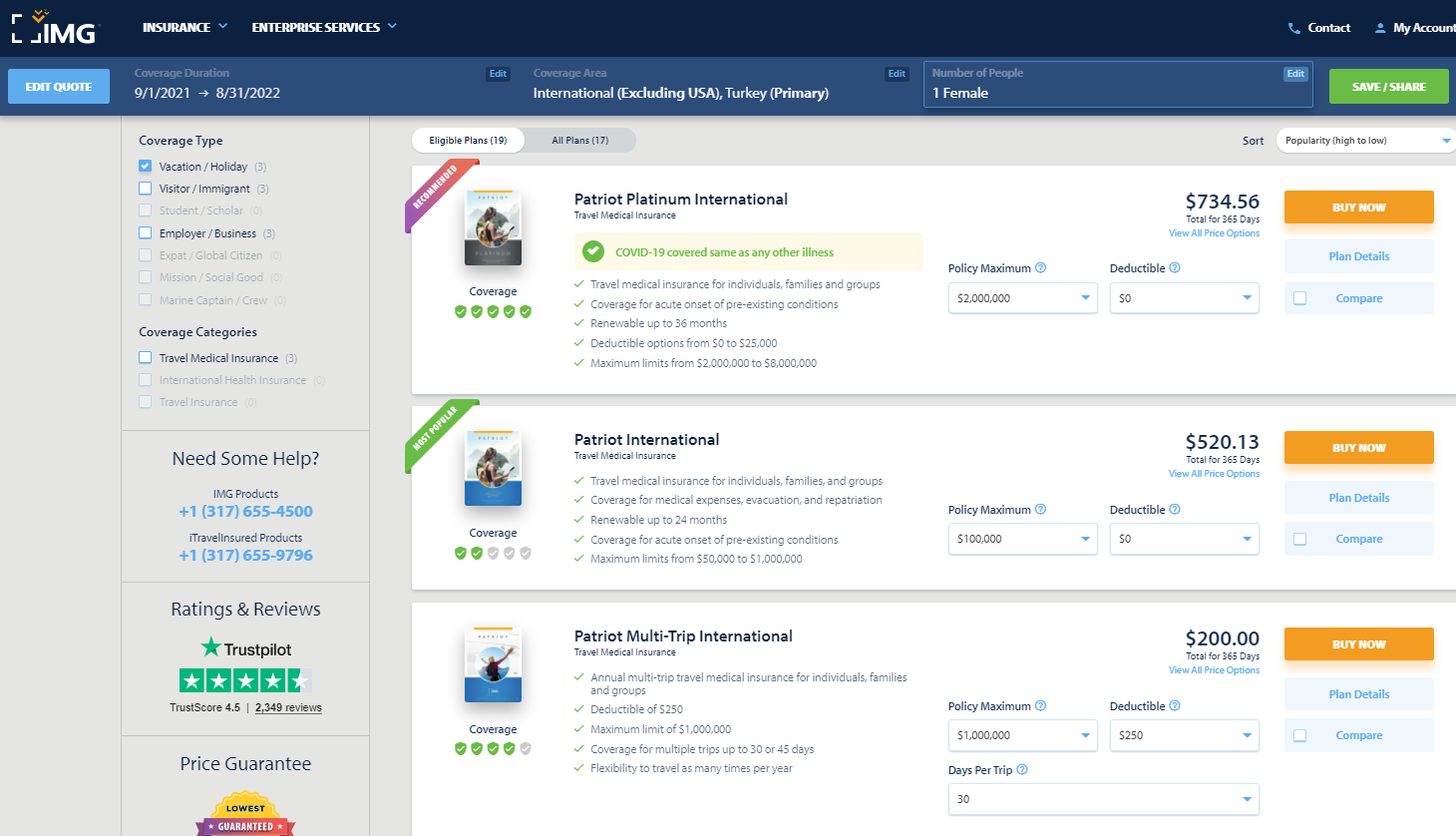

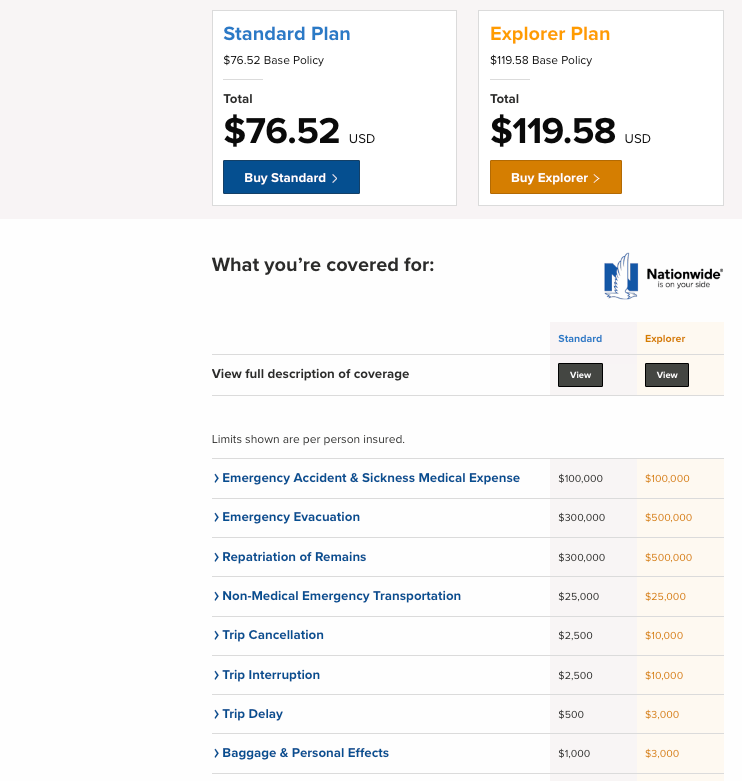

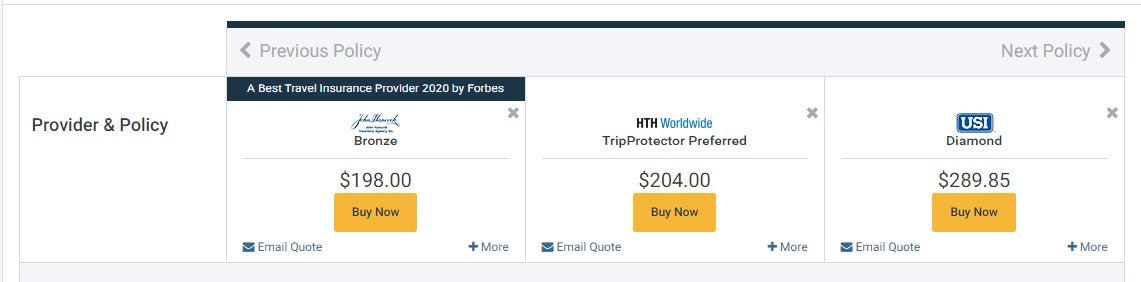

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

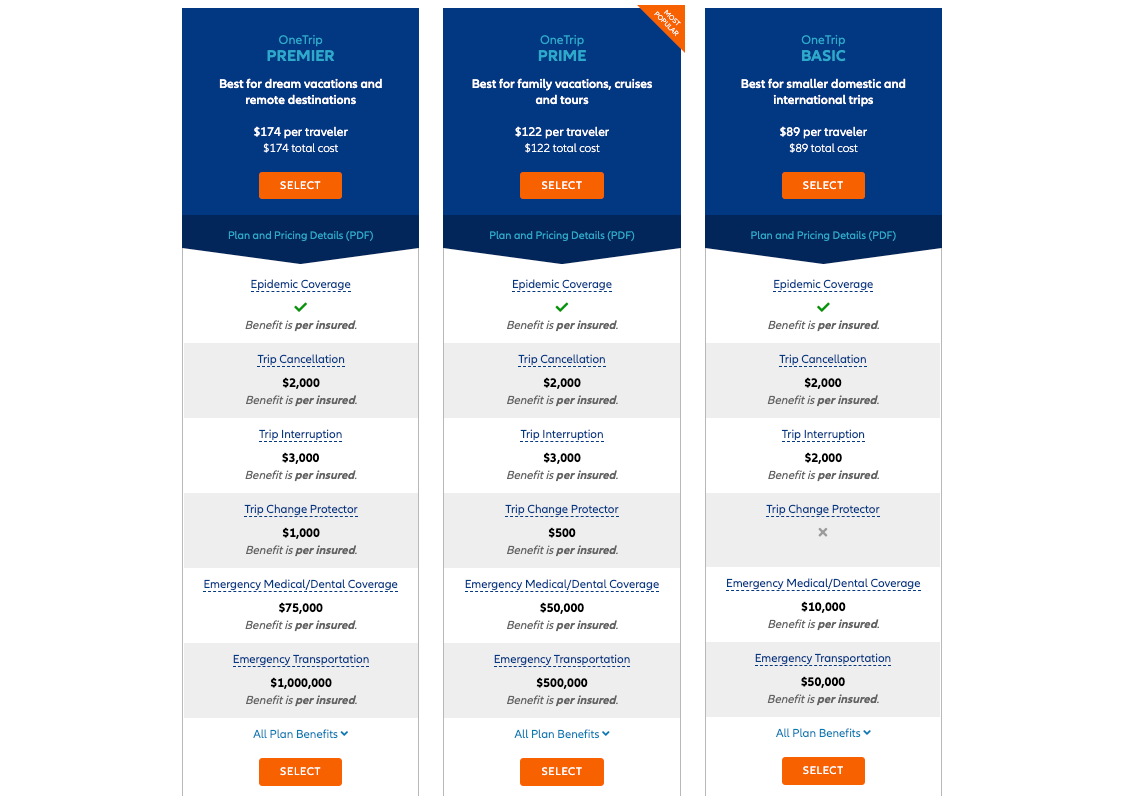

AIG Travel Guard

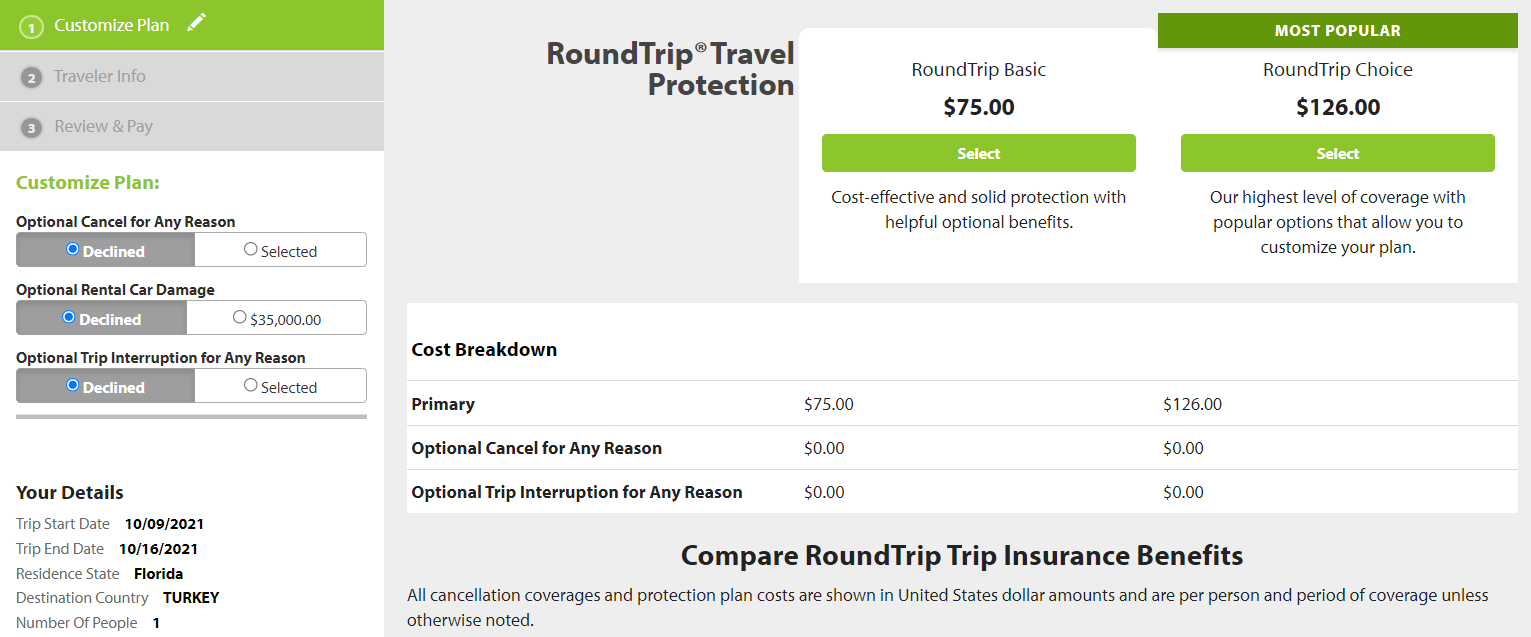

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

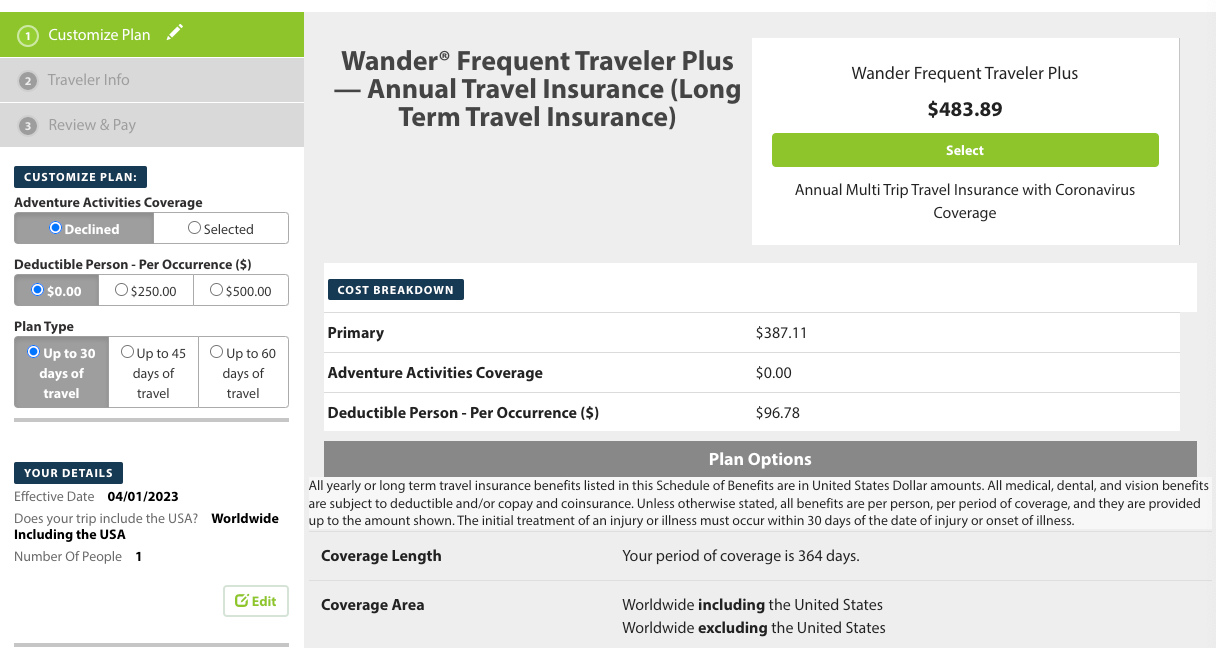

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

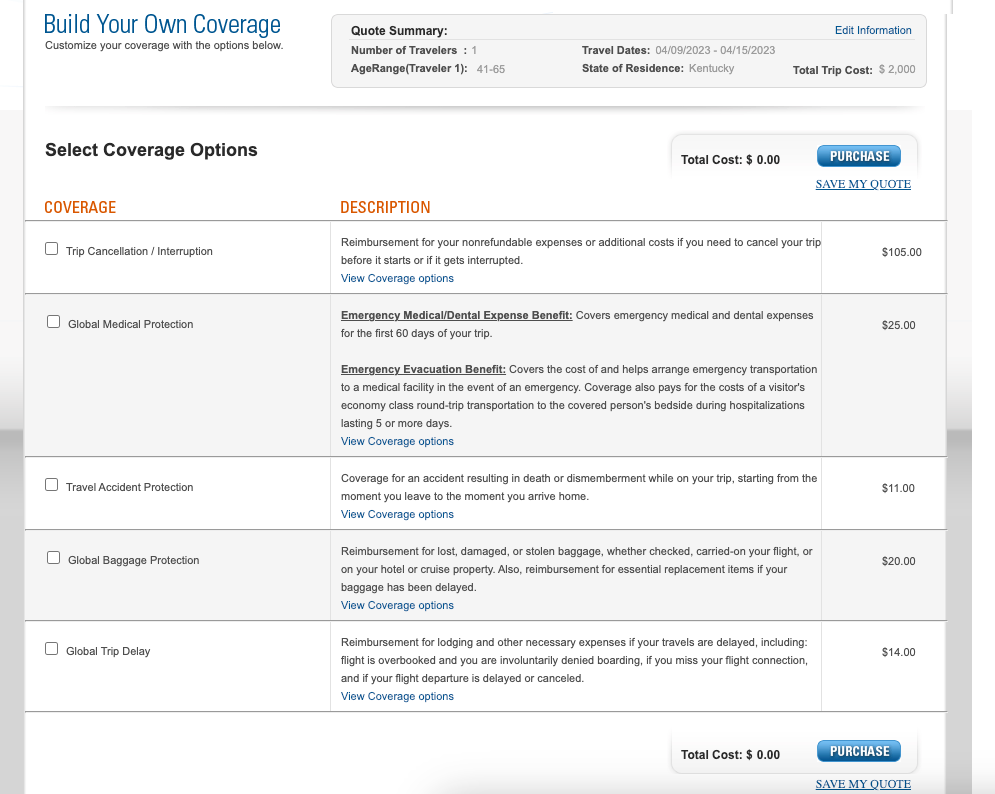

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

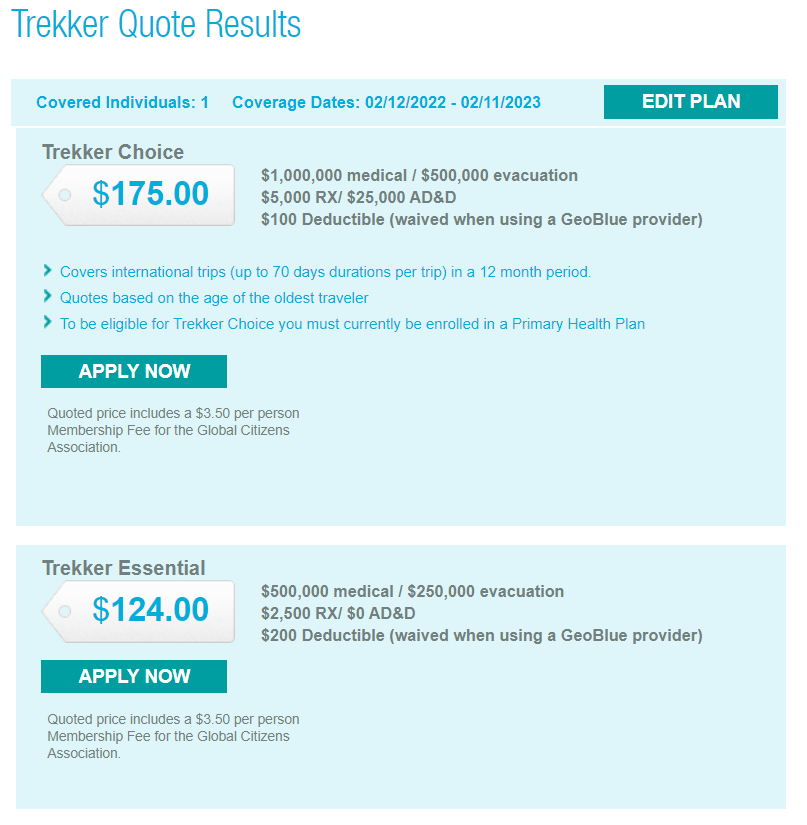

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

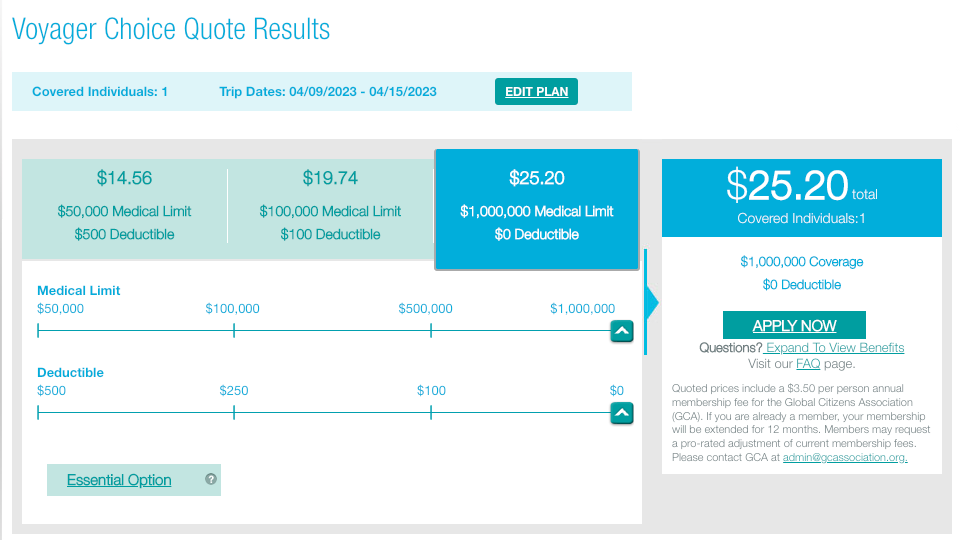

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

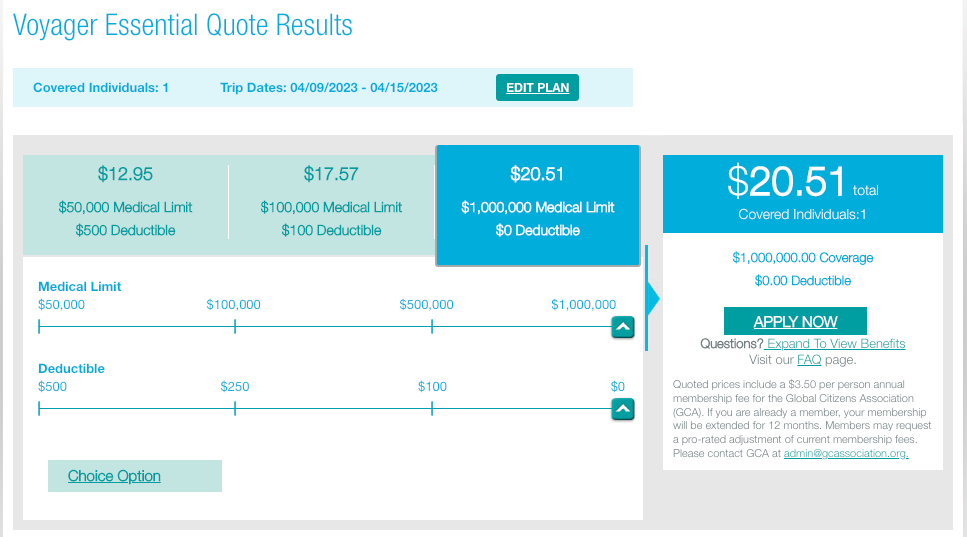

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

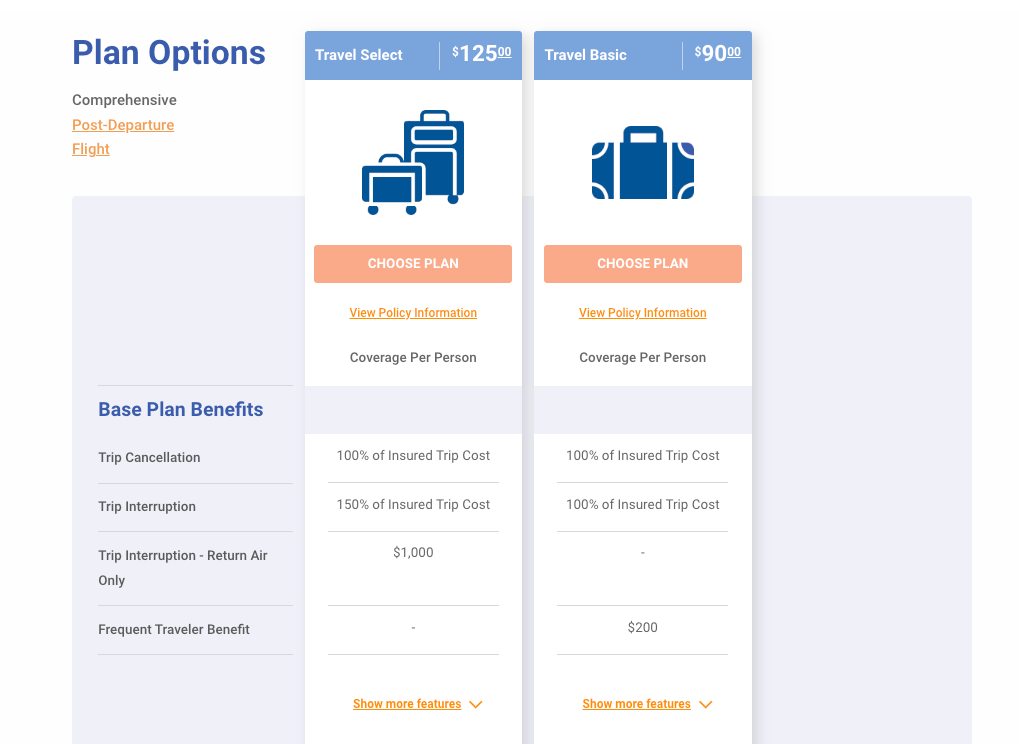

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

9 Best Travel Insurance Companies of April 2024

According to our analysis of more than 50 travel insurance companies and hundreds of different travel insurance plans, the best travel insurance company is Travelex Insurance Services. In our best travel insurance ratings, we take into account traveler reviews, credit ratings and industry awards. The best travel insurance companies offer robust coverage and excellent customer service, and many offer customizable add-ons.

Travelex Insurance Services »

Allianz Travel Insurance »

HTH Travel Insurance »

Tin Leg »

AIG Travel Guard »

Nationwide Insurance »

Seven Corners »

Generali Global Assistance »

Berkshire hathaway travel protection ».

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Travel Insurance Companies.

Table of Contents

- Travelex Insurance Services

- Allianz Travel Insurance

Travel insurance can help you protect the financial investment you made in your vacation when unexpected issues arise. Find the best travel insurance for the type of trip(s) you're taking and the coverages that matter most to you – from interruptions and misplaced belongings to illness and injury.

- Travelex Insurance Services: Best Overall

- Allianz Travel Insurance: Best for Trip Interruptions

- HTH Travel Insurance: Best for Groups

- Tin Leg: Best Cost

- AIG Travel Guard: Best for Families

- Nationwide Insurance: Best for Last-Minute Travel Insurance

- Seven Corners: Best for 24/7 Support When Traveling

- Generali Global Assistance: Best for Medical Emergencies

- Berkshire Hathaway Travel Protection: Best for Specialized Coverage

Customizable upgrades are available, including car rental coverage, additional medical insurance and adventure sports coverage

Medical and trip cancellation maximum are not as high as some other companies

- 100% of the insured trip cost for trip cancellation; 150% for trip interruption

- Up to $1,000 in coverage for lost, damaged or stolen bags and personal items; $200 for luggage delays

- $750 in missed connection coverage

- $50,000 in emergency medical and dental coverage

- Up to $500,000 in emergency medical evacuation and repatriation coverage

SEE FULL REVIEW »

Annual and multitrip policies are available

Distinguishing between the company's 10 travel insurance plans can be challenging

- Up to $200,000 in trip cancellation coverage; $300,000 in trip interruption coverage

- $2,000 for lost, damaged or stolen luggage and personal effects; $600 for bag delays

- Up to $1,600 for travel delays

- Emergency medical coverage of up to $75,000

- Epidemic coverage

Generous coverage at the mid- and high-tier levels, and great group discounts

Preexisting conditions coverage is only available at mid- and high-tier plans

- 100% trip cancellation coverage (up to $50,000); 200% trip interruption coverage

- Up to $2,000 in coverage for baggage and personal effects; $400 in baggage delay coverage

- Up to $2,000 in coverage for trip delays; $1,000 for missed connections

- $500,000 in coverage per person for sickness and accidents

Variety of plans to choose from, including two budget-friendly policies and several more premium options

More limited coverage for baggage issues than other companies

- 100% trip cancellation protection; 150% trip interruption

- $500 per person for lost, stolen or damaged baggage and personal items

- Up to $2,000 per person in travel delay coverage ($150 per day); $100 per person for missed connections

- $100,000 per person in emergency medical coverage, including issues related to COVID-19

Travel insurance policy coverage is tailored to your specific trip

Information about policy coverage inclusions is not readily available without first obtaining a quote

- Trip cancellation coverage for up to 100% of your trip's cost; trip interruption coverage for up to 150% of the trip cost

- Up to $2,500 in coverage for lost, stolen or damaged baggage; $500 related to luggage delays

- Up to $1,000 in missed connection and trip delay coverage

- $100,000 in emergency medical coverage

Variety of plans to choose from and coverage available up to a day before you leave on your trip

Limited trip cancellation coverage even at the highest tier

- Trip cancellation coverage up to $30,000; trip interruption coverage worth up to 200% of the trip cost (maximum of $60,000)

- $2,000 for lost, damaged or stolen baggage; $600 for baggage delays

- Up to $2,000 for trip delays; missed connection and itinerary change coverage of $500 each

- $150,000 for emergency medical and dental issues

Customer service available 24/7 via text, Whatsapp, email and phone

Cancel for any reason coverage costs extra

- 100% trip cancellation coverage (up to between $30,000 and $100,000 depending on your state of residence); interruption coverage for up to 150% of the trip cost

- Lost, stolen or damaged baggage coverage up to $2,500; up to $600 for luggage delays

- Trip delay and missed connection coverage worth up to $1,500

- Emergency medical coverage worth up to between $250,000 and $500,000 (depending on where you live)

Generous emergency medical and emergency evacuation coverage

Coverage for those with preexisting conditions is only available on the Premium plan

- 100% reimbursement for trip cancellation; 175% reimbursement for trip interruption

- $2,000 in coverage for loss of baggage per person

- $1,000 per person in travel delay and missed connection coverage

- $250,000 in medical and dental coverage per person

In addition to single-trip plans, company offers specific road trip, adventure travel, flight and cruise insurance coverage

Coverage for missed connections or accidental death and dismemberment is not part of the most basic plan

- Trip cancellation coverage worth up to 100% of the trip cost; interruption coverage worth up to 150% of the trip cost

- $500 in coverage for lost, stolen or damaged bags and personal items; bag delay coverage worth $200

- Trip delay coverage worth up to $1,000; missed connection coverage worth up to $100

- Medical coverage worth up to $50,000

To help you better understand the costs associated with travel insurance, we requested quotes for a weeklong June 2024 trip to Spain for a solo traveler, a couple and a family. These rates should help you get a rough estimate for about how much you can expect to spend on travel insurance. For additional details on specific coverage from each travel insurance plan and to input your trip information for a quote, see our comparison table below.

Travel Insurance Types: Which One Is Right for You?

There are several types of travel insurance you'll want to evaluate before choosing the policy that's right for you. A few of the most popular types of travel insurance include:

COVID travel insurance Select insurance plans offer some or a combination of the following COVID-19-related protections: coverage for rapid or PCR testing; accommodations if you're required to quarantine during your trip if you test positive for coronavirus; health care; and trip cancellations due to you or a family member testing positive for COVID-19. Read more about the best COVID-19 travel insurance options .

Cancel for any reason insurance Cancel for any reason travel insurance works exactly how it sounds. This type of travel insurance lets you cancel your trip for any reason you want – even if your reason is that you simply decide you no longer want to go. Cancel for any reason travel insurance is typically an add-on you can purchase to go along with other types of travel insurance. For that reason, you will pay more to have this kind of coverage added to your policy.

Also note that this type of coverage typically only reimburses 50% to 80% of your nonrefundable prepaid travel expenses. You'll want to make sure you know exactly how much reimbursement you could qualify for before you invest in this type of policy. Compare the best cancel for any reason travel insurance options here .

International travel insurance Travel insurance is especially useful when traveling internationally, as it can provide medical coverage for emergencies (in some cases for COVID-19) when you're far from home. Depending which international travel insurance plan you choose, this type of travel insurance can also cover lost or delayed luggage, rental cars, travel interruptions or cancellations, and more.

Cheap travel insurance If you want travel insurance but don't want to spend a lot of money, there are plenty of cheap travel insurance options that will offer at least some protections (and peace of mind). These are typically called a company's basic or standard plan; many travel insurance companies even allow you to customize your coverage, spending as little or as much as you want. Explore your options for the cheapest travel insurance here .